Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

China has added 5 tonnes of gold to its reserves in below a month as a part of an growing aggressive buy of the dear metallic. Bitcoin continues to face agency above the $87,000 degree regardless of current market fluctuations.

Associated Studying

PBOC Gold Accumulation Up As Bitcoin Worth Soars

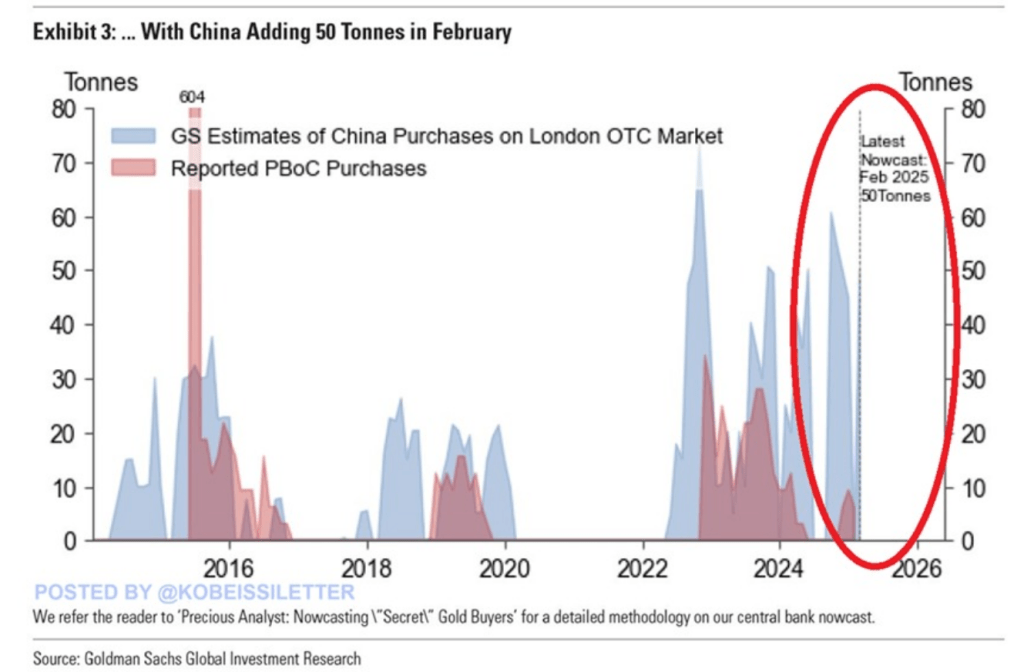

In line with the Kobeissi Letter in posting messages on X, the Individuals’s Financial institution of China has been abruptly accumulating gold. It has acquired 5 tonnes over the past month. This has taken place amid uncertainty in international markets from the rift attributable to persistent tensions in trade alongside US-China fronts.

Bitcoin merchants appear to witness this, as the value of the crypto holds robust at $87,280, with scanty unfavorable macronews within the background. Merely 4 days in the past, cryptocurrencies fell again after US President Donald Trump proclaimed a 245% import tax on Chinese language gadgets. The short restoration has shocked many market observers.

BREAKING: China’s central financial institution elevated its gold holdings by 5 tonnes in March, posting their fifth consecutive month-to-month buy.

This brings whole China’s gold reserves to a file 2,292 tonnes.

Chinese language gold holdings now replicate 6.5% of its whole official reserve property.… pic.twitter.com/LuwiBvnirn

— The Kobeissi Letter (@KobeissiLetter) April 20, 2025

Whale Wallets Point out Rising Urge for food For Bitcoin

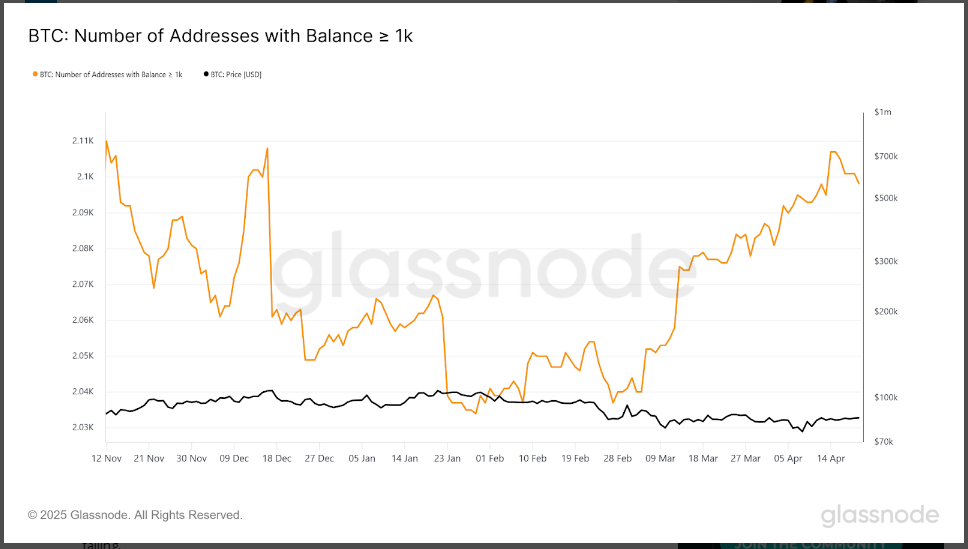

Statistics by Glassnode point out a steep increase in addresses containing over 1,000 Bitcoin. Greater than 60 new “whale” wallets have entered the market since early March.

The variety of such giant Bitcoin addresses has elevated from 2,030 in late February to 2,100 as of April 15, which is the best in 4 months. The increase signifies giant buyers are buying extra Bitcoin regardless of altering market situations.

Others say the power of Bitcoin lies in its elevated recognition as an inflation hedge, akin to gold. This idea has change into extra extensively accepted as China appears to be steering away from US dollar-denominated property.

Gold Costs Hit New Information As Commerce Tensions Mount

Prices of gold have surged to $3,401, up by near $100 over solely per week. The rise comes as establishments, dominated by China, elevate their gold stockpiles.

The continuing tariff conflict between the US and China has pushed buyers in the direction of conventional safe-haven property. Bitcoin can be seen to be gaining from this identical development, with some buyers seeing it as a recent choice for gold in occasions of uncertainty.

Blended Alerts From ETF Flows And Market Analysts

Not every part is rosy for Bitcoin. Reviews disclose that almost $5 billion has exited Bitcoin ETFs since their combination stream hit all-time highs. Despite this outflow, Bitcoin’s value has remained extraordinarily secure.

Associated Studying

There are additionally contradictory stories concerning China’s position on Bitcoin. Whereas there are rumors that China could also be accumulating a Strategic Bitcoin Reserve, different stories say the nation offered 15,000 BTC on offshore exchanges.

The cryptocurrency’s potential to keep up its value regardless of these combined alerts has caught the eye of merchants worldwide. As US-China economic tensions proceed, buyers are watching each gold and Bitcoin as potential protected havens in an more and more unstable international market.

Featured picture from GEPL Capital, chart from TradingView