Because the world shifts from a U.S.-dominated unipolar order to a multipolar panorama led by BRICS nations, the U.S. greenback faces unprecedented stress from declining bond demand and rising debt prices. The Genius Act, passed in July 2025, indicators a daring U.S. technique to counter this by legalizing Treasury-backed stablecoins, unlocking billions in international demand for U.S. bonds.

The blockchain internet hosting these stablecoins will form the worldwide economic system for many years. Bitcoin, with its unmatched decentralization, Lightning Network privateness, and sturdy safety, emerges because the superior option to energy this digital greenback revolution, making certain low switching prices when fiat inevitably fades. This essay explores why the greenback should and can develop into digitized by way of blockchains and why Bitcoin should develop into its rails for the U.S. economic system to have a smooth touchdown from the highs of being a world empire.

Finish of the Unipolar World

You might need heard that the world is transitioning from a unipolar world order — the place america was the one superpower and will make or break markets and dominate conflicts throughout the globe — to a multipolar world, the place a union of Jap-allied international locations can manage regardless of U.S. international coverage. This japanese alliance is known as BRICS and is made up of main international locations like Brazil, Russia, China and India. The inevitable consequence of the rise of BRICS is the restructuring of geopolitics, posing a problem to the hegemony of the U.S. greenback system.

There are a lot of apparently remoted information factors that sign this restructuring of the world order. Take, for instance, america’ navy alliance with a rustic like Saudi Arabia. The U.S. is now not defending the petrodollar agreement, which noticed Saudi oil bought just for {dollars} in change for navy protection of the area. The petrodollar technique was a serious supply of demand for the greenback and was thought-about pivotal to the energy of the U.S. economic system for the reason that ’70s, however has successfully ended in recent times — a minimum of for the reason that begin of the Ukraine warfare, when Saudi Arabia began accepting currencies other than the dollar for oil-related trades.

The Weakening of the U.S. Bond Market

One other crucial information level within the geopolitical change of the world order is the weakening of the U.S. bond market. Doubts concerning the long-term creditworthiness of the U.S. authorities are rising. Some have considerations concerning the nation’s inner political instability, whereas others are skeptical that the present authorities construction can adapt to the quickly altering, high-tech world and the rise of BRICS.

Elon Musk, reportedly the richest man on the earth and arguably the simplest CEO in historical past, able to operating a number of seemingly unattainable corporations concurrently — corresponding to SpaceX, Tesla, The Boring Firm and X.com — is one in all these skeptics. Musk not too long ago spent months with the Trump administration determining methods to restructure the federal authorities and the nation’s monetary place by way of DOGE, the Division Of Authorities Effectivity, earlier than an abrupt exit from politics in Might.

Musk not too long ago shocked the web in an All-In Summit look the place he commented on his expertise on the matter, saying, “I haven’t been to DC since Might. The federal government is mainly unfixable. I applaud David (Sacks’) noble efforts… however on the finish of the day, in the event you have a look at our nationwide debt.. .if AI and robots don’t clear up our nationwide debt, we’re toast.”

If Elon Musk can’t get the U.S. authorities to pivot away from monetary doom, who can?

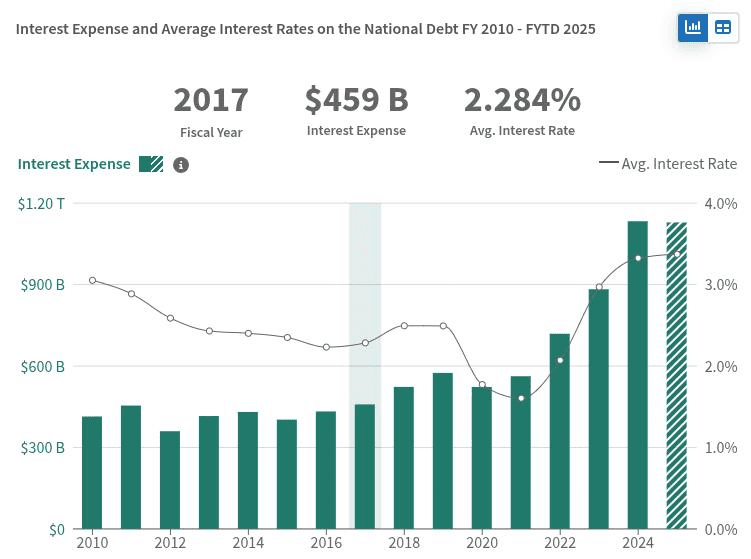

Doubts of this kind are mirrored within the low demand for long-term U.S. bonds, as evidenced by the necessity for larger rates of interest to draw buyers. In the present day, the US30Y is at 4.75%, a 17-year excessive. Demand in long-dated auctions of U.S. bonds, just like the US30Y, has additionally trended downward with “disappointing” demand in 2025, according to Reuters.

The weakening demand for long-dated U.S. bonds has vital penalties for the U.S. economic system. The U.S. Treasury has to supply larger rates of interest to entice buyers, in flip rising the funds the U.S. authorities has to make on the curiosity of the nationwide debt. In the present day, the U.S. curiosity funds are near one trillion dollars a year, greater than the entire military budget of the nation.

If america fails to search out sufficient patrons for its future debt, it might wrestle to pay its fast payments, having to rely as an alternative on the Fed to purchase that debt, which expands its stability sheet and the cash provide. The consequences, although advanced, would seemingly be inflationary on the greenback, additional harming the U.S. economic system.

How Sanctions Wounded the Bond Market

Additional weakening the U.S. bond market, in 2022, america manipulated the U.S.-controlled bond market rails in opposition to Russia in response to its invasion of Ukraine. Because the Russians invaded, the U.S. froze Russian treasury reserves held abroad, which have been supposed partly to pay its nationwide debt to Western buyers. In what seems like an try and drive Russia right into a default, the U.S. additionally reportedly started blocking all makes an attempt made by Russia to repay its personal debt to international bondholders.

A U.S. Treasury spokeswoman confirmed at the time that sure funds have been now not being allowed.

“In the present day is the deadline for Russia to make one other debt cost,” the spokeswoman mentioned.

“Starting immediately, the U.S. Treasury is not going to allow any greenback debt funds to be constructed from Russian authorities accounts at U.S. monetary establishments. Russia should select between draining remaining helpful greenback reserves or new income coming in, or default.”

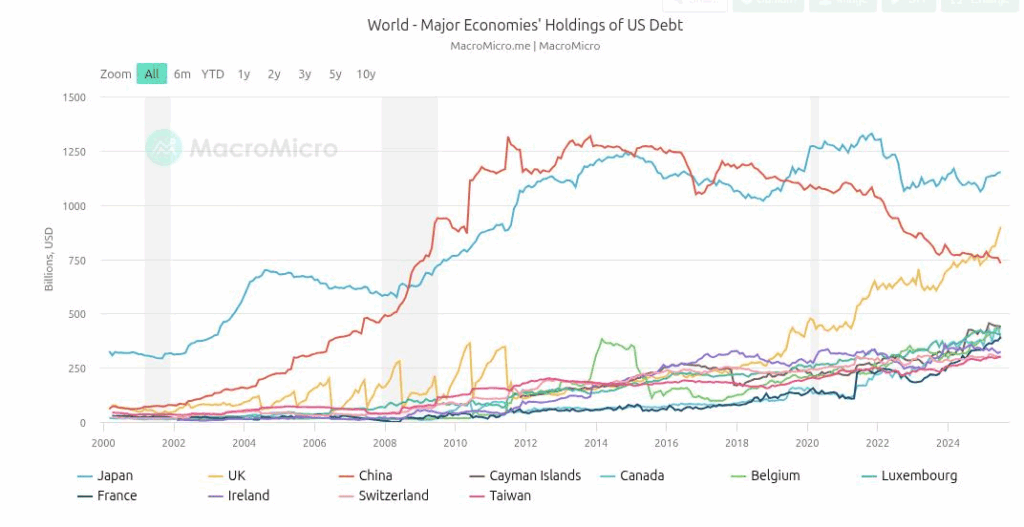

The U.S. successfully weaponized the bond market in opposition to Russia by way of a novel use of its international coverage sanctions regime. However sanctions are a double-edged sword: Since then, international demand for U.S. bonds has weakened as nations not aligned with U.S. international coverage appeared to diversify their threat. China has led this trend away from U.S. bonds, its holdings peaked in 2013 at over 1.25 trillion {dollars} and has accelerated downward for the reason that starting of the Ukraine warfare, sitting immediately at near 750 billion.

Whereas this occasion demonstrated the devastating effectiveness of sanctions, it additionally deeply wounded confidence within the bond market. Not solely was Russia blocked from paying off its money owed beneath the Biden administration sanctions, additionally harming buyers as collateral injury, however the freezing of its international treasury reserves confirmed the world that in the event you, as a sovereign nation, go in opposition to U.S. international coverage, all bets are off — and that features the bond market.

Following the controversial overreach of sanctions from the earlier administration, the Trump admin has backed off from sanctions as a method, since they hurt the U.S. monetary sector, and pivoted to a tariff-based method to international coverage. These tariffs to date have had blended outcomes. Whereas the Trump administration boasts record revenue and infrastructure investments by the non-public sector within the nation, Jap nations have accelerated their collaboration through the BRICS alliance.

The current SCO summit in Tianjin, China, introduced collectively world leaders, together with Chinese language President Xi Jinping, Russian President Vladimir Putin and Prime Minister of India Narendra Modi, amongst others. Essentially the most notable information to come back out of the SCO summit was a joint pledge by India and China to be “partners not rivals,” an extra step towards the multipolar world order.

The Stablecoin Playbook

Whereas China has divested from U.S. bonds up to now decade, a brand new purchaser has emerged, rapidly coming into the highest echelons of energy. Tether, a monetary know-how firm born within the early days of Bitcoin and initially constructed on prime of its community by way of the Mastercoin layer-two protocol, immediately owns $171 billion worth of U.S. bonds, near 1 / 4 of the quantity China owns and greater than most different international locations.

Tether is the issuer of the preferred stablecoin, USDT, with a market cap of 171 billion {dollars} in worth in circulation, equal to its reported bond holdings. The corporate reported $1 billion in profits for Q1 of 2025, with a easy but good enterprise mannequin: purchase short-dated U.S. bonds, emit USDT tokens backed 1-for-1, and pocket the coupon curiosity funds from the U.S. authorities. With 100 staff initially of the yr, Tether is claimed to be one of the crucial worthwhile corporations per worker on the earth.

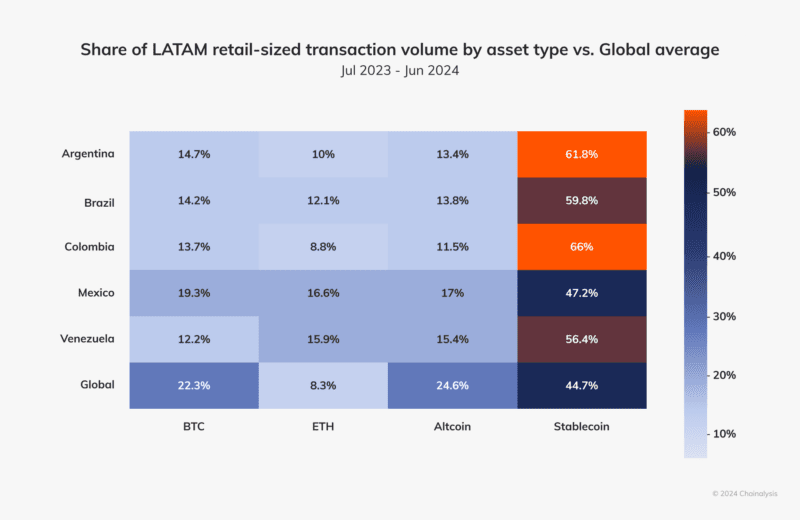

Circle, the issuer of USDC and the second-most well-liked stablecoin out there, additionally holds near $50 billion in short-dated treasuries. Stablecoins are used everywhere in the world, significantly in Latin America and growing nations, as a substitute for native fiat currencies, which undergo far deeper inflation than the greenback and are sometimes hindered by capital controls.

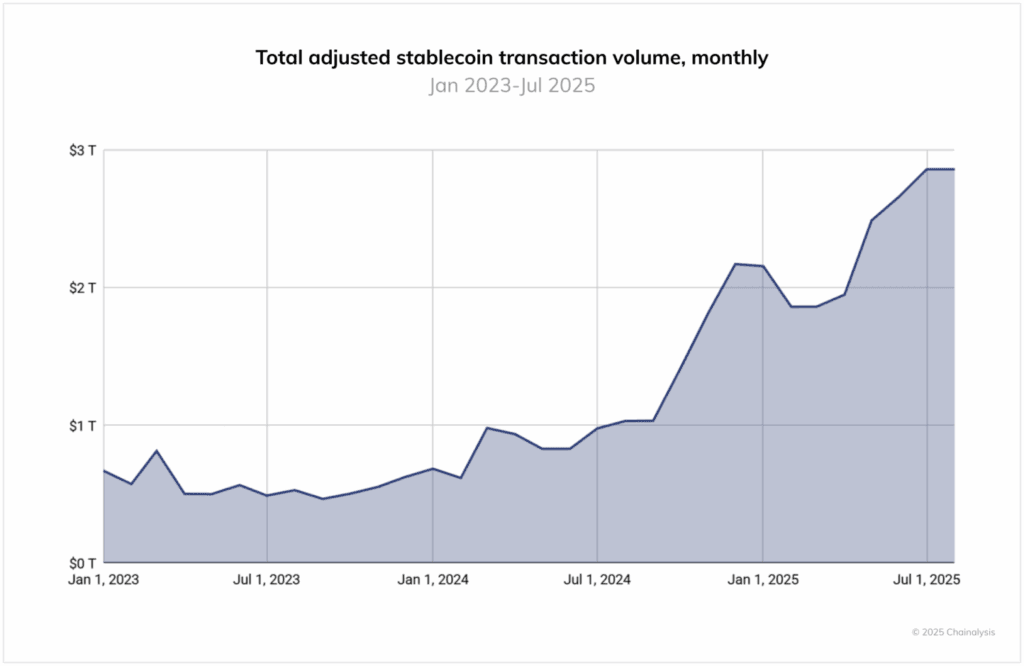

The quantity processed by stablecoins immediately is past a distinct segment, nerd monetary toy; it’s within the trillions of {dollars}. A 2025 Chainalysis report states, “Between June 2024 and June 2025, USDT processed over $1 trillion per thirty days, peaking at $1.14T in January 2025. USDC, in the meantime, ranged from $1.24T to $3.29T month-to-month. These volumes spotlight the continued centrality of Tether and USDC in crypto market infrastructure, particularly for cross-border funds and institutional exercise.”

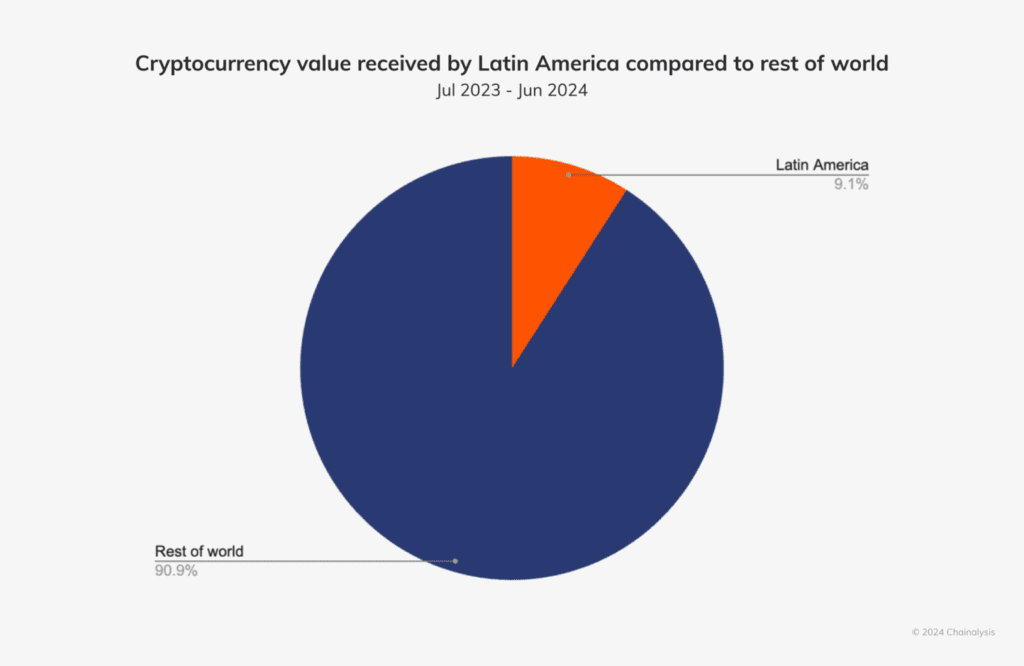

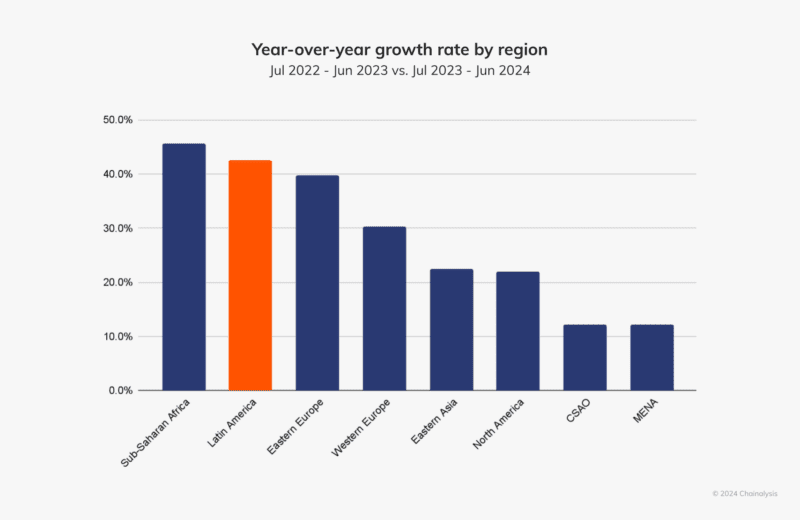

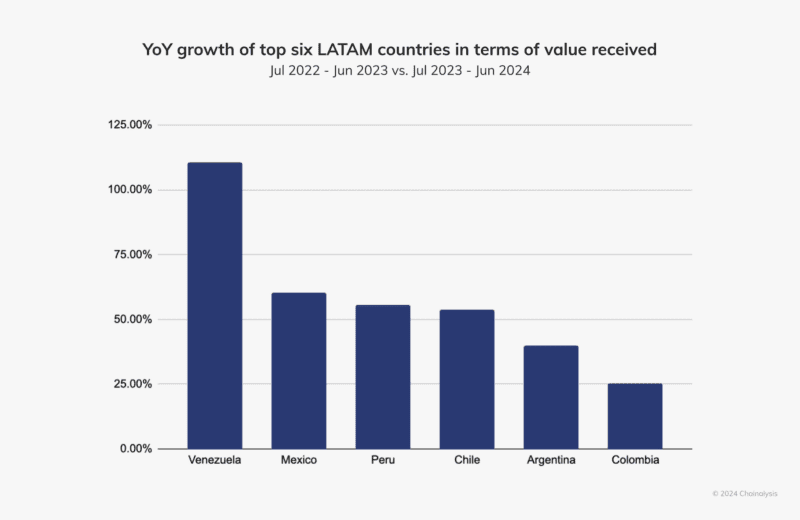

Latin America, for instance, accounted for 9.1% of complete crypto worth acquired between 2023 and 2024, with year-to-year utilization development charges of 40-100%, of which over 50% have been stablecoins, based on a 2024 Latin America-focused report by Chainalysis, demonstrating the robust demand for various currencies within the growing world.

The U.S. wants new demand for its bonds, and that demand exists within the type of demand for the greenback, provided that most individuals all through the world are locked into fiat currencies which are far inferior to these of america. If the world transitions to a geopolitical construction that forces the greenback to compete on even phrases with all different fiat currencies, it nonetheless could proceed to be the very best amongst them. The US, for all its faults, stays a superpower, with unbelievable wealth, human capital and financial potential, significantly when in comparison with many smaller international locations and their questionable pesos.

Latin America has demonstrated a deep starvation for the greenback, however there’s a provide drawback as native nations resist legacy banking greenback rails. Gaining access to dollar-denominated accounts in lots of international locations outdoors of america will not be simple. Native banks are sometimes tightly regulated and serve on the behest of native governments, who even have an curiosity in defending their peso. The U.S. will not be the one authorities that understands the worth of printing cash and defending its worth, in any case.

Stablecoins clear up each issues; they create demand for U.S. bonds and may ship dollar-denominated worth to everybody, anyplace on the earth, regardless of the pursuits of their native governments.

Stablecoins, leveraging the censorship-resistant qualities of their underlying blockchains, can present people believable deniability and privateness from their native state, a function that native banks can not present. Consequently, the U.S., by way of the promotion of stablecoins, can entry international markets it has but to succeed in, increasing its demand and consumer base, whereas additionally exporting greenback inflation to nations that shouldn’t have a direct affect on American politics — a protracted custom within the historical past of the USD. From a strategic perspective, this sounds perfect for america, and it’s a easy extension of how the USD has labored for many years, simply on prime of recent monetary know-how.

The U.S. authorities understands this chance. In keeping with Chainalysis, “The stablecoin regulatory landscape has advanced considerably over the previous 12 months. Whereas the GENIUS Act in the U.S. (which legalized U.S. bond-backed stablecoins) has not but taken impact, its passage has pushed robust institutional curiosity.”

Why Stablecoins Ought to Journey On Prime of Bitcoin

One of the best ways to ensure Bitcoin advantages from the elevation of the growing world out of mediocre fiat currencies is to ensure the greenback makes use of Bitcoin as its rails. Each greenback stablecoin pockets needs to be a Bitcoin pockets as nicely.

Critics of the Bitcoin greenback technique will say that it goes in opposition to Bitcoin’s libertarian roots, that Bitcoin was supposed to interchange the greenback — not improve it or convey it into the twenty first century. Nevertheless, this concern is essentially U.S.-centric. It’s simple to sentence the greenback if you receives a commission in {dollars} and your financial institution accounts are denominated in USD. It’s simple to critique a 2-8% greenback inflation fee (relying on the way you measure it) when that’s your native forex. In too many international locations outdoors of the U.S., 2-8% yearly inflation could be a blessing.

A big portion of the inhabitants of the world suffers from fiat currencies far worse than the greenback, with inflation charges within the low-to-high double digits and even triple digits, which is why stablecoins have already gained large adoption all through the third world. The growing world must get off the sinking ship first. The hope is that after they’re on a secure boat, they may begin trying round for methods to improve to the Bitcoin yacht.

Sadly, most stablecoins are not on top of Bitcoin today, regardless of having began on Bitcoin, a technical actuality that could be a large supply of friction and threat for customers. Nearly all of the stablecoin quantity immediately runs on the Tron blockchain, which is a centralized community run on a handful of servers by Justin Solar, a Chinese language nationwide who may be simply focused by international states that detest the unfold of greenback stablecoins inside their borders.

Many of the blockchains on prime of which stablecoins transfer immediately are additionally completely clear. Public addresses, which function account numbers for his or her customers, are publicly trackable, usually linked by native exchanges to the consumer’s private information, and simply accessible by native governments. That’s a lever international nations can use to push again on the unfold of dollar-denominated stablecoins.

Bitcoin doesn’t have these infrastructure dangers. Not like Ethereum, Tron, Solana, and so on., Bitcoin is extremely decentralized, with tens of hundreds of copies of itself all through the world and a strong peer-to-peer community used to transmit transactions in a method that may simply route round any bottlenecks or choke factors. Its proof-of-work layer offers a separation of powers that different proof-of-stake blockchains shouldn’t have. Michael Saylor, for instance, regardless of his large stack of bitcoins, 3% of the total supply, doesn’t have a direct vote on the consensus politics of the community. The identical can’t be mentioned for Vitalik, and the proof-of-stake consensus politics of Ethereum, or Justin Solar and Tron.

Moreover, the Lightning Community on prime of Bitcoin unlocks immediate transaction settlement, which advantages from Bitcoin’s underlying blockchain safety. Whereas additionally offering customers vital privateness, as all Lightning Community transactions are off-chain by design, and don’t depart an everlasting footprint on its public blockchain. This basic distinction in method to funds grants customers privateness from these they ship cash to, in addition to from third-party observers who don’t run Lightning wallets or high-liquidity Lightning nodes. This reduces the variety of menace actors that may invade consumer privateness from anybody who looks like trying on the blockchain, to a handful of extremely competent entrepreneurs and know-how companies, at worst.

Customers may also run their own Lightning nodes locally and select how they connect with the community, and loads of folks do, taking their privateness and safety into their very own fingers. None of those qualities may be seen within the blockchains that most individuals use for stablecoins immediately.

Compliance insurance policies and even sanctions might nonetheless be utilized to greenback stablecoins, their governance anchored to Washington, with the identical analytics and smart-contract-based approaches used immediately to cease legal use of stablecoins. There’s no basic technique to decentralize one thing just like the greenback; in any case, it’s centralized by design. Nevertheless, if a lot of the stablecoin worth have been to be transferred over the Lightning Community as an alternative, consumer privateness may be maintained, defending customers in growing nations from organized crime and even their local governments.

In the end, what customers care about is transaction charges — the price of shifting their cash round — which is why Tron has dominated the market to date. Nevertheless, with USDT coming on-line on prime of the Lightning Community, that might quickly change. Within the Bitcoin dollar world order, the Bitcoin community would develop into the medium of change of the greenback, whereas the greenback would stay, for the foreseeable future, because the unit of account.

Can Bitcoin Survive This?

Critics of this technique are additionally involved concerning the influence the Bitcoin greenback technique could have on Bitcoin itself. They surprise if placing the heavy incentives of the greenback on prime of Bitcoin can distort its underlying construction. The obvious method through which a superpower just like the U.S. authorities would possibly need to manipulate Bitcoin is to bend it into compliance with sanctions regimes, one thing they might theoretically do on the proof-of-work layer.

Nevertheless, as mentioned earlier, the sanctions regime has arguably already peaked, giving technique to the period of tariffs, which search to manage the move of products slightly than the move of funds. This post-Trump, post-Ukraine warfare shift in U.S. international coverage technique truly relieves stress off Bitcoin.

Moreover, as main Western companies, corresponding to BlackRock, and even the U.S. authorities, proceed to undertake bitcoin as long-term investments, or, within the phrases of President Donald J. Trump, a “Strategic Bitcoin Reserve,” they too begin to align with the longer term success and survival of the Bitcoin community. Attacking Bitcoin’s censorship resistance qualities wouldn’t solely undermine their funding within the asset however would additionally weaken the community’s potential to ship stablecoins to the growing world.

The obvious compromise that Bitcoin must make within the Bitcoin greenback world order is to surrender the unit of account dimension of cash. That is dangerous information for a lot of Bitcoiners, and rightfully so. Unit of account is the mecca of hyperbitcoinization, and plenty of of its customers dwell in that world immediately, as they calculate their financial selections based mostly on the final word influence on the quantity of sats they maintain. Nevertheless, nothing can actually take that away from those that perceive Bitcoin as essentially the most sound cash to have ever existed. The truth is, the conviction of Bitcoin as a retailer of worth and a medium of change shall be strengthened with this Bitcoin greenback technique.

Sadly, after 16 years of makes an attempt to make bitcoin a unit of account as ubiquitous because the greenback, some are recognizing that within the medium time period, the greenback and stablecoins will seemingly fulfill that use case. Bitcoin funds won’t ever go away, and bitcoiner-led corporations will proceed to rise and will proceed to just accept bitcoin as cost to construct up their bitcoin treasuries — however stablecoins and dollar-denominated worth will seemingly dominate crypto commerce within the coming a long time.

Nothing Stops This Prepare

Because the world continues to adapt to the rising powers within the east and the emergence of the multipolar world order, america will seemingly should make tough and pivotal selections to keep away from a long-lasting monetary disaster. The nation might, in idea, decrease its spending, pivot, and restructure to be able to develop into extra environment friendly and aggressive within the twenty first century. And the Trump administration is definitely making an attempt to do exactly that, as seen by the tariff regime and different associated efforts, which try and convey again manufacturing of important industries into america and bolster its native expertise. Nevertheless, within the now legendary phrases of Lyn Alden, nothing stops this train.

Whereas there are a number of miracles that maybe might clear up america’ monetary woes, such because the science-fiction-like automation of labor and intelligence, and even the Bitcoin greenback technique, finally, even placing the greenback on the blockchain gained’t change its destiny: to develop into a collectible for historical past buffs, a rediscovered token of an historic empire match for a museum.

The greenback’s centralized design and dependence on American politics finally doom the greenback as a forex, but when we’re practical, its demise may not be seen for an additional 10, 50 and even 100 years. When the time does come, if historical past repeats, Bitcoin needs to be there because the rails, prepared to choose up the items and fulfill the prophecy of hyperbitcoinization.

BM Big Reads are weekly, in-depth articles on some present subject related to Bitcoin and Bitcoiners. Opinions expressed are these of the authors and don’t essentially mirror these of BTC Inc or Bitcoin Journal. In case you have a submission you suppose suits the mannequin, be at liberty to succeed in out at editor[at]bitcoinmagazine.com.