After reaching an all-time excessive above $100,000, the Bitcoin price has entered a multi-week downtrend. This correction has naturally raised questions on whether or not Bitcoin continues to be aligned with the 2017 bull cycle. Right here we’ll analyze the info to evaluate how intently Bitcoin’s present worth motion correlates with earlier bull markets, and what we are able to anticipate subsequent for BTC.

Bitcoin Value Tendencies in 2025 vs. 2017 Bull Cycle

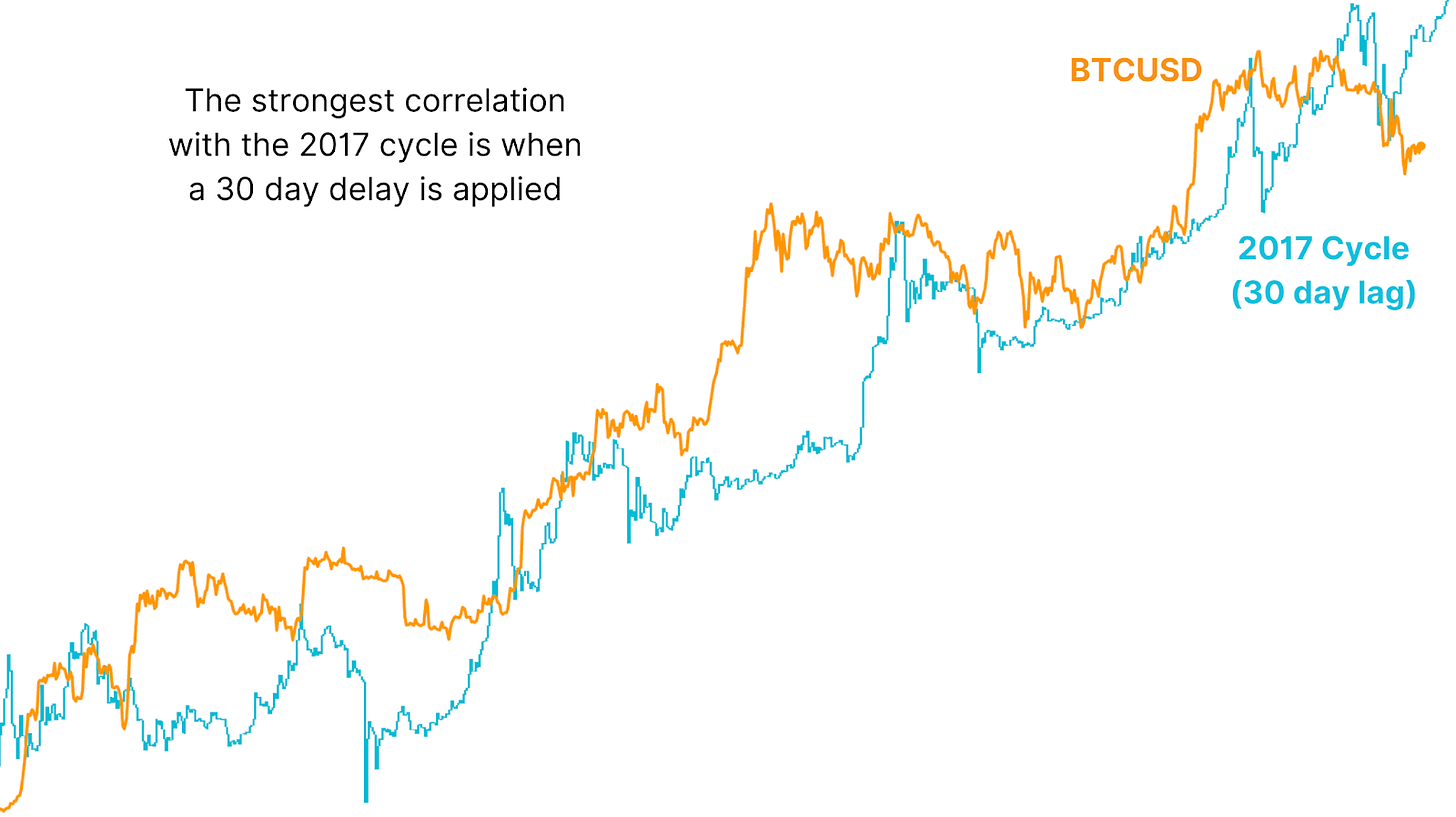

Bitcoin’s price trajectory since the cycle lows set in the course of the 2022 bear market has proven exceptional similarities to the 2015–2017 cycle, the bull market that culminated in Bitcoin reaching $20,000 in December 2017. Nevertheless, Bitcoin’s latest downtrend marks the primary main divergence from the 2017 sample. If Bitcoin have been nonetheless monitoring the 2017 cycle, it ought to have been rallying to new all-time highs over the previous month, as a substitute, Bitcoin has been shifting sideways and declining, suggesting that the correlation could also be weakening.

Regardless of the latest divergence, the historic correlation between Bitcoin’s present cycle and the 2017 cycle stays surprisingly excessive. The correlation between the present cycle and the 2015–2017 cycle was round 92% earlier this 12 months. The latest worth divergence has lowered the correlation barely to 91%, nonetheless an especially excessive determine for monetary markets.

How Bitcoin Market Conduct Echoes 2017 Cycle Patterns

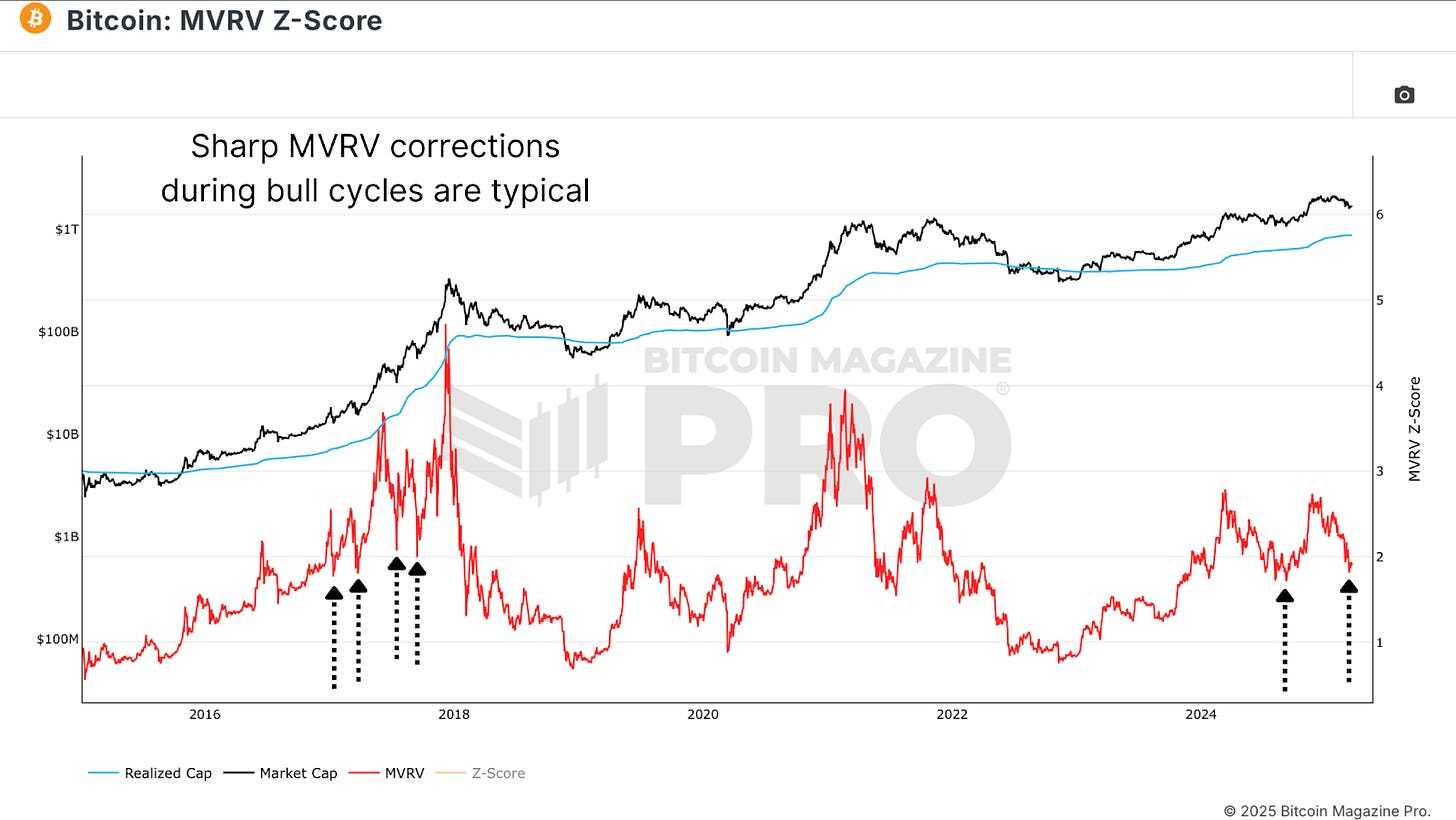

The MVRV Ratio is a key indicator of investor habits. It measures the connection between Bitcoin’s present market worth and the common price foundation of all BTC held on the community. When the MVRV ratio rises sharply, it signifies that buyers are sitting on vital unrealized income, a situation that usually precedes market tops. When the ratio declines towards the realized worth, it alerts that Bitcoin is buying and selling near the common acquisition worth of buyers, typically marking a bottoming section.

The latest decline within the MVRV ratio displays Bitcoin’s correction from all-time highs, nevertheless, the MVRV ratio stays structurally much like the 2017 cycle with an early bull market rally, adopted by a number of sharp corrections, and as such, the correlation stays at 80%.

Bitcoin Value Correlation with 2017 Bull Cycle Knowledge

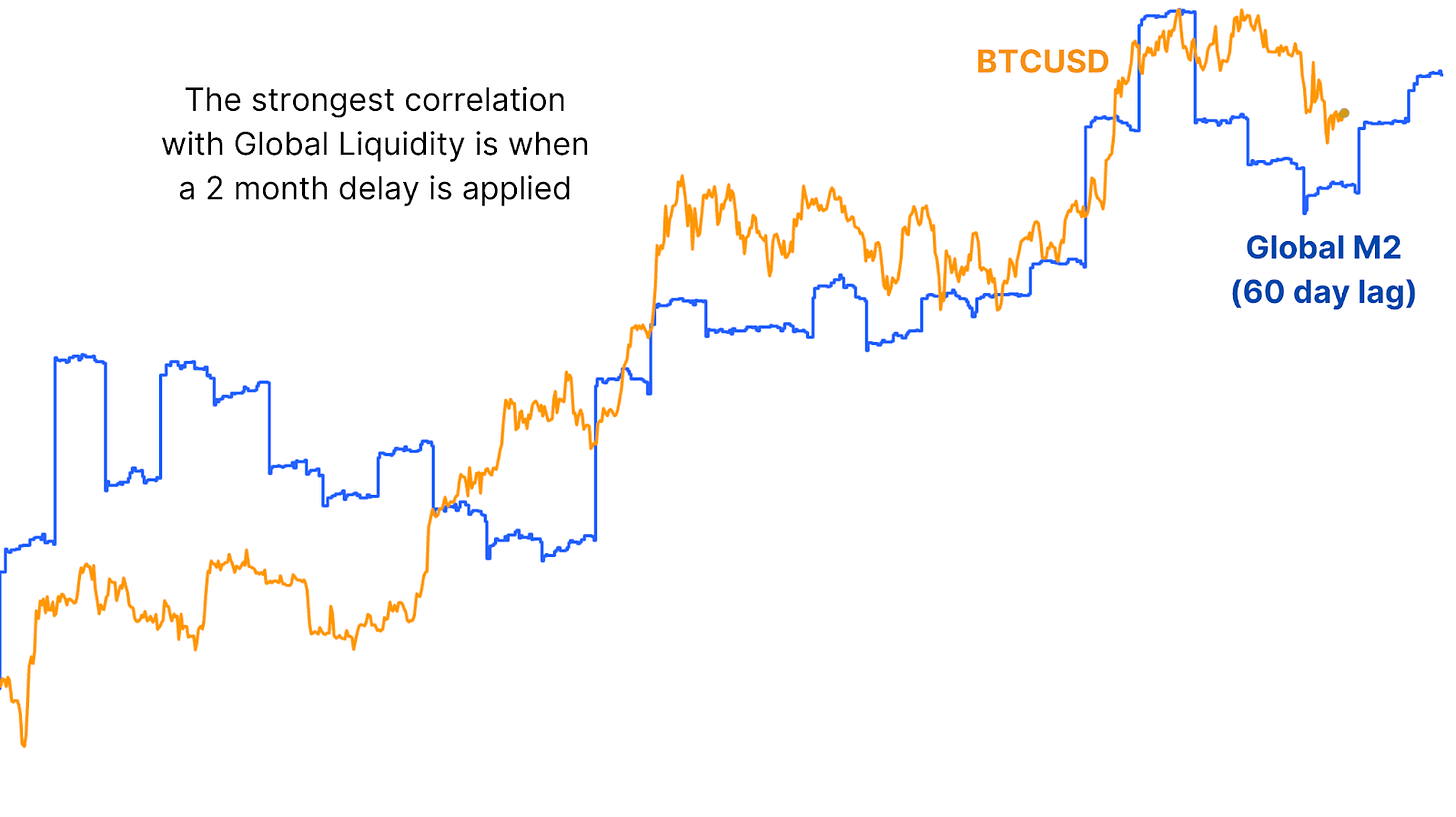

One potential clarification for the latest divergence is the affect of information lag. For instance, Bitcoin’s worth motion has proven a robust correlation with Global Liquidity, the overall provide of cash in main economies; nevertheless, historic evaluation exhibits that modifications in liquidity typically take round 2 months to mirror in Bitcoin’s worth motion.

By making use of a 30-day lag to Bitcoin’s worth motion relative to the 2017 cycle, the correlation will increase to 93%, which might be the very best recorded correlation between the 2 cycles. The lag-adjusted sample means that Bitcoin may quickly resume the 2017 trajectory, implying {that a} main rally might be on the horizon.

What 2017 Bull Cycle Indicators Imply for Bitcoin Value At this time

Historical past could not repeat itself, but it surely typically rhymes. Bitcoin’s present cycle could not ship 2017-style exponential beneficial properties, however the underlying market psychology stays strikingly related. If Bitcoin resumes its correlation with the lagging 2017 cycle, the historic precedent means that Bitcoin may quickly recuperate from the present correction, and a pointy upward transfer may comply with.

Discover dwell information, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s worth motion at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding selections.