12 months-to-date, bitcoin returns are flat — at detrimental 0.4%. That is removed from bitcoin’s returns in 2024 at +121% and its compound annual development charge of 98.60% over the past 13 years.

After hitting an all-time excessive of $109,000 on January 20, 2025, Bitcoin worth suffered a extreme drop three months later: In the course of the worldwide tariff fright on April 9, bitcoin dropped as little as $76,000. On the time of writing, it’s buying and selling at round $106,000 — about 6% under its ATH milestone.

Given the depth of turmoil that President Trump’s commerce warfare triggered, it seems that it’s now exceedingly unlikely for bitcoin to ever attain the deep, discounted ranges of its much less mature self. On the identical time, is it probably for bitcoin worth to exceed the $112,000 all-time excessive, or will it once more topple beneath sell-off strain?

To aim to reply that, let’s study which components are coming into play a yr after Bitcoin’s halving.

Are Bitcoin Fundamentals Nonetheless Sound?

The fourth Bitcoin halving final April slashed miner block rewards from 6.25 BTC to three.125 BTC. Consequently, it lowered Bitcoin’s inflation charge to 0.83%, which is considerably decrease even than the Federal Reserve’s goal inflation charge of 2%.

As all the time, Bitcoin’s fundamentals may be summed up in easy phrases:

- Mass democracy requires escalating authorities spending and social applications to fortify folks’s reliance and allegiance. Consequently, authorities spending ignites steep funds deficits, totaling virtually $2 trillion in 2024.

- Large funds deficits spur the central financial institution into motion, devaluing the greenback. In spite of everything, if the amount of {dollars} outpaces the amount of actual belongings, these belongings will likely be priced greater. Over time, folks begin on the lookout for an exit path to safeguard wealth.

- Bitcoin is uniquely positioned to reap the benefits of this want. Though Bitcoin is digital, making it match for the fashionable age, its proof-of-work mechanism ties it to bodily belongings — machines and power.

- Mixed with the programmed shortage of 21 million bitcoin, alongside the decentralization of Bitcoin’s computing community, this makes Bitcoin a comparatively protected uneven wager in opposition to a debt-based financial system.

In a hypothetical situation, if the Federal Reserve completely halts all cash provide machinations, the U.S. authorities must depend on traders shopping for bonds to cowl its deficits. However as we’ve seen through the reciprocal tariffs fiasco, the bond market responds to fundamentals.

Because of this, the Treasury’s operations must develop into sound. Nevertheless, the soundness of the greenback, because the world’s reserve foreign money, depends on each home spending for social applications and military hegemony spending.

In different phrases, it’s tough to image a world by which it’s doable for the federal government to develop into fiscally sound. Due to this fact, its reliance on the Federal Reserve to devalue the greenback must be maintained as a matter after all.

Obstacles within the Approach of Bitcoin Fundamentals

Now that we perceive the character of the beast, it’s straightforward to see why bitcoin managed to draw a lot capital over time, with the notable drawdown exceptions in 2018 and 2022:

Merely put, the Bitcoin community exists to seize capital flows from a system that depends on financial debasement. From this beginning framework, it’s then straightforward to see what would get in the best way of capturing these inflows:

- Is it possible to scale the schooling of the populace on Bitcoin’s fundamentals, i.e., central banking and financial concept?

- How excessive is the cognitive ceiling that curtails the scaling of instructional efforts?

- Is the institutional sanctification of Bitcoin adequate to offset the cognitive ceiling?

- Are fiat-to-bitcoin rails sufficiently handy to just accept capital inflows?

Worldwide, fiat-to-BTC conversion is theoretically doable for 76% of the world’s inhabitants (~6 billion), as that is the variety of folks with financial institution accounts. Nevertheless, this proportion drastically goes down when one accounts for nations that debanked cryptocurrencies, partially or totally. Whether or not it’s due to worries about cloud security of sure platforms, in addition to the still-glaring lack of robust regulatory frameworks.

Moreover, one has to account for the tradition of saving and investing itself. It’s clear that People have essentially the most developed investing tradition, with 62% of adults having publicity to the inventory market. And as of 2023, the FDIC reported that 96% of U.S. households are banked.

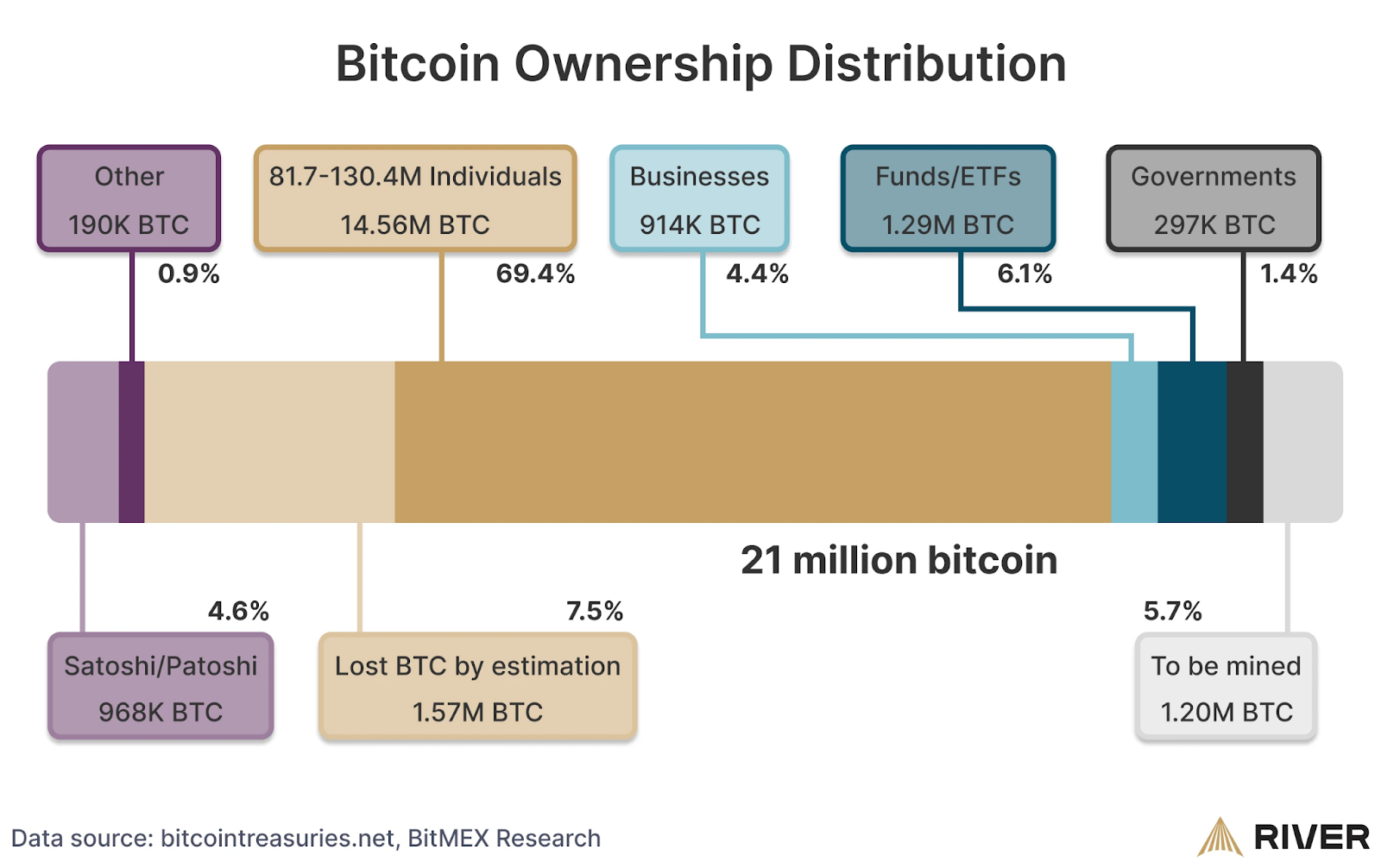

In fact, the U.S. inventory market mirrors U.S. hegemony and the U.S. greenback as reserve foreign money, which means that its inventory market routinely outperforms global equities. When accounting for all these components, it’s then not stunning to see that, out of ~6 billion banked folks globally, as much as 130.4 million people acquired publicity to bitcoin — a trifle (0.002%) of the banked inhabitants.

Nonetheless, 21 million is itself a tiny determine in comparison with 6 billion, rendering retail participation moot. And early 2024 and 2025 have been exceptionally fortifying for Bitcoin fundamentals.

In January 2024, the Securities and Alternate Fee (SEC) approved a collection of spot-traded ETFs. Not solely did this place bitcoin alongside shares for capital inflows, however bitcoin was institutionally sanctified.

This pivotal milestone made it harder for mainstream media to color bitcoin as illegitimate. Likewise, the heads of huge monetary establishments initiated a pointy turnaround, as evidenced by Larry Fink, CEO of BlackRock.

On high of bitcoin’s institutionalization through ETFs in 2024, President Trump’s administration not solely canceled Operation Choke Point 2.0, however moved to kind a Strategic Bitcoin Reserve. Provided that public opinion is an artifact of mainstream media, it’s now much less related what the general public is aware of about Bitcoin however slightly how Bitcoin is framed.

Altogether, Bitcoin is now extra nestled inside the system than ever earlier than. This interprets into much less friction for fiat-to-BTC inflows. Traditionally, world M2 money supply correlates highly with Bitcoin worth, now poised for one more bounce.

Finally, bitcoin lacks the complexity of quarterly earnings studies. In a tradition accustomed to inventory investing, this simplicity could entice higher inflows as traders search refuge from greenback devaluation.

Submit-Halving Efficiency Failure in 2024/2025

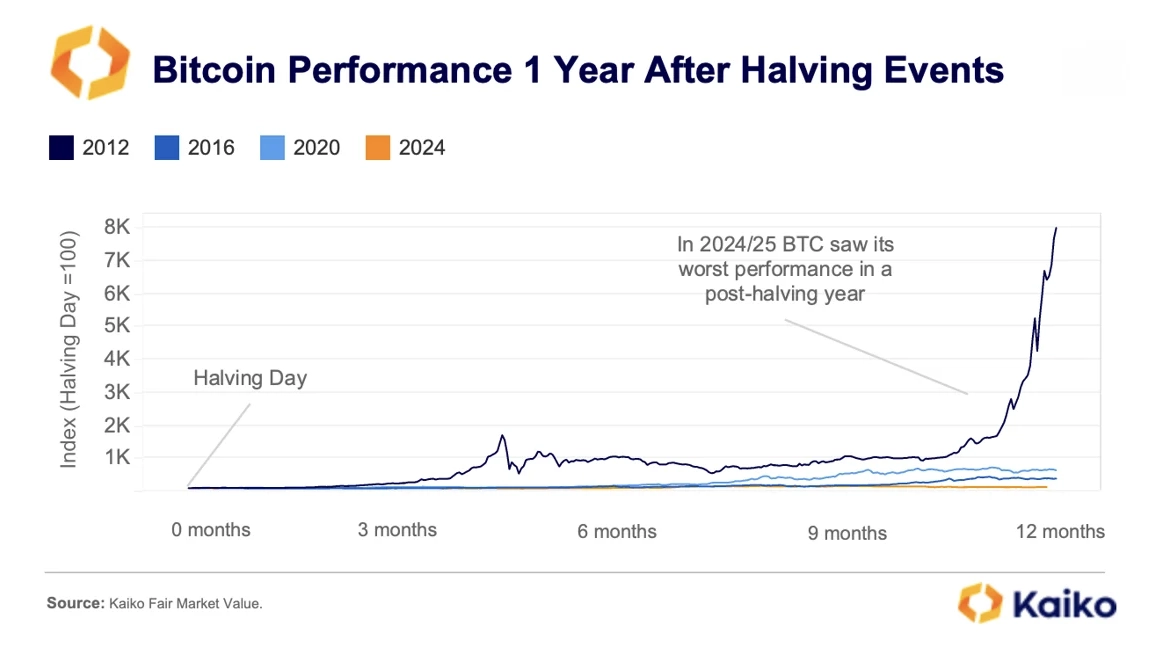

Following every halving, bitcoin’s beneficial properties are likely to fall inside a 12-month interval. The third halving was an exception attributable to unprecedented world financial stimulus mixed with low rates of interest.

- 1st halving in 2012: BTC worth up 7,000% over 12 months.

- 2nd halving in 2016: BTC worth up 291% over 12 months.

- third halving in 2020: BTC worth up 541% over 12 months.

- 4th halving in 2024: BTC worth up 43% over 12 months.

Throughout that post-2020 interval of low-cost cash we additionally noticed a crypto growth, tied to overleveraged crypto platforms corresponding to BlockFi, FTX, Celsius, Voyager Digital and others. When the Federal Reserve reversed course in March 2022 and began quickly rising rates of interest, the central financial institution triggered a cascade of crypto bankruptcies.

In flip, the remaining retail turned to degen playing referred to as memecoin trading — a development that solely widened the gulf between bitcoin and altcoins, pushing bitcoin dominance to 64%, amplifying the significance of trading rooms, the place targeted bitcoin discussions have changed the fragmented noise of altcoin hype.

Nonetheless, crypto debanking, crypto bankruptcies and fraudulent memecoins left a mark. Based on Kaiko research figures, Bitcoin’s fourth halving interval now tracks for the worst efficiency.

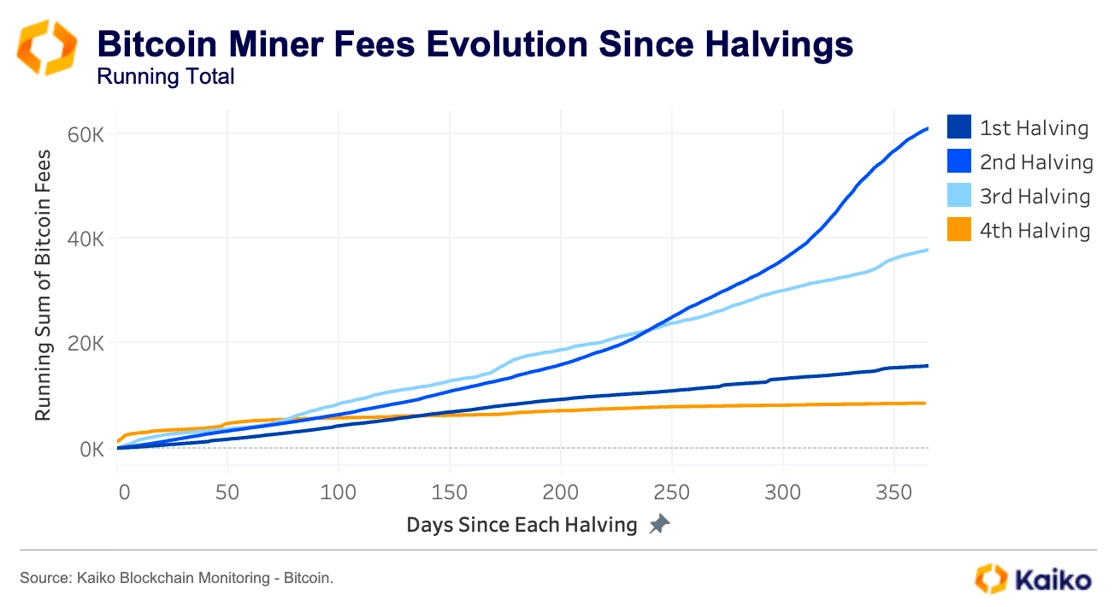

On the identical time, Bitcoin miners are performing as if this can be a momentary efficiency lapse. Reminder: With decrease BTC block rewards and unchanged worth, miners obtain much less worth for a similar computing energy exerted and related prices.

Because of this, miners rely on the BTC worth to go as much as compensate for the loss. And if some miners succumb to financial strain, they exit the community and scale back Bitcoin’s community complete hashrate.

Nevertheless, over a one-year interval, Bitcoin’s hashrate has gone steadily up, having reached an all-time high in April. This implies a few situations:

- If many miners get squeezed out from the shortage of extended BTC worth efficiency, this may exert a sell-off strain. Is that this more likely to be accompanied by dip-buyers is anybody’s guess, however Bitcoin’s institutional maturity and lack of structural vulnerability recommend the dip will likely be purchased up.

- Consequently, if Bitcoin’s mining problem is lowered from the exit of inefficient miners, remaining miners will achieve higher profitability. This course of has unfolded many times.

- If macro circumstances, corresponding to world cash provide, push BTC worth greater within the second half of 2025, there isn’t any sell-off strain; the BTC worth quickly skyrockets.

In both situation, bitcoin’s distinctive fundamentals enter the calculus to maintain the BTC worth up over the long run. In a means, as retail participation slumps, that is extra more likely to forestall main sell-off pressures. In spite of everything, funds and publicly traded firms are targeted on long-term trajectories and fundamentals, not on short-term expenditures for consumption wants.

Ultimately, bitcoin’s steadily rising hashrate and institutional maturity underscore its resilience. Any sell-off pressures are more likely to be absorbed by long-term traders to maintain upward worth momentum.