Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bloomberg Intelligence’s chief commodity strategist, Mike McGlone, has issued a stark warning to Dogecoin holders and the broader crypto group by drawing comparisons to historic situations of market extra. In a sequence of latest posts revealed on X , McGlone invoked the years 1929 and 1999—the infamous eras of the inventory market crash and the dot-com bubble—to underscore the dangers of speculative “silliness” in digital belongings.

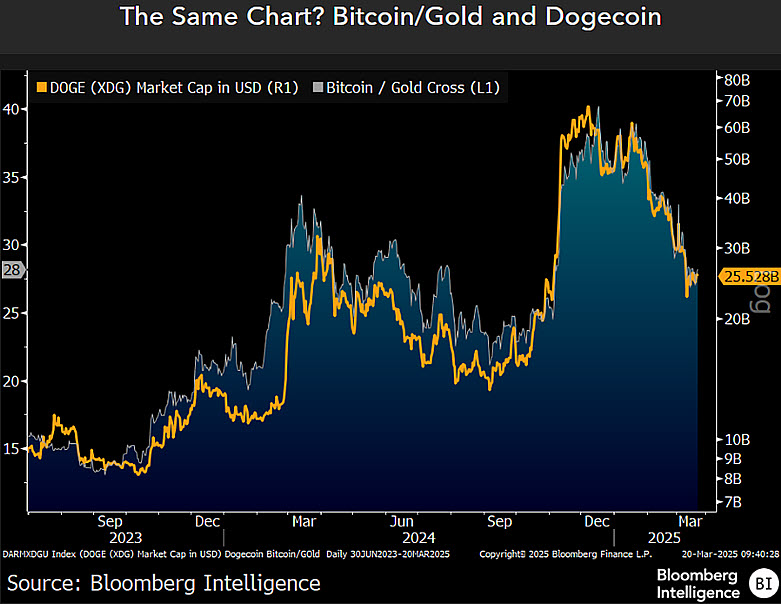

Dogecoin Mirrors 1929-Fashion Threat

He singled out Dogecoin specifically, emphasizing its vulnerability to a possible market reversion, whereas additionally pointing to gold as a beneficiary if danger urge for food continues to deteriorate. “Dogecoin, 1929, 1999 Threat-Asset Silliness and Gold – The ratio of gold ounces equal to Bitcoin buying and selling virtually tick-for-tick with Dogecoin could present the dangers of reversion in extremely speculative digital belongings, with deflationary implications underpinning the steel,” he wrote.

Associated Studying

The chart under exhibits how carefully the meme-inspired cryptocurrency’s market cap has mirrored the Bitcoin-to-gold ratio. The monitoring of those two metrics means that every time the relative worth of Bitcoin to gold experiences a shift, Dogecoin’s trajectory pivoted sharply, exposing it to the identical market forces which have traditionally challenged extremely speculative belongings.

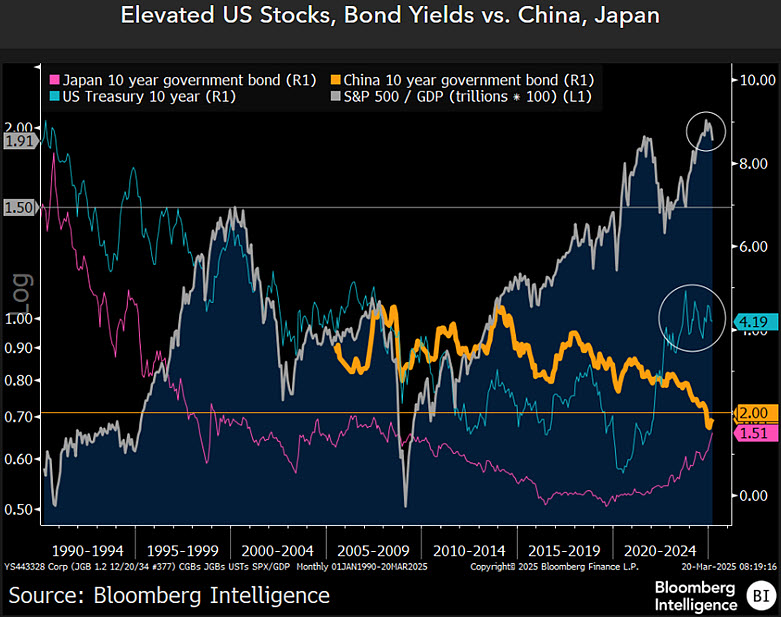

McGlone’s broader thesis doesn’t finish with Dogecoin. In one other publish, he turned consideration to the notion of gold reaching $4,000 per ounce, linking such a risk to dynamics within the bond market and to potential declines throughout risk-on sectors, together with cryptocurrencies.

“What Will get Gold to $4,000? 2% T-Bonds? Melting Cryptos Might Information – A path towards $4,000 an oz for #gold might require one thing that’s usually a matter of time: reversion in silly-expensive danger belongings, notably cryptocurrencies,” he acknowledged.

He underscored that if the US inventory market had been to stay beneath stress, bond yields may ultimately be pulled decrease by the comparatively meager 2% or decrease yields seen in China and Japan. Such a situation, in McGlone’s view, provides tailwinds for gold as a result of a shift from comparatively high-yielding Treasuries to lower-yielding authorities bonds overseas might drive buyers towards different havens.

Associated Studying

The chart shared by McGlone reinforces his evaluation of decelerating demand for danger belongings. One visible, titled “Elevated US Shares, Bond Yields vs. China, Japan,” shows the persistent divergence between US Treasury yields, which hover across the 4.19% mark, and the comparatively subdued charges of Chinese language and Japanese authorities bonds, located nearer to 2% and 1.51% respectively.

The graphic additionally portrays the S&P 500’s market cap-to-GDP ratio, which stays traditionally excessive regardless of latest volatility. McGlone’s conclusion is that continued stress on fairness markets, mixed with international bond charges that sit nicely under US yields, might speed up a rotation into gold if buyers understand a downturn in “costly” asset courses, together with danger belongings like Dogecoin.

A 3rd publish addressed the broader altcoin market, with McGlone pointing to Ethereum as a leading indicator of whether or not the general development has turned bearish for digital belongings. “Has the Pattern Turned Down? Ethereum Might Information – Ether, the No. 2 cryptocurrency, is breaking down, with deflationary implications and gold underpinnings,” he famous.

At press time, DOGE traded at $0.16663.

Featured picture created with DALL.E, chart from TradingView.com