Bitcoin skilled excessive volatility yesterday after reaching a brand new all-time excessive of $104,088 on Wednesday. What adopted was a textbook “Darth Maul” candle on the every day chart, as BTC plummeted from $103,550 to as little as $90,500 earlier than stabilizing. Whereas some observers initially learn the transfer as a harsh rejection on the psychologically important $100,000 stage, main analysts counsel this might symbolize a routine market flush-out quite than a cyclical peak.

May This Be The Bitcoin Cycle Prime?

Merchants and analysts on X current a unified narrative: the abrupt spike and subsequent plunge have been seemingly orchestrated by giant gamers capitalizing on high-leverage traders. Veteran dealer IncomeSharks (@IncomeSharks) said, “Bitcoin – Traditional Darth Maul. Right me if I’m fallacious however I don’t suppose we’ve seen an asset high with that sort of candle. Normally that’s the punish late longers, entice the shorters, and ship it increased candle.”

One other crypto analyst often called Astronomer (@astronomer_zero) added, “It’s simply whales utilizing the ‘rinse excessive leverage button.’ Earlier than persevering with no matter it was meant to do. I might wish to see the draw back of that wick cleared, however that might be it too.”

Associated Studying

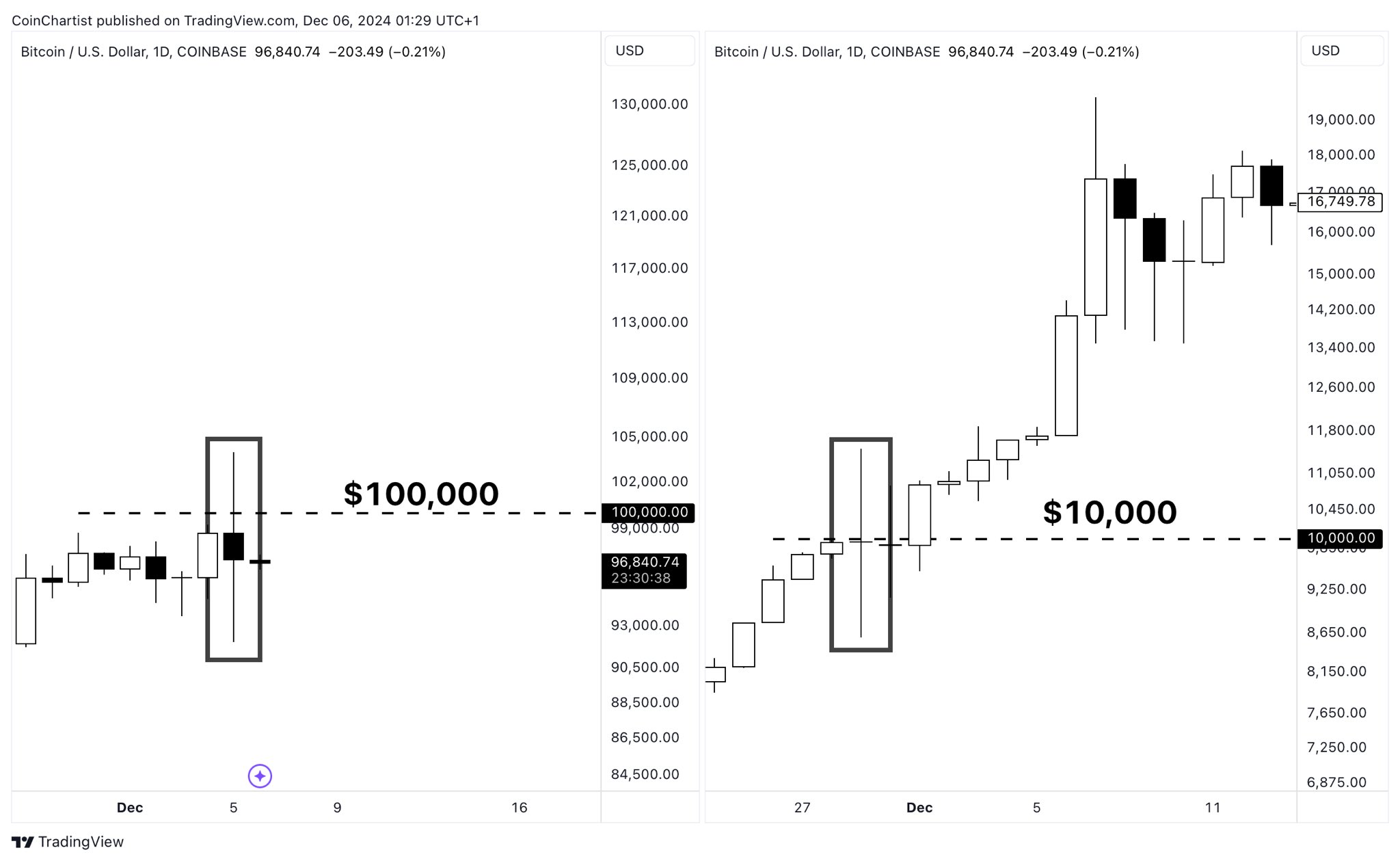

Tony “The Bull” Severino, CMT, underscored the dimensions of those strikes, noting: “An $11K ‘Darth Maul’ on the Bitcoin every day chart. Stops on each side have been run. Unimaginable intraday volatility in Bitcoin. Welcome to what it’s like for BTC to be $100K. $10,000 strikes in a day at the moment are a factor.”

He adopted up, “$100K Bitcoin is the brand new $10K,” sharing comparative charts from the 2020–2021 bull run and drawing parallels to the present value atmosphere.

Charles Edwards, founding father of Capriole Investments, bolstered this historic context: “Bitcoin. Sure, that is regular.” Edwards posted the same chart, recalling the volatility when BTC was at $10,000 in addition to $1,000 in early 2017.

Key indicators additionally stay suggestive of additional upside. In response to Matthew Sigel, head of analysis at VanEck, high alerts are scarce at these ranges. “Except for funding charges, which might keep elevated for a while, only a few of our ‘high alerts’ indicators say the cycle is peaking. The trail of least resistance remains to be increased, for my part.”

Associated Studying

Sigel referenced 4 key metrics: the MVRV Z-Rating (nonetheless beneath 5), the Bitcoin Worth SMA Multiplier (indicating room for additional development), subdued Google Traits, and Crypto Market Dominance at a mid-range stage. These information factors collectively suggest that the present cycle is probably not approaching its apex.

Macro analyst Alex Krüger (@krugermacro) delivered one other perspective: “Being requested if that was the highest so enable me to share my view. In my ebook the primary levered flush out of a robust bull run, notably one pushed by sturdy fundamentals, doesn’t mark the highest.”

He famous that whereas the transfer was extensively anticipated on the whole phrases—albeit not exactly timed—it doesn’t alter the underlying energy of Bitcoin’s rally. Krüger added that the sudden retail pivot to older, “dino” altcoins may need signaled a neighborhood high for these property, however not essentially for Bitcoin: “Nothing actually has modified imo. Would have appreciated to see funding additionally reset on alts. Alas, we are able to’t get all of it.”

At press time, BTC traded at $98,146.

Featured picture created with DALL.E, chart from TradingView.com