Prime Cryptocurrency Exchanges

When diving into the world of digital belongings, choosing the right cryptocurrency change is an enormous deal. I’ve delved into the highest platforms by rankings, transaction volumes, and their total market presence.

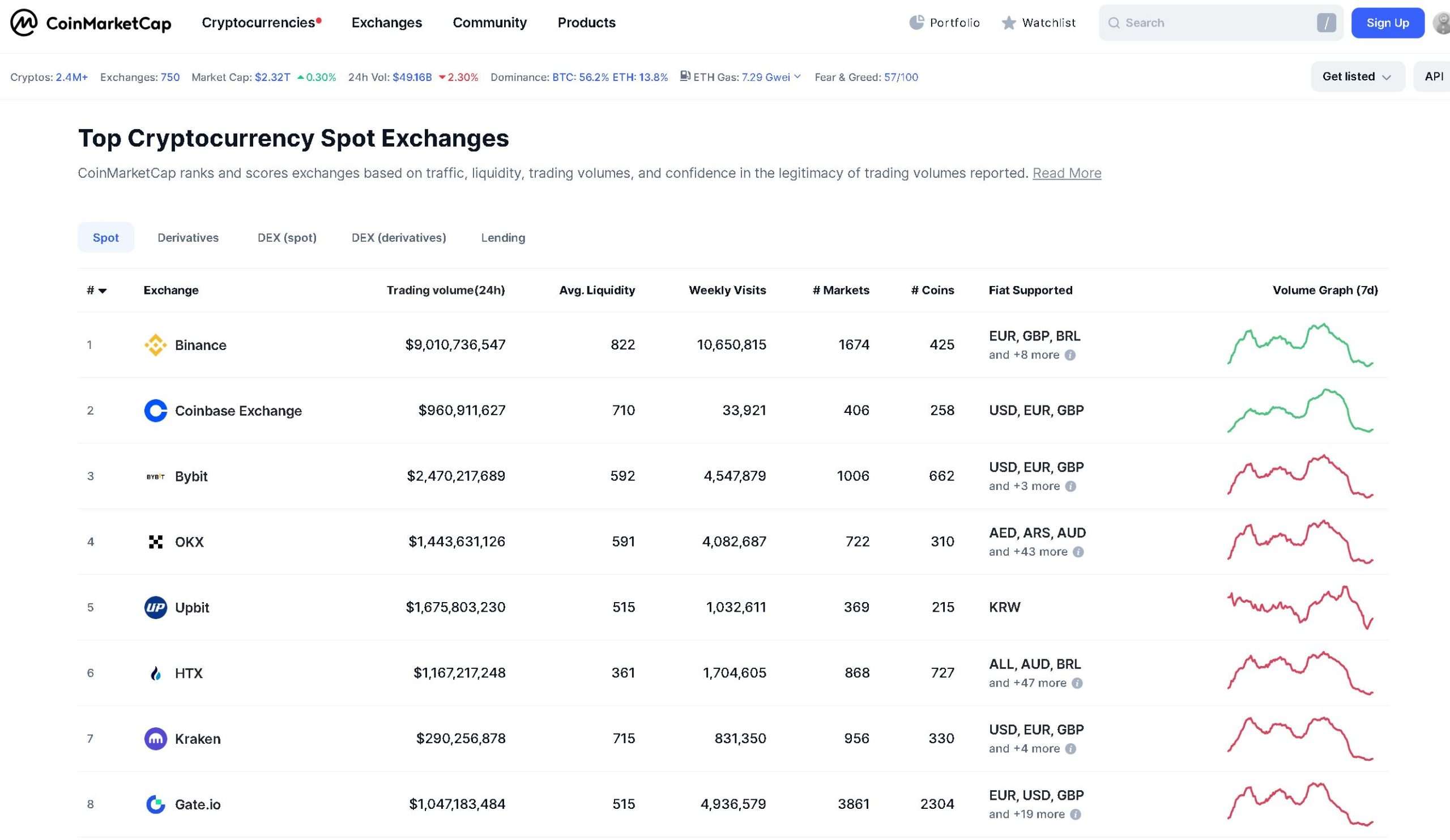

CoinMarketCap Rankings

In accordance with CoinMarketCap, exchanges are ranked based mostly on components like site visitors, liquidity, buying and selling volumes, and the reliability of reported buying and selling volumes. Proper now, they’re retaining tabs on 253 spot exchanges with a complete 24-hour buying and selling quantity hitting round $747.86 billion.

Right here’s a fast breakdown of some high exchanges:

| Alternate Title | 24-Hour Buying and selling Quantity (USD) |

|---|---|

| Binance | 36 billion (approx.) |

| Coinbase | 2 billion (approx.) |

| Gemini | 175 million (approx.) |

Binance: Main the Business

Binance is the massive canine within the crypto change world, main by commerce volumes. It shot to the highest, surpassing $36 billion in trades by early 2021 (CoinMarketCap). With a variety of cryptocurrencies and superior buying and selling options, it’s an important selection for each newbies and seasoned merchants.

Binance is known for its low buying and selling charges and huge number of digital belongings, making it straightforward for customers to discover varied funding choices.

Gemini: A Rising Presence

Based in 2014 by the Winklevoss twins, Gemini is making waves within the crypto market. With buying and selling volumes over $175 million, it’s positioned itself as a dependable change as detailed by CoinMarketCap. Recognized for sturdy safety, regulatory compliance, and a user-friendly interface, Gemini is a strong selection.

They even launched the Gemini Greenback token, including one other layer to its ecosystem. For these simply beginning out, Gemini gives a simple and safe setting.

Coinbase: US Market Large

Since its inception in 2012, Coinbase has dominated the U.S. market, boasting the most important buying and selling quantity amongst U.S. exchanges. With buying and selling volumes over $2 billion in early 2021, it’s cemented its standing as a market chief (CoinMarketCap).

Acknowledged for its intuitive design and clean onboarding, Coinbase is very accessible for newcomers. Plus, it gives a wide range of cryptocurrencies, supporting customers as they diversify their portfolios.

Exploring totally different platforms is essential for anybody all for buying and selling. Particular person preferences for options, charges, and securities ought to information the selection of change. For extra insights, take a look at our cryptocurrency exchange reviews and discover decentralized cryptocurrency exchanges for extra choices.

Key Options of Exchanges

Whereas exploring varied cryptocurrency exchanges, I found that sure options can drastically improve the buying and selling expertise. Right here, I’ll spotlight key choices from 4 exchanges: Huobi International, Kraken, Crypto.com, and KuCoin.

Huobi International: Derivatives Buying and selling

Huobi International is well-known for its intensive derivatives buying and selling choices, permitting customers to have interaction in futures and choices contracts. These choices allow merchants to invest on value actions with out truly proudly owning the asset. That is significantly interesting for these seeking to hedge investments or amplify positive aspects.

Key Options:

| Characteristic | Description |

|---|---|

| By-product Choices | Futures, choices, and margin buying and selling accessible |

| Superior Instruments | Analytical instruments for knowledgeable buying and selling choices |

| Consumer-Pleasant Interface | Simpler navigation for each learners and skilled merchants |

Kraken: Superior Choices

Kraken shines with its superior buying and selling options, providing a strong set of instruments for these diving deep into the crypto market. From margin buying and selling to futures and staking choices, Kraken is ideal for superior merchants who respect a classy buying and selling setting.

Key Options:

| Characteristic | Description |

|---|---|

| Margin Buying and selling | As much as 5x leverage accessible |

| Staking Choices | Earn rewards on cryptocurrency holdings |

| Safety Measures | Sturdy deal with securing person belongings |

Crypto.com: Vast Cryptocurrency Choice

Crypto.com impresses with an unlimited number of over 250 cryptocurrencies for buying and selling. This intensive providing permits customers to simply diversify their portfolios. The platform additionally supplies distinctive perks and rewards for Crypto.com Visa Card customers, including additional incentives for normal merchants. Customers also can make the most of Cronos (CRO), the platform’s utility token, to decrease charges and earn advantages.

Key Options:

| Characteristic | Description |

|---|---|

| Number of Cryptocurrencies | Over 250 cryptos accessible for buying and selling (Forbes) |

| Rewards for Card Customers | Additional advantages for utilizing the Crypto.com Visa Card |

| Payment Discount | Pay buying and selling charges with CRO for decrease prices |

KuCoin: Altcoin Entry

KuCoin is acknowledged for its deal with offering entry to a variety of altcoins. This change offers customers the chance to put money into lesser-known cryptocurrencies that might not be accessible on different platforms. KuCoin additionally caters to a world viewers, providing varied buying and selling pairs and alternatives for people exploring different investments.

Key Options:

| Characteristic | Description |

|---|---|

| Intensive Altcoin Choice | Entry to quite a few altcoins for buying and selling |

| Low Buying and selling Charges | Aggressive payment construction for varied transactions |

| Consumer-Pleasant Design | Easy usability for newcomers and skilled merchants alike |

By analyzing these options, customers could make an knowledgeable selection when deciding on a cryptocurrency change based mostly on their buying and selling wants. Every platform serves totally different focuses, so it’s important to contemplate what aligns finest with particular person funding methods.

Alternate Safety Concerns

After I began my journey into cryptocurrency, considered one of my main issues was the safety of the exchanges I thought-about. With quite a few high-profile hacks up to now, it’s essential to remain knowledgeable in regards to the safety panorama of cryptocurrency exchanges.

Historic Alternate Hacks

Many exchanges have skilled important safety breaches, impacting hundreds of customers and leading to monumental monetary losses. As an illustration, Coincheck was hacked in early 2018, dropping over $534 million in NEM resulting from storing all tokens in a single sizzling pockets with out multisignature safety. The notorious Mt. Gox hack noticed the theft of 80,000 BTC in 2011 and one other 850,000 BTC in 2014, mixed losses amounting to round $29 billion in in the present day’s worth. Moreover, in 2018, Italian crypto change BitGrail misplaced 17 million NANO cash price $170 million, attributed to vulnerabilities in its code.

Even exchanges which might be typically deemed safe, like Binance, confronted assaults. In Could 2019, hackers stole roughly 7,000 BTC and delicate person information from round 60,000 accounts, revealing vulnerabilities even inside sturdy platforms.

| Alternate | 12 months of Hack | Quantity Misplaced | Trigger |

|---|---|---|---|

| Coincheck | 2018 | $534 million | Scorching pockets insecurity |

| Mt. Gox | 2011 & 2014 | $29 billion | Unencrypted pockets recordsdata |

| BitGrail | 2018 | $170 million | Code vulnerabilities |

| Binance | 2019 | $40 million | Malware and safety flaws |

Significance of Safety Audits

Common safety audits are important for any cryptocurrency change. These audits assist establish vulnerabilities and be sure that the newest safety practices are being carried out. They’ll additionally instill confidence in customers by confirming that an change has been totally evaluated by a 3rd get together.

I at all times search for exchanges which have up-to-date safety audits accessible for public evaluation. Understanding their dedication to safety can affect my selection considerably.

Safe Storage Strategies

One of many crucial components in retaining cryptocurrency protected is the place the belongings are saved. Many exchanges provide custodial storage, the place they handle person belongings. In accordance with Investopedia, storing cryptocurrency non-public keys on a good and controlled change will be as safe as utilizing a chilly pockets, particularly if the change gives insurance coverage towards theft. Platforms like Coinbase and Gemini present custodial storage together with insurance coverage for his or her customers’ belongings.

| Storage Methodology | Safety Stage | Instance Exchanges |

|---|---|---|

| Scorching Pockets | Much less safe, linked to the web | Binance, BitGrail |

| Chilly Pockets | Safer, offline storage | Ledger, Trezor |

| Custodial Storage with Insurance coverage | Safe and insured storage | Coinbase, Gemini |

Dangers of Alternate Wallets

Utilizing change wallets carries inherent dangers. Whereas handy, change wallets will be susceptible to assaults. Even exchanges with sturdy safety measures can expertise breaches. Moreover, customers shouldn’t have management over their non-public keys, which may result in potential lack of funds if the change turns into bancrupt or suffers a hack.

For long-term investments, I want to switch my belongings to a chilly pockets, guaranteeing that my funds stay protected from the vulnerabilities that include utilizing change wallets.

In abstract, the safety of a cryptocurrency change is paramount to guard one’s investments. Consciousness of previous hacks, the significance of safety audits, safe storage strategies, and understanding the dangers related to wallets will assist me select safer choices within the risky world of cryptocurrency. For additional insights, I like to recommend trying out cryptocurrency exchange reviews.

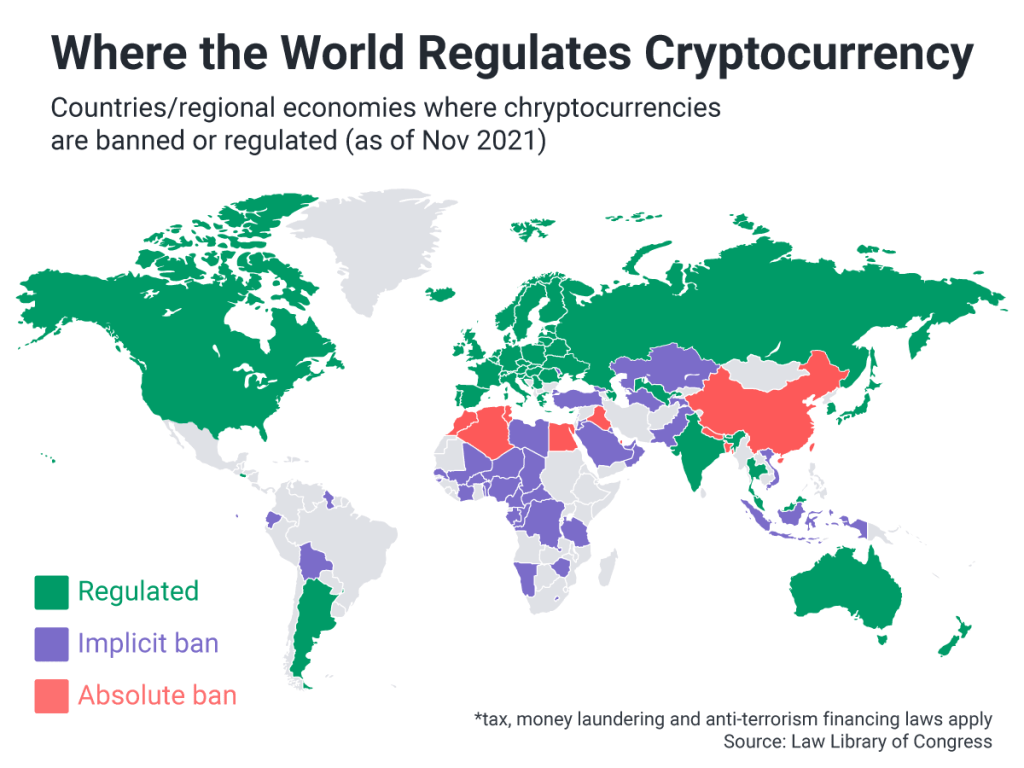

Nation Rules and Legalities

Understanding the authorized panorama of cryptocurrency is essential for anybody seeking to make investments or commerce on varied platforms. Rules can drastically affect the functioning of exchanges and the way cryptocurrencies are perceived in numerous jurisdictions.

Cryptocurrency Authorized Standing Worldwide

The authorized standing of cryptocurrency varies considerably throughout the globe. As of June 2024, El Salvador stands out as the one nation that has formally accepted Bitcoin as authorized tender for financial transactions. Different nations have adopted various approaches. As an illustration, Japan has clear rules underneath the Fee Companies Act, whereas China has imposed a ban on cryptocurrency exchanges, transactions, and mining, pushing for its Central Financial institution Digital Foreign money (CBDC) as a substitute. In India, the authorized framework stays pending; nevertheless, there isn’t a present illegality, permitting exchanges to function. The European Union has taken steps to legitimize cryptocurrencies, with rules just like the European Fee’s Markets in Crypto-Belongings (MiCA) legislation set to standardize practices and shield customers (Investopedia).

| Nation | Authorized Standing | Noteworthy Factors |

|---|---|---|

| El Salvador | Authorized tender for Bitcoin | First nation to just accept Bitcoin legally |

| Japan | Acknowledged underneath Fee Companies Act | Clear rules in place |

| China | Ban on exchanges and mining | Give attention to CBDC |

| India | No present illegality | Awaiting framework |

| European Union | Authorized with rules | MiCA carried out for standardization |

Affect of Rules on Exchanges

Rules play a pivotal position in shaping the operations of cryptocurrency exchanges. In July 2023, a U.S. courtroom dominated that cryptocurrencies bought by institutional patrons are thought-about securities, whereas these purchased by retail traders on exchanges are usually not. This distinction represents a major step ahead for crypto fanatics, because it permits for extra freedom in buying and selling for most people. Nevertheless, exchanges are nonetheless topic to oversight by regulatory our bodies such because the Securities and Alternate Fee (SEC), which governs coin choices and gross sales to institutional patrons (Investopedia).

| Regulation Kind | Affect |

|---|---|

| Institutional vs Retail | Totally different classifications can have an effect on buying and selling methods and authorized implications |

| SEC Oversight | Exchanges should adjust to rules for coin choices, particularly for institutional gross sales |

Authorized Tender Acceptance

The acceptance of cryptocurrency as authorized tender considerably impacts its use and legitimacy. El Salvador’s distinctive place units it aside, because it permits Bitcoin for use alongside the U.S. greenback for all transactions. This acceptance could contribute to higher adoption and understanding amongst its residents.

In distinction, the shortage of acceptance in nations like China limits the potential for day-to-day transactions and closely restricts the market. Recognizing cryptocurrency as authorized tender can improve shopper confidence, affect buying and selling volumes, and promote broader acceptance into the monetary system (Investopedia).

| Nation | Authorized Tender Standing | Implications |

|---|---|---|

| El Salvador | Accepts Bitcoin as authorized tender | Enhanced adoption and shopper confidence |

| China | No authorized tender standing | Limits market potential and shopper use |

Understanding these rules and their implications may help inform my decisions when navigating by totally different cryptocurrency exchanges and ensures that I stay compliant whereas exploring the world of digital belongings.

Transaction Charges Comparability

Understanding transaction charges is essential when deciding on a cryptocurrency change. The prices related to shopping for, promoting, and buying and selling cryptocurrencies can drastically have an effect on one’s total funding technique. Beneath, I’ll break down the payment buildings of a number of fashionable platforms, together with Binance, Coinbase, and Robinhood, in addition to spotlight varied payment choices throughout exchanges.

Binance Payment Buildings

Binance, the most important cryptocurrency buying and selling platform, employs a tiered payment construction based mostly on buying and selling quantity over the previous 30 days. They categorize customers into “Makers” and “Takers.” Makers, who place restrict orders, usually get pleasure from decrease charges in comparison with Takers, who execute market orders.

| Buying and selling Quantity (30 days) | Taker Payment (%) | Maker Payment (%) |

|---|---|---|

| Lower than $50,000 | 0.10 | 0.09 |

| $50,000 – $1,000,000 | 0.08 | 0.07 |

| $1,000,000 – $10,000,000 | 0.06 | 0.05 |

Moreover, customers can go for a 25% low cost on charges by paying with Binance Coin (BNB) holdings (The Motley Fool).

Coinbase Payment Fashions

Coinbase contains a comparable payment construction to Binance, the place transaction charges range relying on the person’s buying and selling quantity over the previous 30 days. Their charges are additionally cut up between Takers and Makers, with Takers often paying the next share.

| Buying and selling Quantity (30 days) | Taker Payment (%) | Maker Payment (%) |

|---|---|---|

| Lower than $10,000 | 0.50 | 0.00 |

| $10,000 – $50,000 | 0.40 | 0.00 |

| Over $50,000 | 0.25 | 0.00 |

Not like Binance, Coinbase doesn’t provide reductions for buying and selling charges by its personal cryptocurrency (The Motley Fool).

Robinhood Fee Setup

Robinhood adopts a singular strategy by providing commission-free cryptocurrency trades. This implies customers pay 0% charges whatever the order kind. Nevertheless, Robinhood generates income by transaction rebates somewhat than executing trades immediately. This could result in barely inflated shopping for costs and decrease promoting costs for its prospects (The Motley Fool).

Assorted Payment Choices Throughout Exchanges

The panorama of cryptocurrency exchanges additionally options platforms with assorted payment buildings catering to totally different person preferences. As an illustration:

- BitMEX and FTX: These exchanges usually cost transaction charges beneath 0.1% for each Takers and Makers.

- eToro, ShakePay, and BlockFi: These platforms function fee-free cryptocurrency buying and selling choices, interesting to customers who prioritize minimal prices of their buying and selling.

When contemplating totally different exchanges, it’s very important to take transaction charges under consideration. A payment that appears small can add up rapidly, particularly with excessive buying and selling volumes. For additional comparisons, you possibly can examine our detailed cryptocurrency exchange reviews for extra insights into payment buildings and different necessary options.

Cryptocurrency Availability

When evaluating the provision of cryptocurrencies throughout totally different exchanges, I discover that the choice supplied can considerably affect my buying and selling choices. Right here, I examine 4 notable platforms based mostly on their cryptocurrency choices.

Crypto.com’s Numerous Choice

Crypto.com is understood for its spectacular range in cryptocurrency choices. The platform helps an in depth variety of cryptocurrencies, offering entry to each fashionable and rising digital belongings. This wide variety makes it an appropriate selection for merchants seeking to discover past mainstream choices and diversify their portfolios. For particular numbers relating to accessible currencies, I like to recommend checking Crypto.com’s official website.

Coinbase’s Intensive Cryptocurrency Checklist

Coinbase stands out with its user-friendly interface and gives over 240 cryptocurrencies for buying and selling (NerdWallet). This intensive checklist contains main gamers like Bitcoin and Ethereum, in addition to quite a few altcoins. For learners, Coinbase’s easy design facilitates straightforward navigation by varied cryptocurrencies, making it a gorgeous possibility for newcomers to the market.

| Alternate Platform | Variety of Cryptocurrencies |

|---|---|

| Crypto.com | Huge choice |

| Coinbase | 240+ |

| Kraken | 200+ |

| Gemini | Restricted however specialised |

Kraken’s Vast Vary of Choices

Kraken supplies over 200 cryptocurrencies, interesting to each newbie and superior merchants. As I explored its platform, I seen that Kraken gives notably low charges for superior buying and selling choices. The mix of a large cryptocurrency choice and aggressive charges makes Kraken an interesting selection for these seeking to maximize returns.

Gemini’s Crypto Buying and selling Specializations

Gemini has carved a distinct segment for itself by specializing in a extra restricted number of cryptocurrencies. Whereas it might not have as many choices as a few of the different exchanges, Gemini’s choices are fastidiously curated. This specialization permits for a safer and dependable buying and selling expertise, significantly for established cash.

In abstract, the cryptocurrency availability throughout these exchanges highlights the varied choices accessible for these all for buying and selling cryptocurrencies.