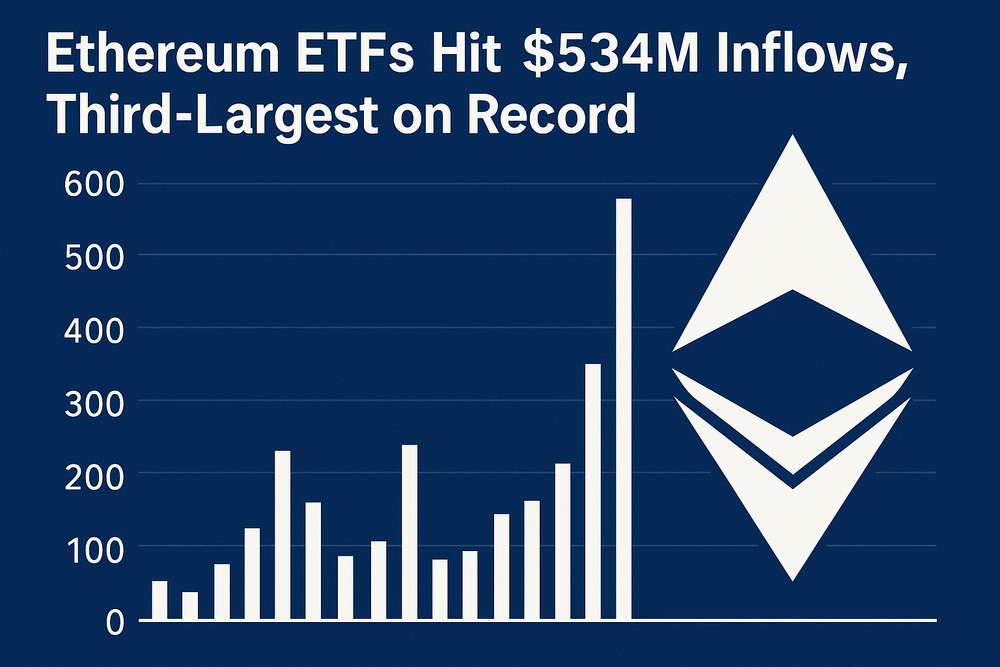

U.S. spot Ethereum exchange-traded funds (ETFs) recorded $534 million in internet inflows on July 22, marking the third-largest single-day influx since their launch. This surge extends a 13-day streak of constructive capital flows into the funds, signaling sturdy institutional and retail demand. BlackRock’s iShares Ethereum Belief (ETHA) dominated the inflows, capturing practically 80% of the whole capital.

The sustained momentum displays rising confidence in Ethereum’s legitimacy following SEC approval of the ETFs earlier this 12 months. Cumulative internet inflows have now reached $8.32 billion, with whole ETF property nearing $19.85 billion—representing 4.44% of Ethereum’s whole market capitalization. Analysts attribute this demand to Ethereum’s technological developments and its foundational function in decentralized finance.

Grayscale’s Ethereum Mini Belief contributed $72.64 million, whereas Constancy’s FETH added $35.01 million. Smaller suppliers like Franklin Templeton and Bitwise confirmed minimal exercise, highlighting investor desire for established monetary establishments. The influx streak coincides with Ethereum’s value climbing to $3,689.40 amid rising validator returns.

BlackRock’s ETF Dominance

BlackRock’s ETHA attracted $426.22 million on July 22 alone, pushing its whole property above $10 billion. This represents 2.24% of Ethereum’s circulating provide, underscoring the fund’s outsized affect. The dominance displays institutional belief in established asset managers for crypto publicity.

ETHA’s efficiency has persistently led the class since launch, capturing the lion’s share of every day inflows. Its success parallels BlackRock’s earlier achievements with Bitcoin ETFs, reinforcing the agency’s place as a gateway for conventional capital getting into crypto markets.

Grayscale and Constancy’s Strategic Roles

Grayscale’s Mini ETH fund secured $72.64 million in new capital, sustaining its place because the second-largest contributor. The fund affords decrease charges than Grayscale’s unique Ethereum belief, interesting to cost-conscious institutional traders.

Constancy’s FETH added $35.01 million, bringing its whole property to $2.36 billion. Each corporations profit from current consumer relationships in conventional finance, easing the transition into digital asset investments. Their participation validates Ethereum’s function in diversified institutional portfolios.

Ethereum’s Market Trajectory

Ethereum’s value rose to $3,689.40 amid the ETF inflows, with technical indicators suggesting sustained momentum. Validator returns elevated as staking participation grew, with over 27% of ETH provide now staked—a file excessive that raises centralization considerations.

Upcoming scalability upgrades like Proto-Danksharding might additional enhance utility by lowering layer-2 transaction prices. Main companies like SharpLink Gaming have adopted Ethereum for treasury reserves, signaling real-world asset tokenization momentum.

Key influx statistics for July 22:

| Supplier | Fund | Influx |

|---|---|---|

| BlackRock | ETHA | $426.22M |

| Grayscale | Mini ETH | $72.64M |

| Constancy | FETH | $35.01M |

Market analysts like Vincent Liu of Kronos Analysis be aware that Ethereum’s momentum seems sustainable mid-term, contingent on regular macroeconomic situations. The SEC’s regulatory readability has eliminated obstacles for conservative traders, accelerating adoption.

Nick Ruck of LVRG Analysis observes that establishments view Ethereum as a “second alternative” following Bitcoin’s historic rise. The ETF inflows coincide with Ethereum’s transition to proof-of-stake and its increasing DeFi ecosystem, detailed in The Block’s analysis.

Set up Coin Push cellular app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

The file inflows sign Ethereum’s maturation into an institutional-grade asset, probably reshaping crypto market dynamics. As ETF property method 5% of ETH’s market cap, their affect on value discovery and volatility patterns will intensify, creating new arbitrage alternatives throughout exchanges.

- ETF (Change-Traded Fund)

- An funding fund traded on inventory exchanges that holds property like shares, commodities, or cryptocurrencies. It permits traders to achieve publicity with out immediately proudly owning the underlying property.

- Proof-of-Stake (PoS)

- A blockchain consensus mechanism the place validators stake cryptocurrency to confirm transactions and create new blocks. It replaces energy-intensive mining with financial incentives for community safety.

- Decentralized Finance (DeFi)

- Monetary companies constructed on blockchain networks that function with out conventional intermediaries like banks. It permits peer-to-peer lending, borrowing, and buying and selling by sensible contracts.

- Tokenization

- The method of changing real-world property (like actual property or artwork) into digital tokens on a blockchain. These tokens symbolize possession and will be traded on digital asset exchanges.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your individual analysis earlier than making any funding selections.

Be happy to “borrow” this text — simply don’t neglect to hyperlink again to the unique.

Editor-in-Chief / Coin Push Dean is a crypto fanatic based mostly in Amsterdam, the place he follows each twist and switch on this planet of cryptocurrencies and Web3.