Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid at present’s market correction, Chainlink (LINK) has misplaced its current beneficial properties, falling again to a vital assist stage. An analyst suggests a month-to-month shut above its present vary may place the cryptocurrency for a 35% surge.

Associated Studying

Chainlink Retest Essential Value Zone

Chainlink has retraced 9.1% up to now 24 hours to retest the important thing $14 assist zone once more. The cryptocurrency surged 15.7% from final Friday’s lows to hit an 18-day excessive of $16 on Wednesday, momentarily recovering 35% from this month’s low.

Nevertheless, the current market correction halted the momentum of most cryptocurrencies, with Bitcoin (BTC) falling again to the $83,700 mark and Ethereum (ETH) dipping to the $1,860 assist zone.

Right this moment, LINK dropped from $15 to $14.07, shedding all its Wednesday beneficial properties. Beforehand, analyst Ali Martinez noted that the cryptocurrency has been in an ascending parallel channel since July 2023.

Chainlink has hovered between the sample’s higher and decrease boundary for the final 12 months and a half, surging to the channel’s higher trendline each time it retested the decrease zone earlier than dropping again.

Amid its current value efficiency, the cryptocurrency is retesting the channel’s decrease boundary, suggesting a bounce to the higher vary may come if it holds its present value ranges.

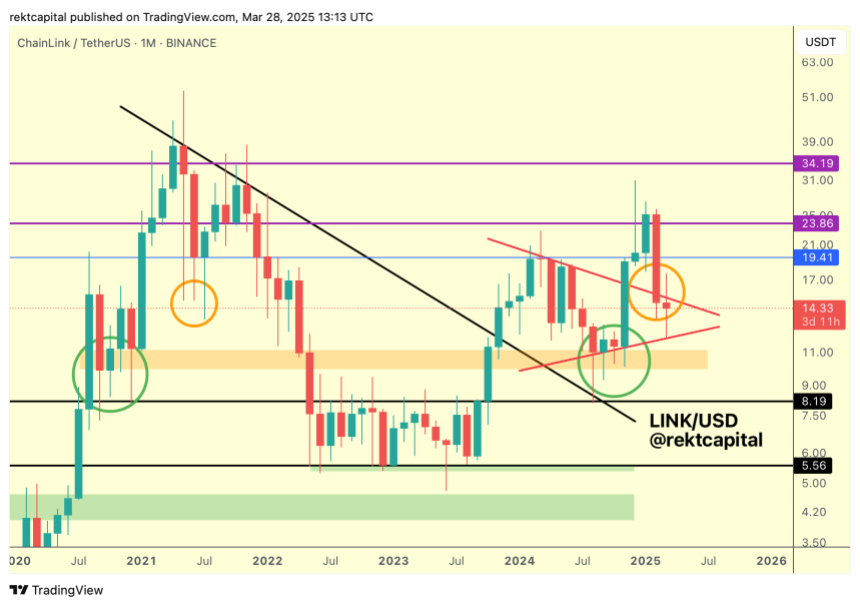

In the meantime, Rekt Capital highlighted that the token is testing its multi-month symmetrical triangle sample, which may decide the cryptocurrency’s subsequent transfer.

Because the analyst defined, Chainlink consolidated inside a “Macro Triangular market construction” for many of 2024 earlier than breaking out of the sample through the November market rally.

In the course of the This autumn 2024 breakout, the cryptocurrency hit a two-year excessive of $30.9 however failed to carry this stage within the following weeks. Consequently, it has been in a downtrend for the previous three months, with LINK’s value falling again into the Macro Triangle.

“The principle objective for LINK right here is to retest the highest of the sample to safe a profitable post-breakout retest,” Rekt Capital detailed, including, “It’s doable this can be a unstable post-breakout retest.”

LINK Wants To Maintain This Stage

Rekt Capital identified that, traditionally, Chainlink has had downside deviations into this value vary: “Again in mid-2021, LINK produced a draw back deviation into this value space within the type of a number of Month-to-month draw back wicks.”

Nonetheless, the cryptocurrency is draw back deviating “however within the type of precise candle-bodies closes quite than draw back wicks” this time.

The analyst additionally highlighted that, like in 2021, LINK is buying and selling inside a historic demand space, at round $13-5 and $15.5, testing this zone as assist. Primarily based on this, the cryptocurrency should efficiently maintain this space to “place itself for upside going ahead.”

Associated Studying

Furthermore, the retest is vital for reclaiming the highest of its triangular market construction. Breaking and recovering that stage would “actual a profitable post-breakout retest” and allow the worth to focus on the $19 resistance sooner or later.

The analyst concluded that if LINK closes the month above the triangle prime, it “would place value for a profitable retest, regardless of the draw back deviation.”

As of this writing, Chainlink trades at $14.09, a 6.9% drop within the month-to-month timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com