Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tom Lee, Fundstrat’s head of analysis, says Bitcoin might climb to $250,000 by the tip of 2025. In keeping with an interview on CNBC’s Squawk Field in the present day, Lee identified that Bitcoin lately dipped from its all-time excessive of $111,970 all the way down to about $104,000. He nonetheless thinks that the market is holding up round that stage.

Associated Studying

Lee’s Quick-Time period Outlook

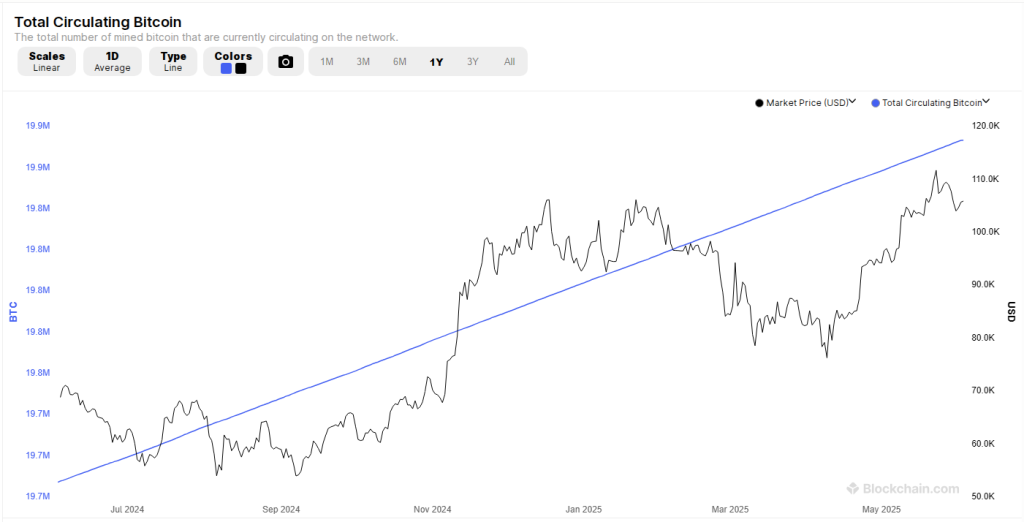

Lee instructed Squawk Field’s host Joe Kernen that 95% of all Bitcoin—about 19.80 million cash—has already been mined out of a most of 21 million. That leaves roughly 1.13 million cash ready to be produced. He sees that as a good supply setup.

He additionally famous that whereas almost all Bitcoin exists, 95% of the worldwide inhabitants doesn’t personal any. Primarily based on experiences, that hole between provide and potential consumers might push costs increased within the months forward.

To succeed in $250,000 from round $104,000 now, Bitcoin would want to leap about 140%. Lee nonetheless believes it will possibly hit $150,000 by December and will even stretch towards $200,000 to $250,000 if demand heats up.

Provide And Demand Hole

Lee highlighted the truth that most individuals on the planet haven’t purchased any Bitcoin. He stated this creates an imbalance. On one aspect you will have an almost fastened provide. On the opposite, there could also be hundreds of thousands of latest consumers within the subsequent 10 years. He defined that if even a fraction of these folks resolve to purchase Bitcoin, the worth might transfer rather a lot increased.

Proper now, solely about 5% of all cash stay to be mined. Which means new provide is slowing down quick. On the identical time, extra wallets, apps, and simple methods to purchase might usher in contemporary cash. Lee thinks this mismatch is a giant a part of why Bitcoin might hold climbing.

Lengthy-Time period Valuation Targets

When requested about Bitcoin’s terminal worth—that means its value when all cash are mined by 2140—Lee stated he expects it to match gold’s roughly $23 trillion market cap. That works out to not less than $1.15 million per Bitcoin if there are 20 million cash in circulation.

He selected 20 million as a substitute of 21 million as a result of assumed losses (misplaced keys, forgotten wallets) imply not each coin will ever be spent. Lee went additional, saying he sees room for Bitcoin to hit $2 million or $3 million per coin. That will put his common “bull case” at $2.5 million, which is roughly a 2,300% rise from in the present day’s ranges.

Associated Studying

Different Analyst Projections

VanEck’s head of digital asset analysis, Matthew Sigel, additionally has a long-range prediction. Primarily based on what Sigel instructed buyers, VanEck sees Bitcoin hitting $3 million by 2050. That forecast strains up with Lee’s concept of Bitcoin matching and even beating gold over time. Each calls assume regular progress in demand, plus wider use by large establishments like hedge funds or pension plans.

Featured picture from Gemini, chart from TradingView