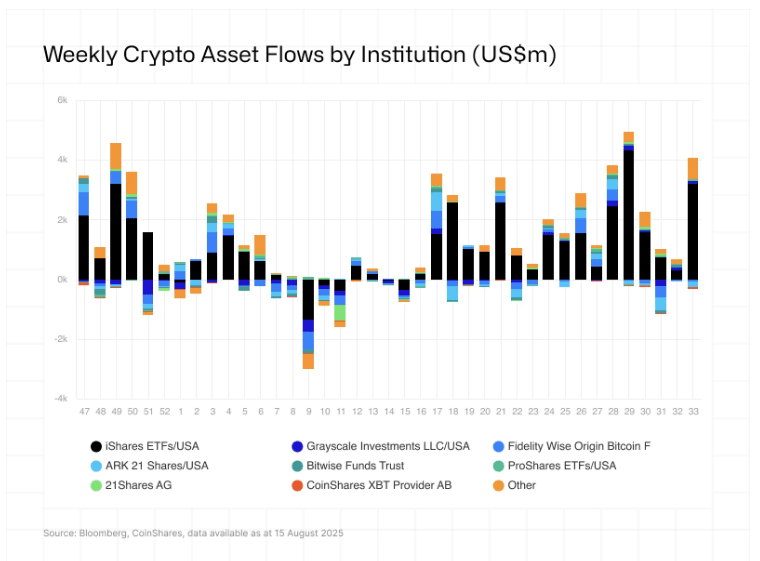

Digital-asset funding merchandise pulled in $3.75 billion final week, lifting belongings beneath administration to $244 billion on August 13.

Associated Studying

The overall ranks among the many largest weekly inflows seen lately, CoinShares data reveals. Costs rose, however the principle driver was cash shifting into funds relatively than a broad retail rush.

Concentrated Flows From A Single Product

Based mostly on experiences from CoinShares, nearly all the inflows got here by means of one supplier. The US accounted for $3.73 billion, nearly your complete week’s whole.

Canada added $33.7 million, Hong Kong near $21 million, and Australia $12 million. In contrast, Brazil and Sweden recorded outflows of $10.6 million and $50 million.

Market members say the majority of the money was funneled right into a single iShares product, which helps clarify how a comparatively slim set of flows moved general AUM so sharply.

Ethereum Attracts The Most Cash

Ethereum attracted the lion’s share of final week’s inflows at $2.87 billion, or 77% of the whole. That brings year-to-date web inflows into ETH to about $11 billion.

Ethereum now makes up almost 30% of belongings beneath administration, versus Bitcoin’s 11.6%. Bitcoin’s weekly consumption was $552 million.

Different strikes included Solana taking $176.5 million and XRP including $126 million, whereas Litecoin and Ton confirmed small outflows of $0.4 million and $1 million, respectively. These numbers level to a transparent shift in the place institutional cash is parked this week.

Company Holdings And Provide Notes

Reviews have disclosed that greater than 16 corporations have added Ethereum to their steadiness sheets, in accordance with CryptoQuant.

Collectively they maintain about 2.45 million ETH, valued at roughly $11 billion, and people cash are successfully out of circulation whereas locked in treasuries or chilly storage.

It’s price noting that Ethereum doesn’t have a set provide like Bitcoin; about a million ETH was added to provide final yr, and provide dynamics can range with community exercise.

Watch Futures And Massive Holders

Futures open curiosity sits close to $38 billion, a sizeable determine that raises the prospect of swift worth strikes when positions are closed.

Associated Studying

Massive, concentrated holders and sudden shifts in futures positions have proven they’ll push costs sharply in both course.

For now, it is a flow-driven occasion greater than a broad retail surge. If the identical product retains taking in massive sums, it’ll preserve including upward strain.

On the similar time, skinny liquidity and massive positions can flip positive factors into losses quick. Buyers and merchants ought to control weekly fund flows, futures open curiosity, and on-chain actions to see whether or not the pattern spreads past just a few huge patrons.

Featured picture from Meta, chart from TradingView