Constancy Investments’ Director of World Macro, Jurrien Timmer, continues to offer insightful frameworks for understanding Bitcoin’s valuation and development. In a recent update, Timmer shared his tackle Bitcoin’s adoption and worth trajectories, illustrated by detailed charts that mirror each historic developments and hypothetical situations.

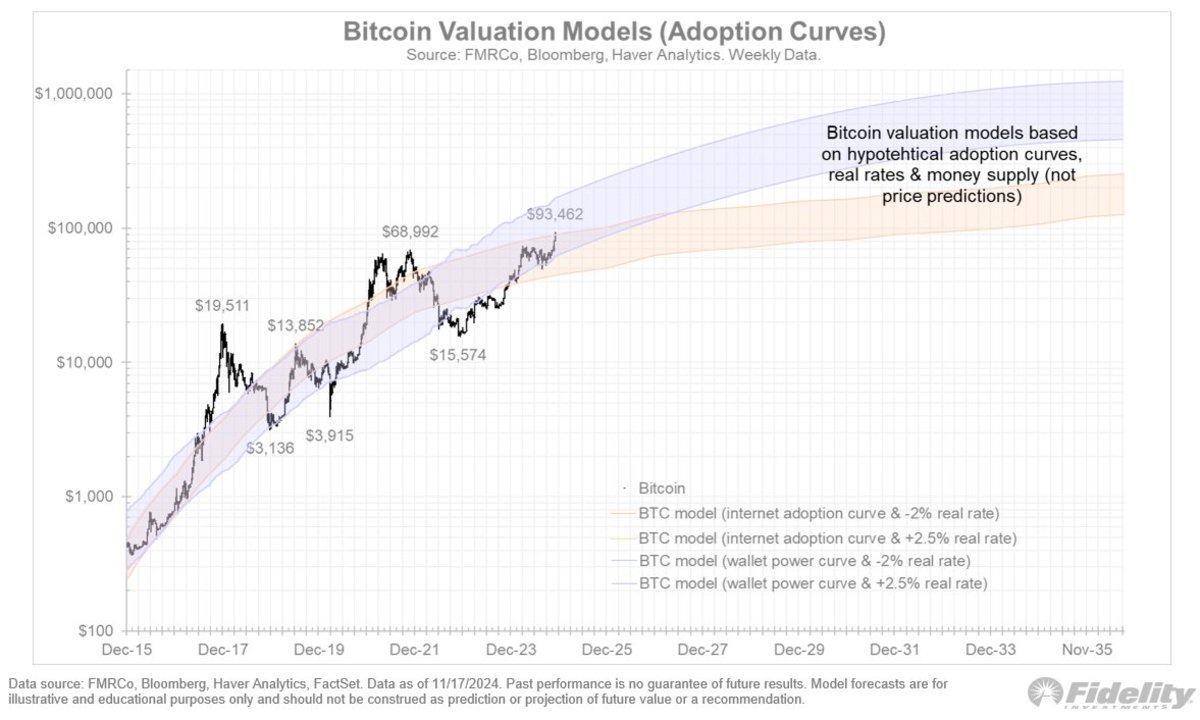

Timmer’s fashions goal to simplify Bitcoin’s advanced development dynamics, bridging the hole between community adoption and valuation. “Whereas the provision is understood, the demand will not be,” he said, emphasizing the crucial function of adoption curves and macroeconomic variables resembling actual charges and financial coverage.

Adoption Curves: Slowing However Constant Development

Regardless of a slowdown in Bitcoin’s community development, as measured by the variety of wallets with a non-zero stability, Timmer famous that the development nonetheless aligns with the steep energy curve proven in his up to date adoption chart. Whereas the web adoption curve has a gentler slope, Bitcoin’s adoption trajectory stays steeper, signifying its speedy however maturing development.

Importantly, Timmer highlighted a key limitation within the measurement of pockets development: the understated pockets/handle depend as a consequence of Bitcoin ETFs, which consolidate holdings into just some wallets. “It’s very doubtless that the pockets/handle depend is unassuming,” he mentioned, mentioning that ETFs obscure the broader distribution of Bitcoin adoption.

Financial Coverage Meets Adoption Dynamics

Constructing on his earlier fashions, Timmer added a brand new layer to his valuation framework by incorporating cash provide development alongside actual rates of interest. The up to date charts evaluate two hypothetical paths for Bitcoin’s valuation: one pushed by adoption curves and actual charges, and one other that features financial inflation as an element.

“Once more, these aren’t predictions,” Timmer clarified, “however merely makes an attempt at visualizing the use case on the idea of adoption, actual charges, and financial inflation.” This layered strategy underscores how exterior macroeconomic forces, like financial coverage, may affect Bitcoin’s adoption and valuation.

Why This Issues

Timmer’s up to date fashions reinforce Bitcoin’s place as a maturing monetary asset. By combining historic S-curves, Metcalfe’s Regulation, and macroeconomic elements, he affords a complete view of Bitcoin’s distinctive mix of community utility and financial options. His work highlights the significance of adoption in driving Bitcoin’s worth, whereas additionally demonstrating how real-world financial situations may form its future.

For Bitcoin proponents and skeptics alike, Timmer’s insights function a useful framework for understanding the asset’s twin nature as each a community and a type of cash. The inclusion of financial inflation in his fashions additional underscores Bitcoin’s potential as a hedge in opposition to fiat forex debasement.

The Street Forward

As Bitcoin continues to evolve, Timmer’s fashions present a crucial lens for monitoring its growth. Whether or not it’s the flattening of the adoption curve or the interaction between financial coverage and valuation, his evaluation underscores the asset’s rising complexity—and its enduring relevance within the monetary world.

For traders, analysts, and fans, these insights are a reminder of Bitcoin’s transformative potential, at the same time as its development curve matures.