Ethereum’s value went via a irritating correction initially of the week. Nonetheless, issues may change quickly, and a rebound may happen within the coming weeks.

Technical Evaluation

By Edris Derakhshi (TradingRage)

The Every day Chart

On the every day chart, the asset has been making decrease highs and lows since getting rejected from the $4,000 resistance stage. The $3,500 stage has additionally been misplaced and has was resistance.

In the mean time, the market is testing the important thing $3,000 help stage and the 200-day shifting common, situated across the identical value mark. This can be a considerably sturdy and important stage that might provoke a rebound for ETH. But, observe {that a} breakdown may result in catastrophic outcomes, as it might point out a whole bearish reversal.

The 4-Hour Chart

The 4-hour chart demonstrates an attention-grabbing image of the current ETH value motion. In the course of the current decline, the asset has created a falling wedge sample, which is usually a bullish reversal sample if it will get damaged to the upside.

With the worth seemingly rebounding from the $3,000 stage for the time being, if a bullish breakout happens, the market may formally start a brand new rally by rising again towards the $4,000 space within the brief time period.

Sentiment Evaluation

By Edris Derakhshi (TradingRage)

Ethereum Open Curiosity

Whereas Bitcoin’s value is at a key stage that might create a backside for all the market, relying solely on technical evaluation wouldn’t essentially yield dependable insights. Consequently, analyzing the futures market sentiment may add some helpful details about the underlying dynamics and result in higher conclusions.

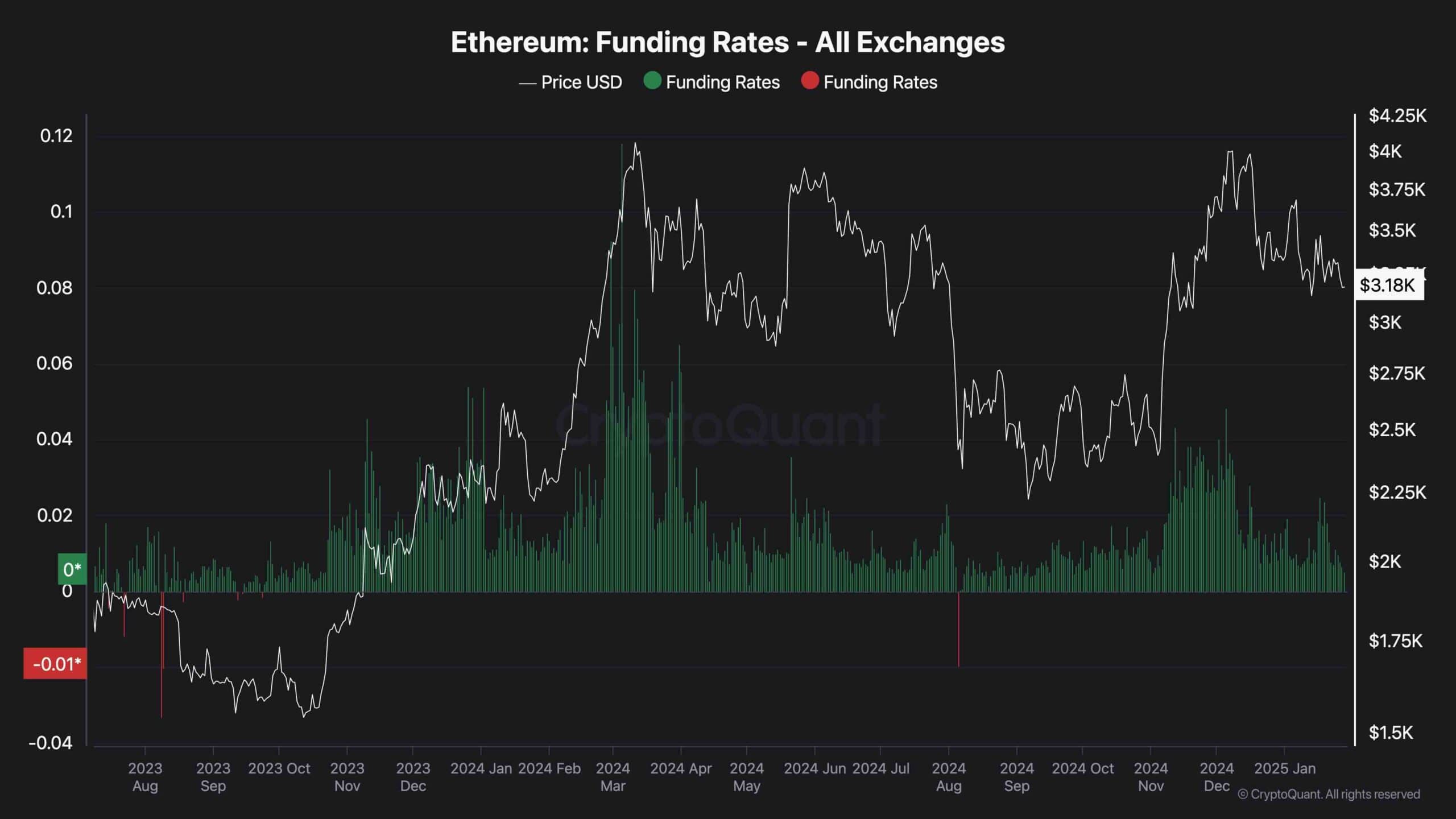

This chart presents the Ethereum funding price metric, which measures whether or not the patrons or the sellers are extra aggressively executing their orders on mixture general exchanges. Optimistic funding charges point out bullish sentiment and vice versa.

It’s evident that whereas ETH’s value has been on a gradual decline just lately, the funding charges metric has additionally been dropping and is now removed from the considerably excessive values seen over the previous few months. This means that the futures market is not overheated, and with sufficient spot demand, the worth can as soon as once more rally larger within the coming weeks.

The publish Ethereum Price Analysis: Can ETH Finally Break Out of its Corrective Phase? appeared first on CryptoPotato.