The workforce behind the DeFi protocol CrediX is suspected of an exit rip-off following a latest $4.5 million safety breach. The workforce has reportedly “vanished” from the mission’s official channels regardless of promising refunds, leaving clients empty-handed.

Associated Studying

DeFi Protocol Suffers $4.5 Million Exploit

On Friday, safety agency CertiK reported that the DeFi lender CrediX’s workforce had disappeared following the platform’s latest exploit, leaving its web site offline for the reason that August 4 incident and all of the sudden deleting the official X account.

For context, the Sonic-based DeFi lender suffered a security breach on Monday after a possible pockets compromise led to the theft of $4.5 million from the protocol’s liquidity pool.

Blockchain safety agency PeckShield explained that the alleged hack was on account of a compromised admin account, which allowed the exploiter to abuse its BRIDGE function to mint unbacked acUSDC (Sonic USDC) tokens, borrow in opposition to them, and drain the pool, earlier than bridging the belongings from Sonic Community to Ethereum.

Notably, SlowMist discovered that the CrediX multisig pockets added an attacker as an admin and bridge function through ACLManager six days earlier than, which raised issues amongst buyers.

The DeFi lender’s workforce acknowledged the incident on X, stating that that they had disabled the web site to forestall customers from depositing. Later, the workforce knowledgeable its neighborhood that it had allegedly “reached profitable parley with the exploiter, who agreed to return the funds throughout the subsequent 24-48 hours.”

In line with the now-deleted publish, posted on CrediX’s official Telegram account by a person, the attacker agreed to return the funds “in return for cash totally paid by the credix treasury.”

The workforce affirmed that they might airdrop the funds to the affected customers’ addresses in “the respective timeframe.”

CrediX Goes Darkish

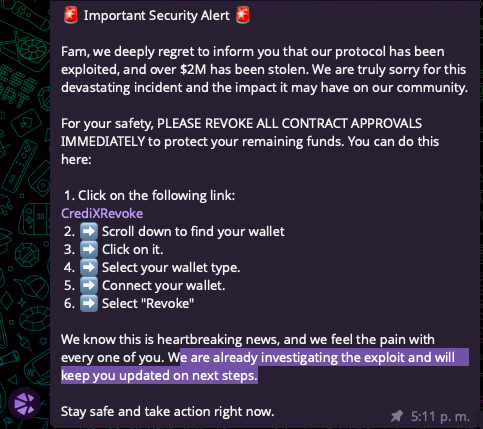

The next day, the workforce addressed the exploit on Telegram, stating, “We’re really sorry for this devastating incident and the impression it might have on our neighborhood,” and affirmed that they might maintain customers up to date on the subsequent steps earlier than disappearing and deactivating the official X account.

On Thursday, the Sonic-based Stability DAO confirmed on its Discord server that CrediX had “gone darkish and disappeared,” straight affecting the protocol’s customers. The exploit affected Stability DAO’s Metavaults because the mission had not too long ago built-in with CrediX.

Within the message, the protocol introduced that each one the affected groups, together with Sonic Labs, Euler, Beets, and Rines Protocol (Trevee), have been in communication and actively engaged on “submitting a proper authorized report with the authorities in hopes of recovering misplaced funds.”

Moreover, they’ve obtained info on two of the DeFi lender’s members, which might be added to the report alongside the remainder of the proof.

“A full incident report might be shared with the neighborhood quickly, outlining all the pieces that occurred and what steps are being taken,” the message vowed.

Associated Studying

This incident follows the alarming pattern that has been creating this 12 months. As reported by NewsBTC, crypto theft has surged this 12 months, reaching a complete lack of $2.7 billion within the first half of 2025.

By the tip of June, extra worth had been stolen year-to-date (YTD) than throughout the identical interval in 2022, suggesting that theft from crypto companies and DeFi tasks might probably hit $4.3 billion by 12 months’s finish.

Featured Picture from Unsplash.com, Chart from TradingView.com