Whereas Bitcoin’s value confronted heightened bearish strain in the previous couple of days, Ethereum’s value skilled vital upside motion, which led to a new all-time high through the weekend. Along with outperforming Bitcoin by way of value motion, ETH is demonstrating notable on-chain exercise when in comparison with BTC.

Bitcoin Is Lagging Behind Ethereum

Ethereum’s strength is turning into more and more evident within the present bull market cycle, with new on-chain information highlighting its edge over Bitcoin. CryptoMe, a market knowledgeable, has outlined a key metric that underscores the disparity in momentum between the 2 crypto giants in a quick-take publish on the CryptoQuant platform.

In keeping with the market knowledgeable, Ethereum is giving sturdy indicators in comparison with Bitcoin, as Wall Road is beginning to undertake the altcoin. Contemplating the pattern, ETH fundamentals look like portray a transparent image of resilience and market dominance.

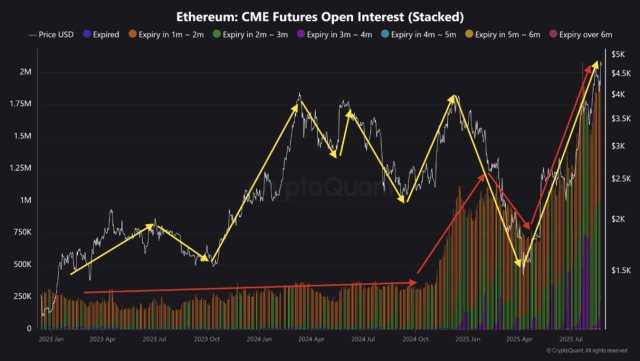

Within the final 3 months, ETH has outperformed, and this disparity could proceed for a while. CryptoMe’s evaluation relies on a comparability of the Open Interest (OI) data for Bitcoin and Ethereum futures contracts traded on the Chicago Mercantile Alternate (CME).

Delving into BTC’s efficiency, the knowledgeable highlighted that Bitcoin hit an all-time excessive of $110,000 in January, then fell to $74,000 in March and April earlier than rising to $124,000 for a brand new all-time excessive. Nevertheless, the open interest didn’t retest its outdated ranges throughout this era.

Due to this fact, even when the value of Bitcoin elevated, it will not have the ability to draw the identical quantity of institutional curiosity as CME choices. In the meantime, the circumstances are completely different for ETH. In 2024, ETH made a number of makes an attempt to interrupt previous the $4,000 mark, however failed every time resulting from its weak open curiosity.

Nevertheless, CryptoMe famous that the open curiosity in CME has began to extend on this present pattern. The event implies that the continuing uptrend is bolstered by contemporary liquidity inflows and exhibits that the altcoin is diverging from Bitcoin.

ETH Rallies To New Highs: The High Is Not In

ETH could have risen sharply to new highs, however CryptoMe foresees a continued uptrend as a result of absence of retail investors on centralized exchanges. Sometimes, retail buyers enter near the highest and provides the foremost gamers exit liquidity. Nonetheless, since retail remains to be absent within the present transfer, it exhibits that ETH’s value motion is wholesome and has room to develop.

Within the general image, ETH is exhibiting a extra bullish outlook in comparison with BTC recently. In keeping with the market knowledgeable, the rise in CME open curiosity and the absence of retail participation point out that this disparity may persist within the close to to medium future.

On the time of writing, ETH was buying and selling at $4,414, demonstrating a virtually 5% within the final 24 hours. Regardless of the waning value motion, CoinMarketCap information reveals that investors’ sentiment is slowly turning bullish, as evidenced by a greater than 10% improve in buying and selling quantity prior to now day.

Featured picture from iStock, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.