TL;DR

- Ethereum was rejected at $4,950, liquidating $720M longs, now testing $4,500 assist with $4,300 threat.

- Whales added $1.6B ETH this week, with demand zones aligned at $4,590–$4,760 Fibonacci cluster.

- Historic knowledge exhibits September pullbacks usually comply with sturdy August positive aspects, leaving ETH weak beneath $4,500.

Ethereum Value Motion

Ethereum surged to a brand new all-time excessive of $4,950 on August 24 earlier than shedding momentum. The token has since pulled again to round $4,550, down 4.5% over the previous 24 hours, although nonetheless up 8% on the week. Since early August, ETH has climbed 26% and stays greater than 220% above its yearly low.

In the meantime, the reversal got here throughout a wave of liquidations throughout the market. Greater than $720 million in positions had been worn out within the final day, with almost $500 million tied to Bitcoin and Ethereum longs. The rejection close to $4,950 triggered a lot of the flush.

Liquidity Seize and Assist Ranges

Analyst Lennaert Snyder stated Ethereum “took liquidity above $4,880 and flushed leveraged longs.” He added that ETH is “at present testing ~$4,500 assist, however it doesn’t look sturdy.”

Snyder pointed to $4,693 as the important thing vary low for bulls to reclaim shortly. A recovery above that degree may open one other transfer towards $4,880. If $4,500 fails, the chart suggests ETH may slide to $4,300, which marked the beginning of its final impulse larger.

$ETH took liquidity above $4,880 and flushed leveraged longs.

At the moment testing ~$4,500 assist, however is doesn’t look sturdy.

Finest case state of affairs for the bulls is to reclaim $4,693 rangelow asap.

If we lose right here, Ethereum will in all probability retest the $4,300 begin impulse. pic.twitter.com/Mkl4BtFizy

— Lennaert Snyder (@LennaertSnyder) August 25, 2025

The $4,880 zone now acts as speedy resistance, whereas $4,500 stays underneath stress.

Whale Shopping for and Institutional Flows

Giant gamers have been lively in latest periods. Clever Crypto noted that whales added greater than $1.6 billion price of ETH this week, whilst volatility elevated. They described $4,590–$4,760 as a requirement space that aligns with the 0.5 Fibonacci retracement at $4,780.

Clever Crypto highlighted $4,950 (0.618 Fib) because the resistance to clear. A break above that line may set a path towards $5,500, with checkpoints at $5,190 and $5,500.

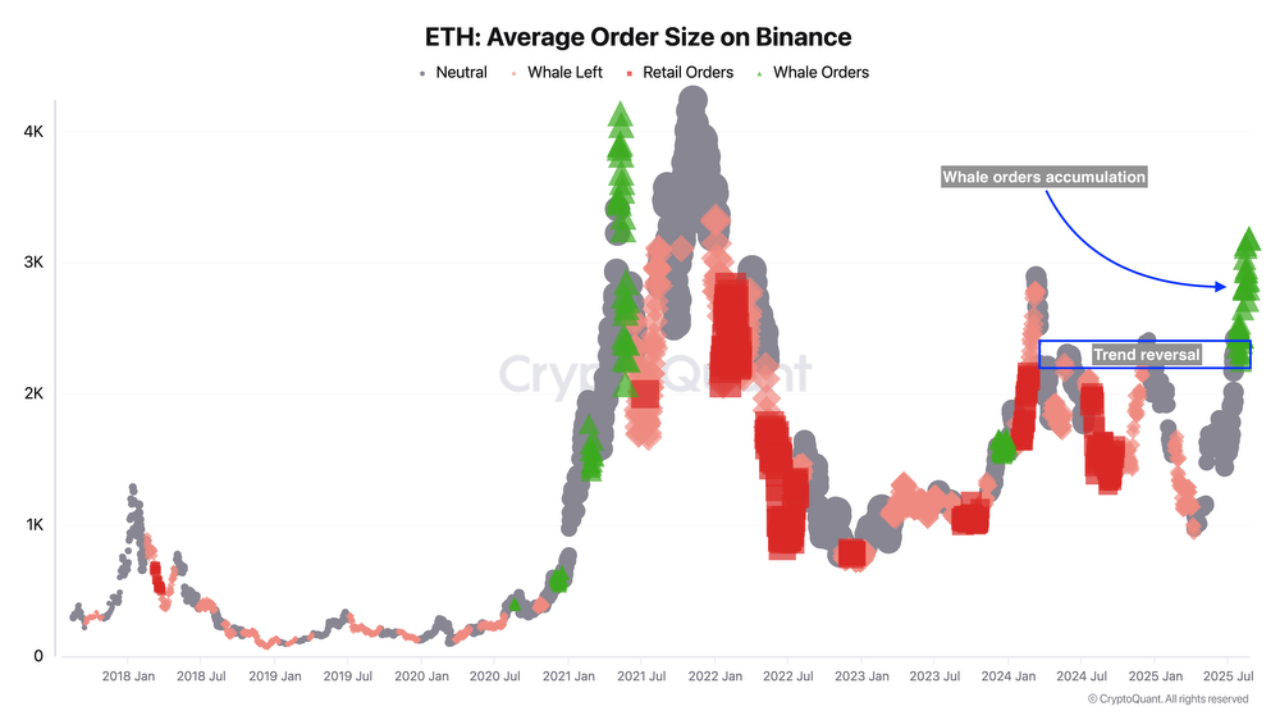

On the similar time, CryptoQuant analyst Darkfost pointed to continued whale accumulation on Binance.

“Since July, now we have seen a major improve in demand coming from Binance whales,” they wrote.

Based on the analyst, their exercise exhibits a choice for constructing positions after express development affirmation, which may present further assist if ETH makes an attempt one other push towards $5,000.

Ethereum’s rally in August has been sturdy, however historic developments point out that September usually brings corrections after a worthwhile August. Knowledge from CoinGlass suggests the identical may apply this 12 months.

For now, ETH sits between crucial ranges: $4,690 on the upside and $4,500–$4,300 on the draw back. A reclaim may reignite momentum towards $5,000, whereas failure could reinforce seasonal weak point.

The put up Ethereum Plummets After $4,950 Liquidity Grab: Is a Bigger Dump Coming? appeared first on CryptoPotato.