Bitcoin value fluctuations are continuously evaluated utilizing on-chain metrics, technical indicators, and macroeconomic tendencies. Nevertheless, one of the underappreciated but important components in Bitcoin’s value motion is International Liquidity. Many buyers could also be underutilizing this metric and even misunderstanding the way it impacts BTC’s cyclical tendencies.

Affect on Bitcoin

With growing discussions on platforms like Twitter (X) and analysts dissecting liquidity charts, understanding the relationship between Global Liquidity and Bitcoin has change into essential for merchants and long-term buyers alike. Nevertheless, latest divergences recommend that conventional interpretations would possibly require a extra nuanced method.

International M2 cash provide refers back to the complete liquid cash provide, together with money, checking deposits, and simply convertible near-money property. Historically, when International M2 expands, capital seeks higher-yielding property, together with Bitcoin, equities, and commodities. Conversely, when M2 contracts, threat property usually decline in worth as a consequence of tighter liquidity situations.

Traditionally, we’ve seen Bitcoin’s value comply with the International M2 growth, rising when liquidity will increase and struggling throughout contractions. Nevertheless, on this cycle, we’ve seen a deviation: regardless of a gradual enhance in International M2, Bitcoin’s value motion has proven inconsistencies.

Yr-on-Yr Change

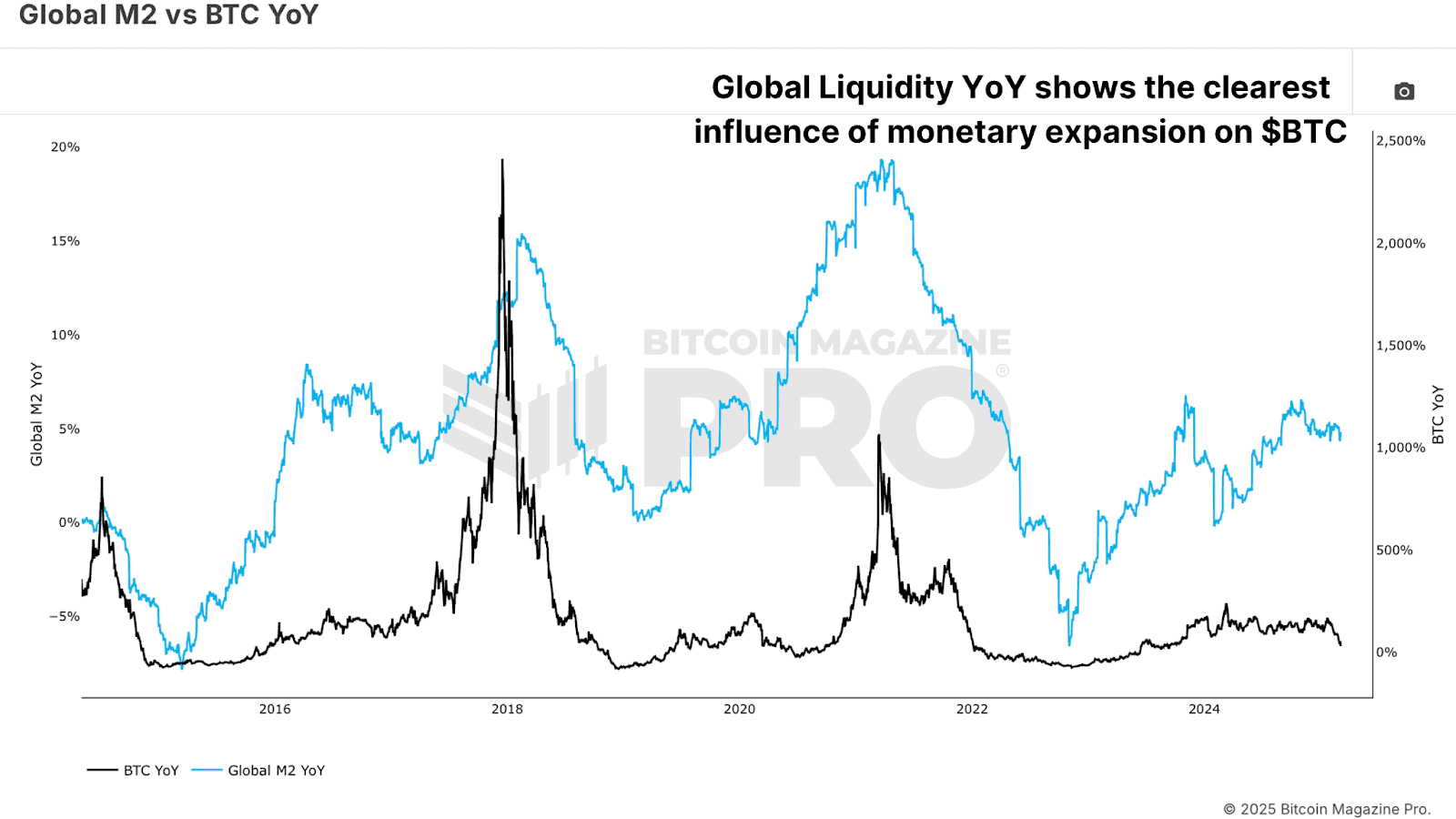

Quite than merely monitoring absolutely the worth of International M2, a extra insightful method is to investigate its year-on-year charge of change. This technique accounts for the rate of liquidity growth or contraction, revealing a clearer correlation with Bitcoin’s efficiency.

After we examine the Bitcoin Year-on-Year Return (YoY) with Global M2 YoY Change, a a lot stronger relationship emerges. Bitcoin’s strongest bull runs align with intervals of fast liquidity growth, whereas contractions precede value declines or extended consolidation phases.

For instance, throughout Bitcoin’s consolidation section in early 2025, International M2 was steadily growing, however its charge of change was flat. Solely when M2’s growth accelerates noticeably can Bitcoin get away in the direction of new highs.

Liquidity Lag

One other key remark is that International Liquidity doesn’t influence Bitcoin immediately. Analysis means that Bitcoin lags behind International Liquidity adjustments by roughly 10 weeks. By shifting the International Liquidity indicator ahead by 10 weeks, the correlation with Bitcoin strengthens considerably. Nevertheless, additional optimization means that probably the most correct lag is round 56 to 60 days, or roughly two months.

Bitcoin Outlook

All through most of 2025, International Liquidity has been in a flattening section following a major growth in late 2024 that propelled Bitcoin to new highs. This flattening coincided with Bitcoin’s consolidation and retracement to round $80,000. Nevertheless, if historic tendencies maintain, a latest resurgence in liquidity development ought to translate into one other leg up for BTC by late March.

Conclusion

Monitoring International Liquidity is a necessary macro indicator for anticipating Bitcoin’s trajectory. Nevertheless, relatively than counting on static M2 information, specializing in its charge of change and understanding the two-month lag impact gives a way more exact predictive framework.

As International financial situations evolve and central banks alter their financial insurance policies, Bitcoin’s price motion will proceed to be influenced by liquidity tendencies. The approaching weeks will likely be pivotal; Bitcoin may very well be poised for a serious transfer if International Liquidity continues its renewed acceleration.

Loved this? Discover extra on Bitcoin value shifts and market cycles in our latest information to mastering Bitcoin on-chain data.

Discover dwell information, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.