Ethereum continues to indicate robust momentum as the worth hovers slightly below a key stage, supported by sustained bullish construction and rising market curiosity. With spot costs holding above main shifting averages and an aggressive rally from June lows, all eyes are on whether or not ETH can break above the $4,107 stage.

Technical Evaluation

By ShayanMarkets

The Every day Chart

On the every day chart, Ethereum is respecting its bullish construction, having flipped the $3,300 zone from resistance into assist. The 100-day and 200-day have additionally created a bullish crossover, offering extra affirmation of the development.

Furthermore, the RSI, which not too long ago entered overbought territory, has barely cooled down however stays elevated, suggesting that momentum is likely to be overheated. But, the clear sweep and reclaim of prior highs round $3,300 replicate energy and dedication from consumers, and so long as this stage holds, the bulls are in management.

This construction is a basic signal of development continuation, particularly when supported by robust quantity and momentum indicators. If the worth begins to increase once more from this consolidation vary, the following upside goal would doubtless be the $4,400 area, the place Ethereum topped throughout earlier cycles.

Conversely, a break under $3,300 would elevate issues of a deeper retracement, however for now, that state of affairs appears much less doubtless until broader market weak point emerges.

The 4-Hour Chart

The 4H chart additional helps the bullish case with a clearly outlined ascending trendline holding the worth. The asset continues to respect the trendline, and every dip has been met with robust shopping for curiosity, signaling that bulls are nonetheless lively and defending the uptrend.

Nonetheless, some warning is warranted within the brief time period, primarily as a result of overbought circumstances on the every day chart. If ETH fails to carry above the $3,700 zone or loses the ascending trendline, a short-term correction towards $3,500 could be a wholesome reset. This stage additionally aligns with the every day assist block, making it a logical space for consumers to step in once more if examined.

On-Chain Evaluation

Ethereum Open Curiosity

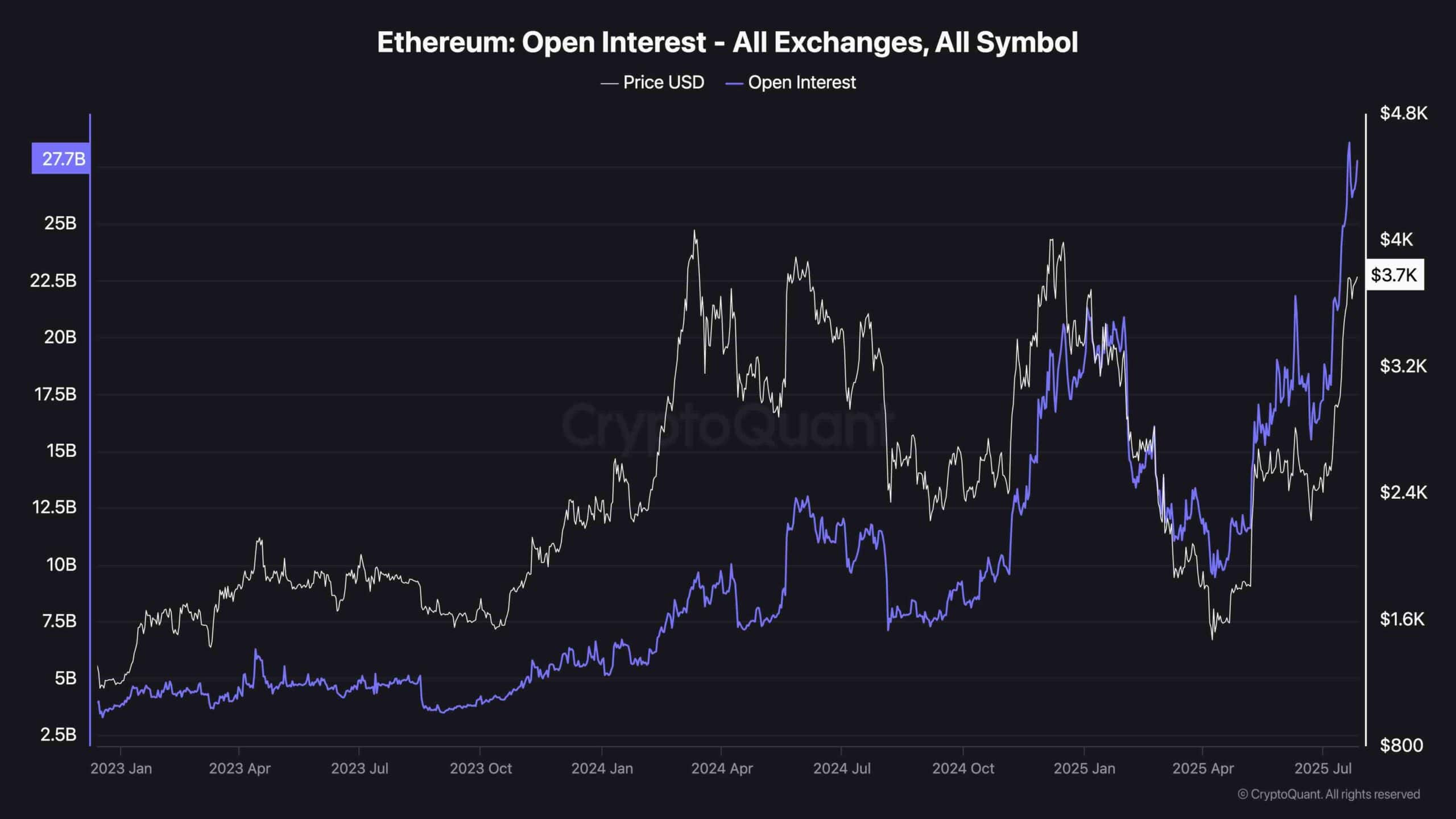

On the sentiment facet, Ethereum’s open curiosity throughout all exchanges has surged to over $27 billion, marking its highest level in years. This means an enormous inflow of leveraged positions and displays rising speculative urge for food available in the market. Traditionally, rising open curiosity in tandem with rising worth indicators confidence and development energy, nevertheless it additionally will increase the danger of a protracted squeeze if the market turns.

What’s notable, nevertheless, is that regardless of the elevated OI, funding charges stay at comparatively average ranges. This means that almost all of merchants should not excessively over-leveraged, and we’re not but seeing the form of euphoria sometimes related to main tops.

It provides Ethereum extra room to push greater with out the fast risk of a pointy deleveraging occasion. For now, positioning stays optimistic however not overheated, protecting the trail open for a possible breakout above $4,100.

The publish Ethereum Price Analysis: Is ETH Gearing Up for a Surge to $4K? appeared first on CryptoPotato.