Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a video revealed on Wednesday, crypto analyst and dealer Miles Deutscher devoted a prolonged section to the long-anticipated distribution of FTX chapter proceeds, arguing that tomorrow’s launch of roughly $5 billion in stablecoins might change into a pivotal liquidity shock for digital-asset markets.

$5 Billion Liquidity Hits Crypto Tomorrow

Deutscher reminded viewers that the cash component of the FTX estate—“round 5 billion in stablecoins,” as he put it—enters collectors’ accounts on Could 30, the primary wave of repayments for the reason that change collapsed in 2022. “Could thirtieth is perhaps some of the necessary days this cycle,” he mentioned. “FTX is distributing over 5 billion in stablecoins to collectors this week. That’s round 2 % of the full stable-coin provide.”

Associated Studying

As a result of most victims “stayed in crypto regardless of the FTX blow-up,” Deutscher believes the majority of the reimbursement is not going to be cashed out to conventional financial institution accounts however redeployed in-kind throughout the ecosystem. “When that $5 billion hits, it’s not sitting idle […] they’re going to rotate that liquidity again into the market,” he predicted, including that the influx “might be the catalyst that pushes Bitcoin to $120,000 and triggers the alt-season setup we’ve been ready for.”

The YouTuber framed the timing as unusually propitious. Bitcoin trades close to its prior all-time highs, Ethereum is exhibiting its first sustained out-performance versus Bitcoin this yr, and US lawmakers seem nearer than ever to passing a regulatory framework for stablecoins. In that context, he argued, even a conservative estimate—the place just a few hundred million {dollars} of the FTX haul migrates straight into smaller tokens—would nonetheless signify “internet new liquidity that has not been within the house as a result of retail cash has been fully dry.”

Already Priced In?

Deutscher pushed again on the concept that the occasion has already been priced in: “It doesn’t really feel like buy-the-rumor, sell-the-news […] in any other case individuals would have been speaking about all of it week. It’s solely right this moment that persons are realizing that is really taking place in a few days’ time.” He known as the forthcoming transfers “sleeper liquidity,” stressing that social-media and trading-desk chatter stays muted in contrast with final yr, when compensation schedules first surfaced.

Associated Studying

How the funds fragment as soon as they land is, in fact, unknowable. The analyst conceded that allocations will range—some recipients will go for Bitcoin or Ethereum, some could maintain in stablecoins, others will chase speculative altcoins—however the overarching impact is expansionary. “What I do know is that that is internet new liquidity hitting the market,” he mentioned. “And what you’ve bought to ask your self is the place that liquidity goes to go.”

Market members is not going to have to attend lengthy for first-order proof. Redemption directions contained in the BitGo portal are already stay, and collectors have till 1 June to finish know-your-customer verification. By tomorrow, no less than a portion of the stable-coin tranche must be seen on-chain, giving analysts real-time knowledge with which to verify—or problem—Deutscher’s thesis.

Whether or not the $5 billion surge proves a short-term jolt or the ignition level of a broader risk-on cycle, it’ll shut one in all crypto’s darkest chapters with an injection of recent capital. As Deutscher summed up, “This might be a fairly good setup alongside the opposite catalysts that I’ve identified.” The market now waits to see whether or not the reclaimed funds will, certainly, change into the tide that lifts all boats.

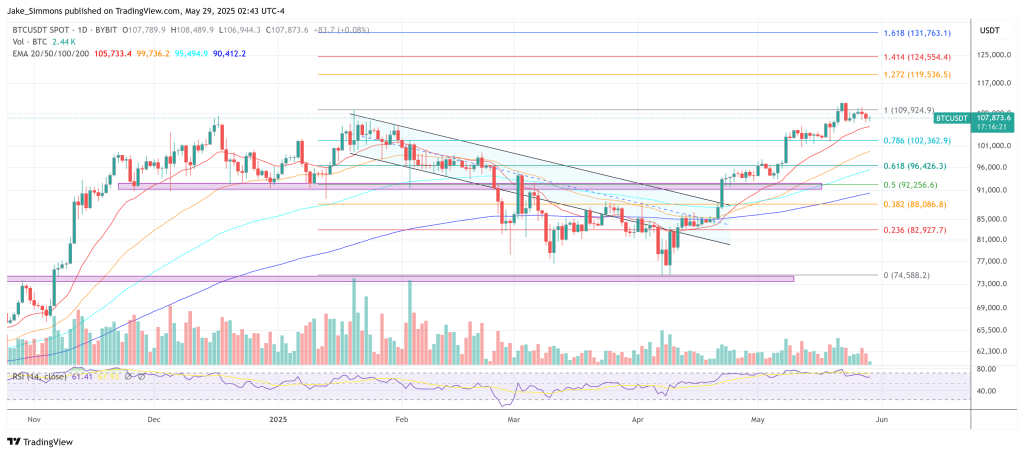

At press time, BTC traded at $107,873.

Featured picture created with DALL.E, chart from TradingView.com