Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

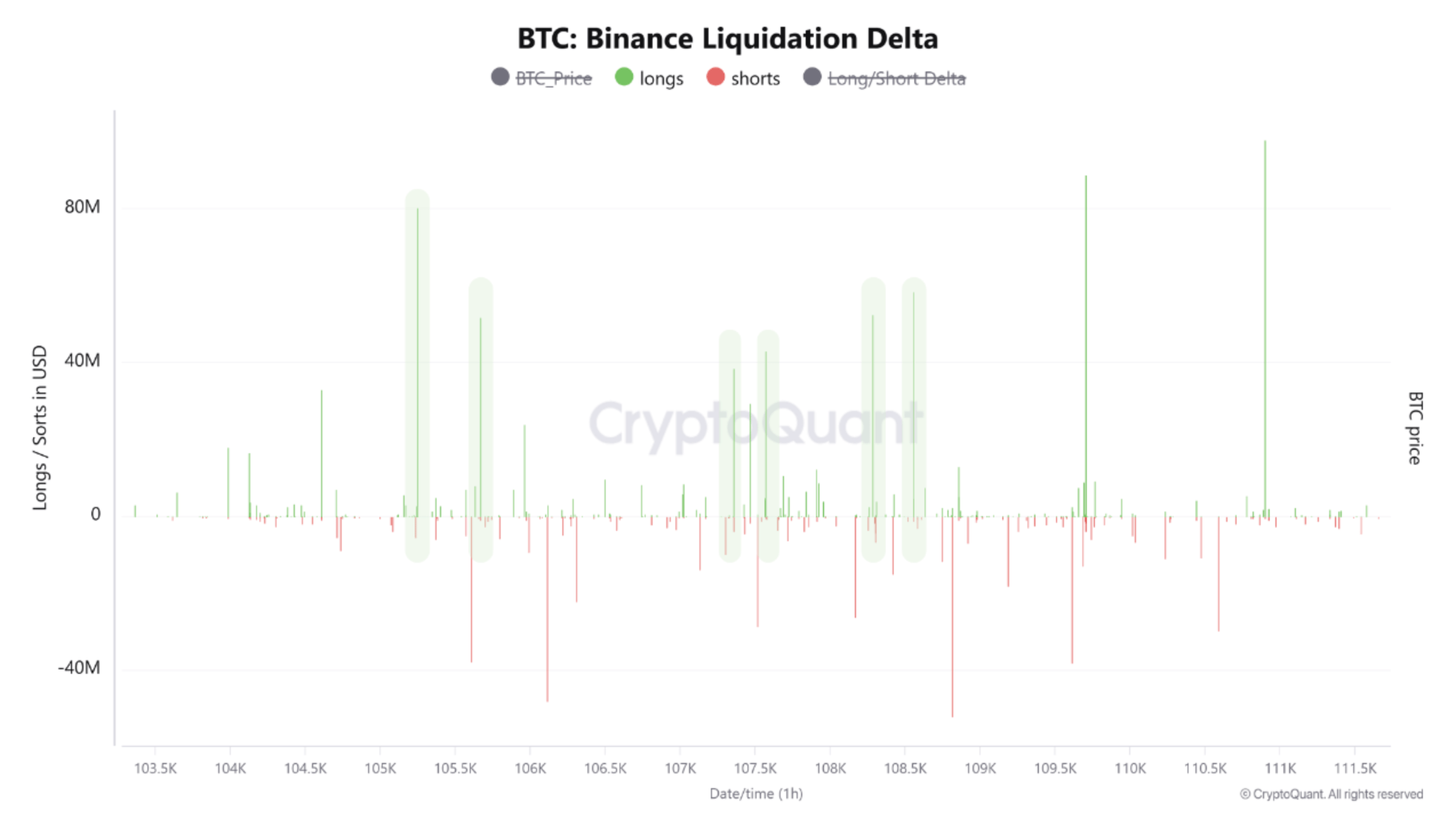

As Bitcoin (BTC) continues to hover close to its all-time excessive (ATH) of $111,814, indicators of a reset within the derivatives market are rising. One such indicator is the Binance Liquidation Delta, which is exhibiting a constant sample of large-scale lengthy place liquidations.

Bitcoin Late-Lengthy Positions Get Wiped Out

In accordance with a latest CryptoQuant Quicktake publish by analyst Amr Taha, Binance’s BTC derivatives market is at present experiencing a major reset. The Binance Liquidation Delta reveals that liquidations of lengthy positions, typically exceeding $40 million, are repeatedly disrupting the market.

Associated Studying

For the uninitiated, the Binance Liquidation Delta measures the distinction between lengthy and brief liquidations on Binance’s futures market. A adverse delta means extra lengthy positions are being forcibly closed, typically indicating bearish stress or a leverage reset. Quite the opposite, a constructive delta suggests extra brief positions are getting liquidated, which may sign a bullish brief squeeze.

The next chart highlights repeated spikes in lengthy liquidations – proven in inexperienced – occurring at hourly intervals. Whereas some brief liquidations are additionally current, they’re far much less important in magnitude.

Taha famous a key element that regardless of the constant flushing of lengthy positions, funding charges on Binance stay impartial, hovering round zero. This means an absence of utmost sentiment – neither overly bullish nor bearish – implying that merchants are cautiously reassessing their positions moderately than panicking.

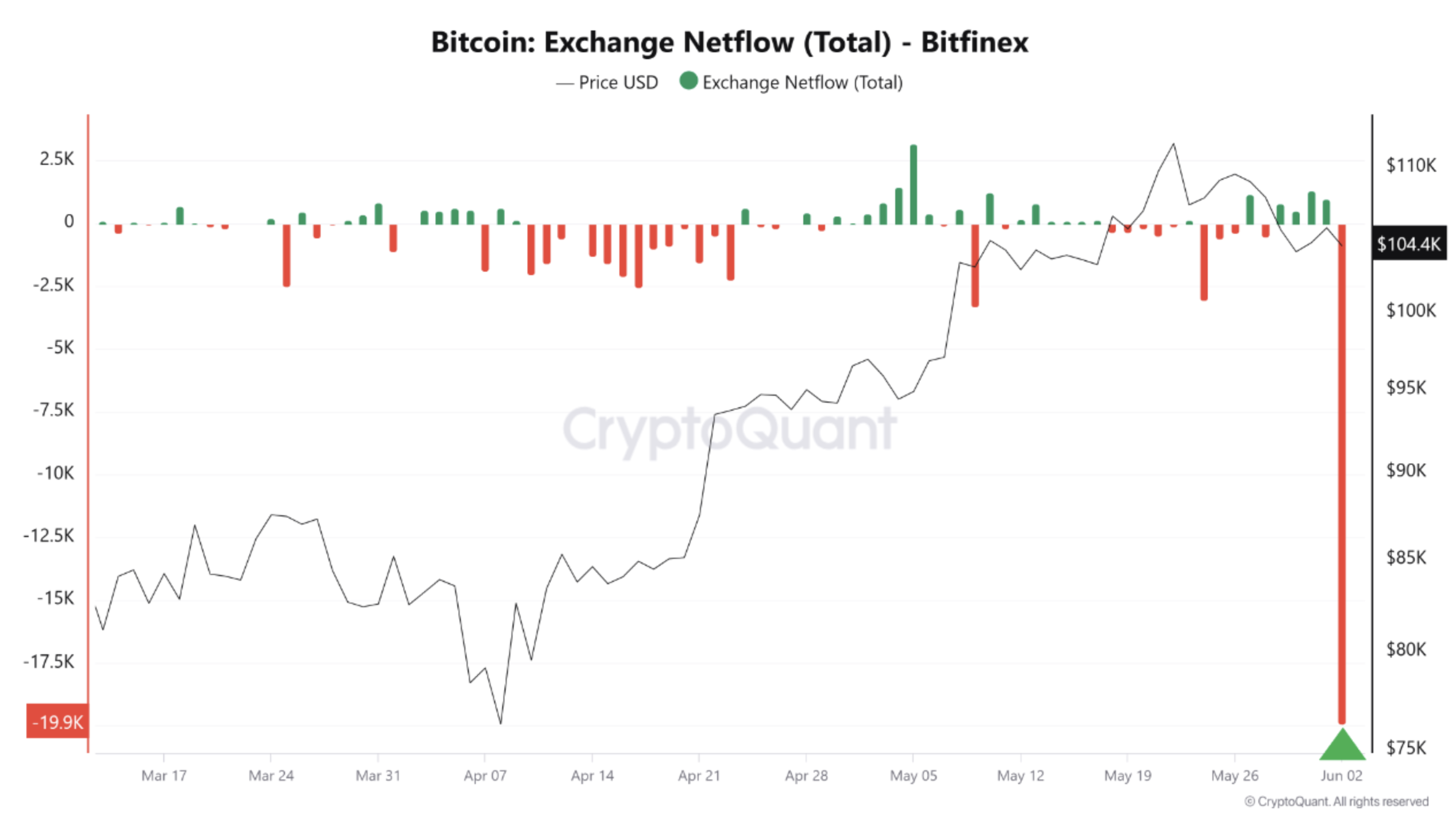

In parallel, whale exercise alerts accumulation moderately than capitulation. Most notably, Bitfinex noticed its largest single-day BTC withdrawal since August 2019, as 20,000 BTC was pulled from the change. Taha commented:

This transaction, valued at over $1.3 billion based mostly on present costs, signifies that such large-scale withdrawals typically replicate long-term holding methods, thereby assuaging instant promoting stress on exchanges.

Contemplating the impartial funding setting, persistent lengthy liquidations, and substantial whale outflows, the analyst prompt that Bitcoin could also be positioning for one more upward move – probably to a brand new ATH.

New ATH On The Horizon For BTC?

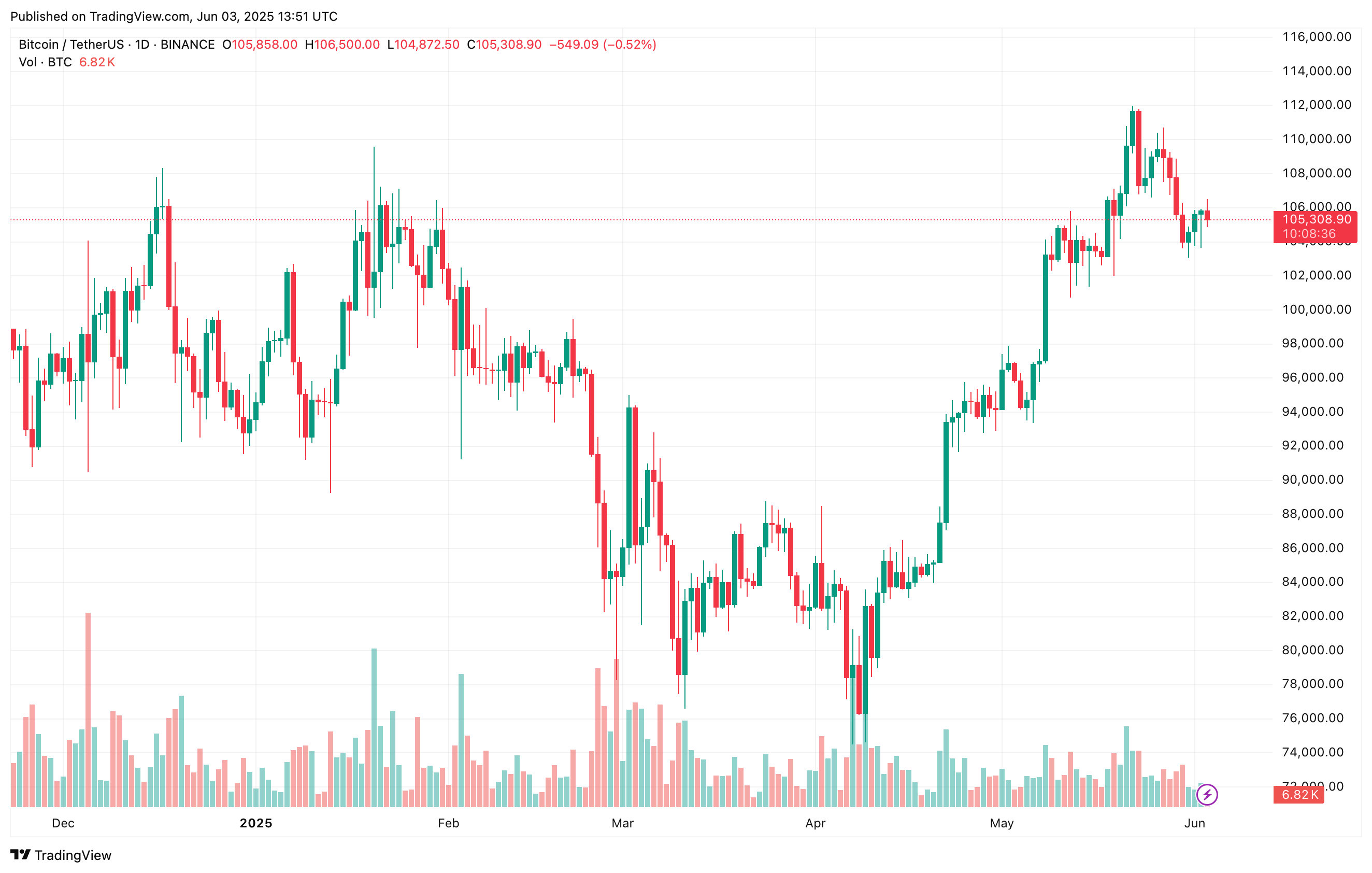

On the time of writing, BTC is buying and selling 5.8% beneath its ATH. Nevertheless, a number of technical and on-chain indicators trace at additional upside for the world’s largest digital asset by market cap.

Associated Studying

As an example, CryptoQuant contributor ibrahimcosar not too long ago projected a worth goal of $112,000 following a bullish double backside breakout. Moreover, Coinbase not too long ago recorded a 7,883 BTC withdrawal, suggesting that institutional traders could also be positioning for the subsequent leg up.

That mentioned, some warning indicators persist. For instance, latest on-chain information shows that long-term BTC holders are decreasing their publicity to the digital asset, possible in anticipation of a worth correction. At press time, BTC trades at $105,308, up 1.4% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com