Bitcoin’s value actions dominate headlines, however the true story of BTC lies beneath the floor. Past technical evaluation and value hypothesis, on-chain information affords an unparalleled view of provide, demand, and investor habits in actual time. By leveraging these insights, merchants and traders can anticipate market developments, comply with institutional actions, and make data-driven choices.

For a extra in-depth look into this subject, try a current YouTube video right here: Mastering Bitcoin On-Chain Data

Realized Worth & MVRV Z-Rating

On-chain information refers back to the publicly out there transaction information on Bitcoin’s blockchain. Not like conventional markets, the place investor actions are obscured, Bitcoin’s transparency permits for real-time evaluation of each transaction, pockets motion, and community exercise. This data helps traders determine main developments, accumulation zones, and potential value inflection factors.

Some of the essential on-chain metrics is Realized Price, which displays the common price foundation of all BTC in circulation. Not like conventional property, the place investor price bases are troublesome to find out, Bitcoin offers real-time visibility into when nearly all of holders are in revenue or loss.

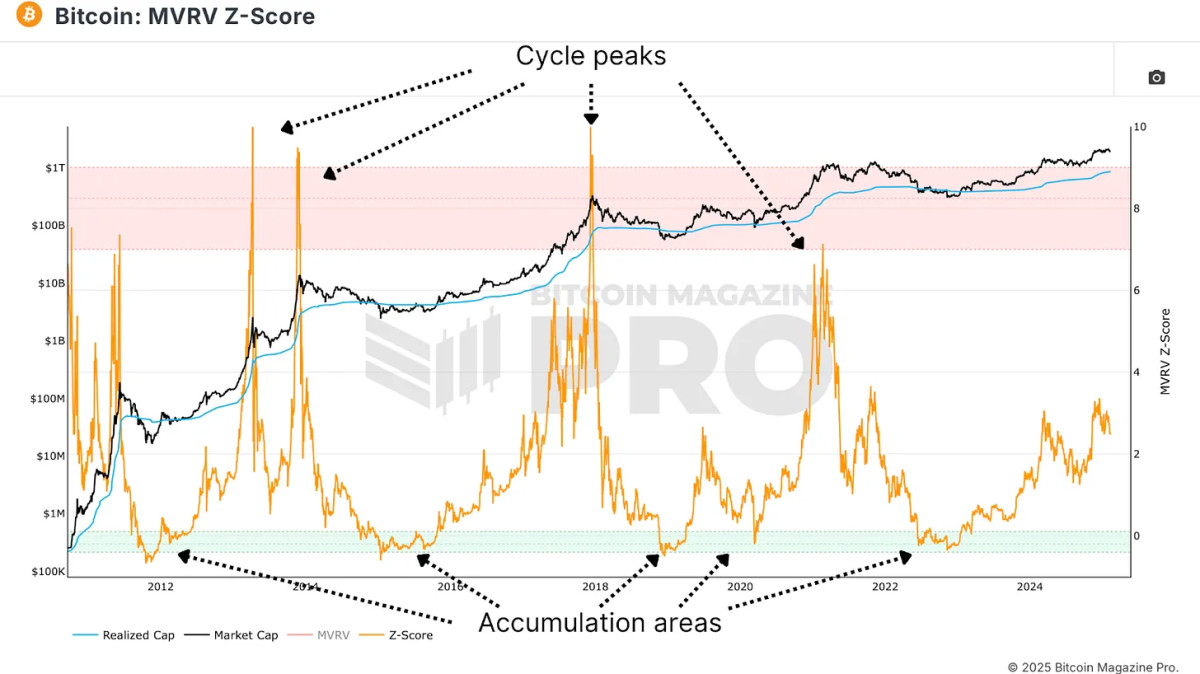

To reinforce the utility of Realized Worth, analysts make use of the MVRV Z-Score, which measures the deviation between market worth and realized worth, standardized for Bitcoin’s volatility. This indicator has traditionally recognized optimum shopping for zones when it enters the decrease vary and potential overvaluation when it enters the pink zone.

Monitoring Lengthy-Time period Holders

One other key metric is the 1+ Year HODL Wave, which tracks Bitcoin addresses that haven’t moved funds for a minimum of a yr. A rising HODL wave signifies that traders are selecting to carry, decreasing circulating provide and creating upward value stress. Conversely, when this metric begins declining, it suggests profit-taking and potential distribution.

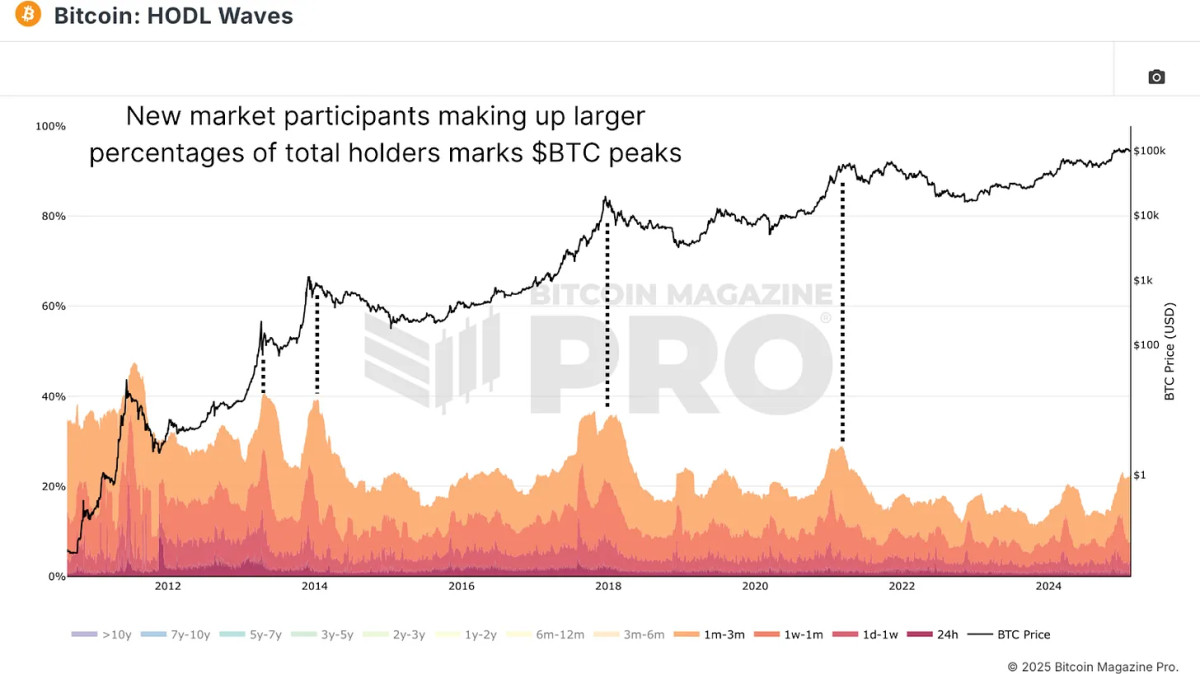

HODL Waves visualizes the whole distribution of Bitcoin possession by age bands. Filtering to new market individuals of three months or much less reveals typical retail participation ranges. Peaks in short-term holders usually sign market tops, whereas low ranges point out excellent accumulation zones.

Recognizing Whale Actions

Supply Adjusted Coin Days Destroyed quantifies the entire BTC moved, weighted by how lengthy it was held, and standardizes that information by the circulating provide at the moment. For instance:

- 1 BTC held for 100 days → 100 Coin Days Destroyed

- 0.1 BTC held for 1,000 days → 100 Coin Days Destroyed

This metric is invaluable for detecting whale exercise and institutional profit-taking. When long-dormant cash immediately transfer, it typically alerts giant holders exiting positions. Historic information confirms that spikes on this information level align with main market tops and bottoms, reinforcing its worth in cycle evaluation.

Realized Beneficial properties & Losses

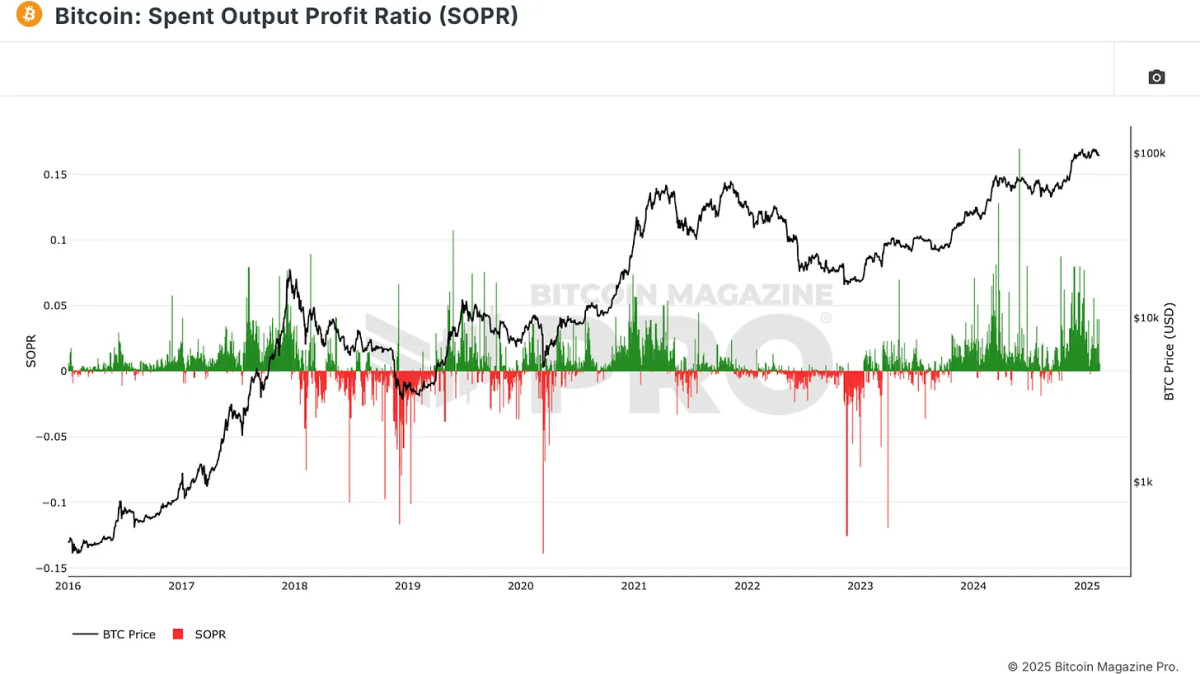

The Spent Output Profit Ratio (SOPR) reveals the profitability of BTC transactions. A SOPR worth above 0 signifies that the common Bitcoin being moved is in revenue, whereas a worth under 0 means the common sale is at a loss. By observing SOPR spikes, merchants can determine euphoric profit-taking, whereas SOPR declines typically accompany bear market capitulations.

Counting on a single metric will be deceptive. To extend the likelihood of correct alerts, traders ought to search confluence between a number of on-chain indicators.

For instance, when:

- MVRV Z-score is within the inexperienced zone (undervalued)

- SOPR signifies excessive realized losses (capitulation)

- HODL waves present a decline in short-term holders (promoting exhaustion)

This alignment traditionally marks optimum accumulation zones. You must also search for confluence for any deliberate profit-taking in your BTC holdings, searching for the above metrics all signaling the other to stipulate overheated market situations.

Conclusion

Bitcoin’s on-chain information offers a clear, real-time view of market dynamics, providing traders an edge in decision-making. By monitoring provide developments, investor psychology, and accumulation/distribution cycles, Bitcoiners can higher place themselves for long-term success.

Discover dwell information, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your personal analysis earlier than making any funding choices.