In a observe printed on Tuesday, Jurrien Timmer, Director of International Macro at Constancy Investments, discusses how a shifting financial panorama may affect markets, central financial institution coverage, and the trajectory of each Bitcoin and gold. With the S&P 500 hitting new highs and the so-called “Trump Commerce” reversing course, Timmer presents nuanced insights into fiscal coverage, inflation, and the function of danger property in a “limbo” market surroundings.

The Trump Impact

Timmer observes that the primary six weeks of 2025 have introduced sudden market strikes and an unusually excessive “noise-to-signal ratio.” The dominant market expectation coming into the yr—anticipating “larger yields, a stronger greenback, and outperforming US equities”—has abruptly flipped. He notes: “It appears so 2025 that the consensus commerce of upper yields, a stronger greenback, and outperforming US equities has changed into the alternative.”

Timmer highlights that Bitcoin, contemporary off a year-end rally, stays on high of rolling three-month return rankings, adopted carefully by gold, Chinese language equities, commodities, and European markets. On the decrease finish of the desk, the US greenback and Treasuries are mentioning the rear.

Associated Studying

Regardless of the S&P 500’s report ranges, Timmer calls this a “digestion interval” following the post-election optimism. He explains that the market beneath the headline index is far much less decisive. In response to Timmer, the equal-weighted index stays on maintain, with solely 55% of shares buying and selling above their 50-day shifting averages.

“Sentiment is bullish, credit score spreads are slim, the fairness danger premium (ERP) is within the tenth decile, and the VIX is at 15. The market seems to be priced for fulfillment.” Timmer underscores that whereas earnings progress was sturdy at 11% in 2024, revisions seem lackluster, and there are open questions on what would possibly occur if long-term charges climb in the direction of 5% or past.

One of the crucial essential items of Timmer’s evaluation facilities on Federal Reserve coverage. He factors to the current CPI report, with a year-over-year core inflation determine of three.5%, as a near-consensus indicator that the Fed will stay on pause. “It’s now all however unanimous that the Fed is on maintain for a while to return. That’s precisely proper, in my opinion. If impartial is 4%, I consider the Fed must be a smidge above that degree, given the potential probability that ‘3 is the brand new 2.’”

He warns about the potential of a “untimely pivot,” recalling the coverage errors from the 1966–1968 interval, when fee cuts occurred too early, finally permitting inflation to achieve a foothold.

With the Fed apparently sidelined, Timmer believes the following market driver for rates of interest will come from the lengthy finish of the curve. Particularly, he sees stress between two situations: one that includes limitless deficit spending and rising time period premiums—hitting fairness valuations—and one other emphasizing fiscal self-discipline, which might presumably rein in long-dated bond yields.

Timmer additionally remarks that weekly jobless claims could come into sharper focus for bond markets, given how authorities spending underneath the brand new administration may affect employment information.

Associated Studying

Timmer factors out a possible bullish sample—a head-and-shoulders backside—within the Bloomberg Commodity Spot Index. Although he stops wanting calling it a definitive shift, he notes that commodities stay in a broader secular uptrend and will see renewed investor curiosity if inflation pressures keep elevated or fiscal circumstances stay unfastened.

Gold, he notes, has been “an enormous winner” lately, outperforming many skeptics’ expectations: “Since 2020, gold has produced virtually the identical return because the S&P 500 whereas having a decrease volatility. In my opinion, gold stays an integral part of a diversified portfolio in a regime wherein bonds would possibly stay impaired.”

Timmer sees gold testing the essential $3,000 degree amid a world uptick in cash provide and a decline in actual yields. Traditionally, gold has proven a powerful adverse correlation with actual yields, although Timmer believes the metallic’s power of late might also replicate fiscal fairly than financial dynamics—notably, geopolitical demand from central banks in China and Russia.

Bitcoin Vs. Gold

In response to Timmer, the outperformance of each gold and Bitcoin has “sparked plenty of dialog about financial inflation.” Nonetheless, he attracts a distinction between the “amount of cash” (the cash provide) and the “worth of cash” (worth inflation).

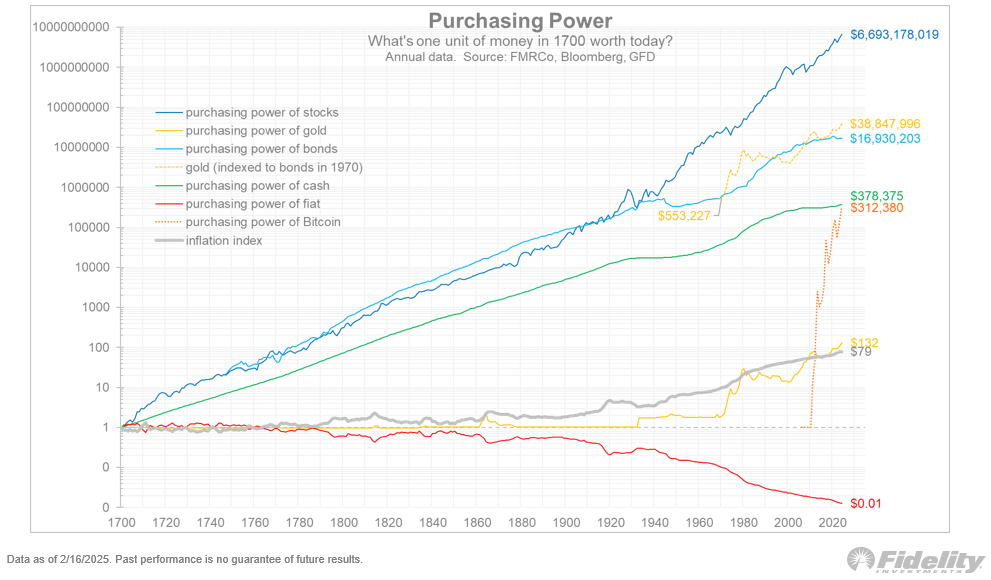

“The purpose of this train is to indicate that the expansion in conventional asset costs over time can’t simply be defined away by financial debasement (which is a favourite pastime of some bitcoiners),” he writes.

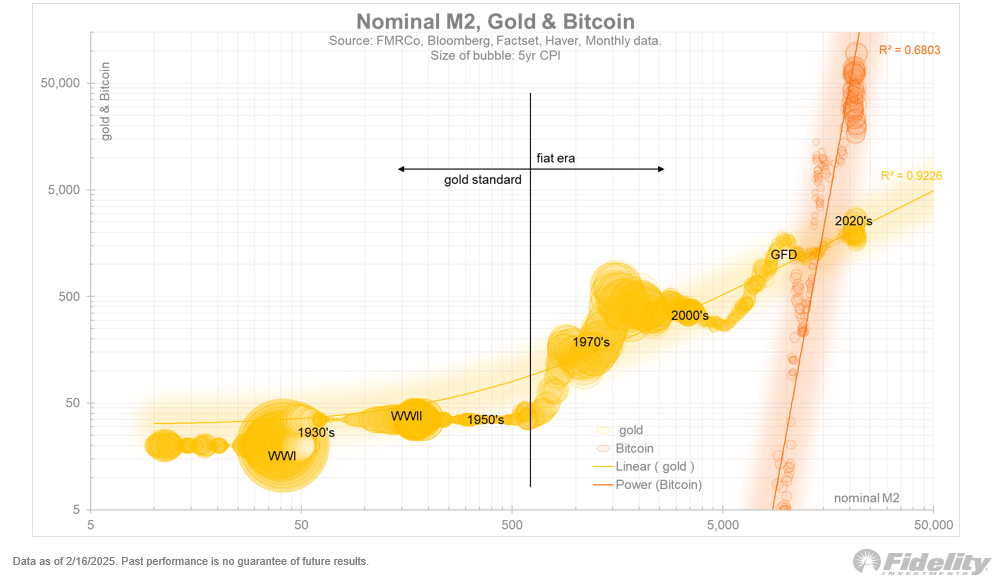

Timmer’s charts counsel that whereas nominal M2 and nominal GDP have moved in close to lockstep for over a century, client worth inflation (CPI) has lagged considerably behind cash provide progress. He cautions that adjusting asset costs solely in opposition to M2 could produce deceptive conclusions.

Nonetheless, his evaluation finds that each Bitcoin and gold have strong correlations to M2, albeit in several methods: “It’s attention-grabbing that there’s a linear correlation between M2 and gold, however an influence curve between M2 and Bitcoin. Totally different gamers on the identical staff.”

Timmer highlights gold’s long-run efficiency since 1970, noting that it has successfully stored tempo—and even exceeded—the worth created by many bond portfolios. He sees gold’s function as a “hedge in opposition to bonds,” particularly if sovereign debt markets stay pressured by fiscal deficits and better long-term charges.

Timmer’s observe underscores that Bitcoin’s robust efficiency can’t be seen in isolation from gold or the broader macroeconomic surroundings. With yields in flux and policymakers grappling with deficits, traders could also be compelled to reassess the traditional 60/40 portfolio mannequin.

He emphasizes that whereas previous expansions of the cash provide have usually spurred inflation, the connection isn’t all the time one-to-one. Bitcoin’s meteoric rise may, in Timmer’s view, replicate a market notion that fiscal issues—not simply financial coverage—are driving asset costs. “And as you may see from the dotted orange line and the inexperienced line, Bitcoin has added the identical quantity of worth that in a single day cash took over 300 years to create,” he concluded.

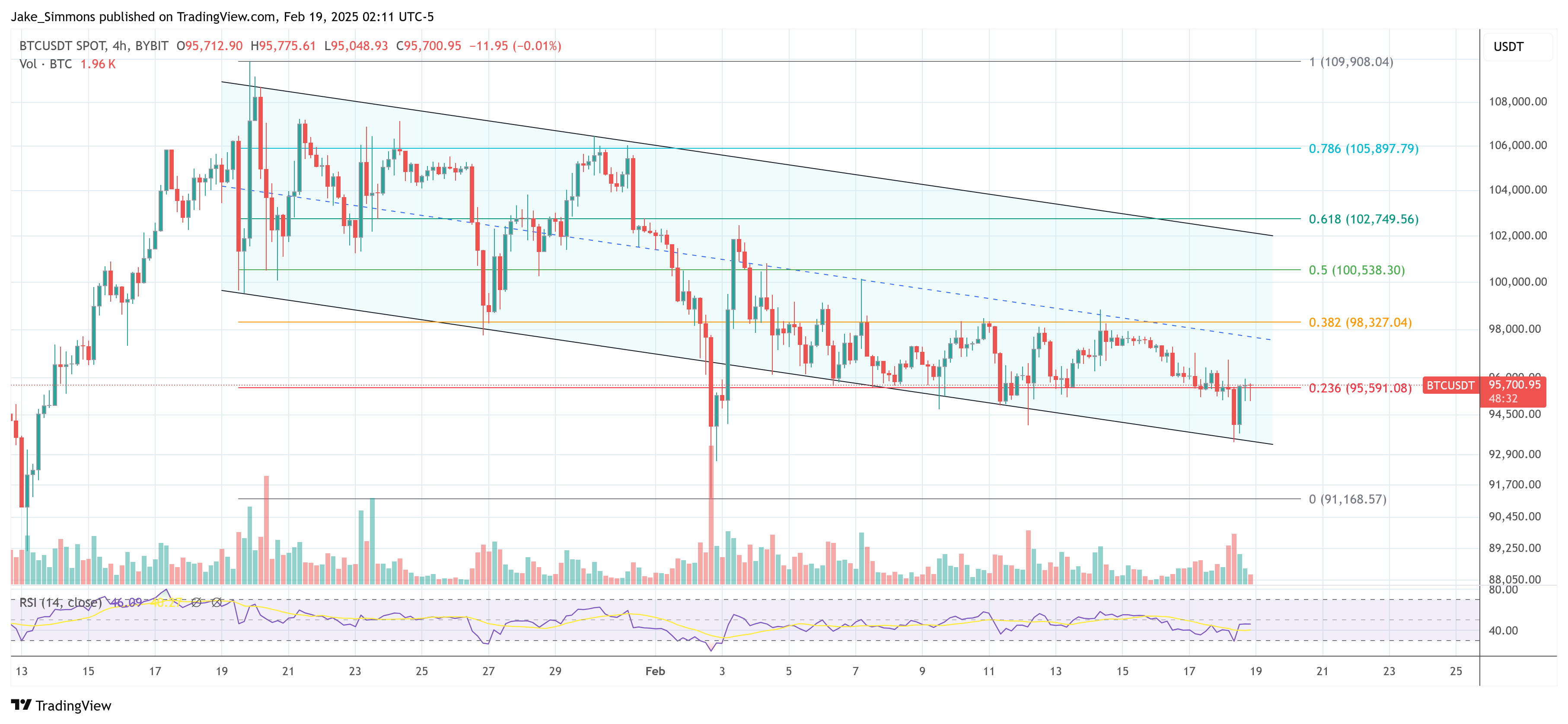

At press time, BTC traded at $95,700.

Featured picture from YouTube, chart from TradingView.com