A new report from the Financial institution for Worldwide Settlements (BIS) reveals that Bitcoin and different cryptocurrencies are getting used extra throughout occasions of financial stress. This occurs largely in international locations the place inflation is excessive, it’s costly to ship cash, or the federal government limits how a lot cash can depart the nation.

Individuals flip to Bitcoin and stablecoins like USDT and USDC when their monetary methods cease working correctly or grow to be too costly to make use of. That is very true for small worldwide funds. Crypto provides individuals another choice once they can’t depend on banks or conventional cash methods.

Bitcoin Turns into a Device Throughout Laborious Occasions

The report helps what many individuals within the crypto house already imagine—Bitcoin isn’t only for investing anymore — in some locations, it’s an actual lifeline. When the worth of native cash drops quick or when it’s laborious or too expensive to ship cash throughout borders, individuals flip to Bitcoin to maintain their cash secure and to ship it sooner, cheaper, and with extra management.

The BIS additionally discovered that when international locations attempt to management how cash strikes in or out (by way of capital circulate administration), crypto use usually goes up. In different phrases, individuals use Bitcoin and different crypto to get round these guidelines.

Cross-Border Crypto Funds Are Rising

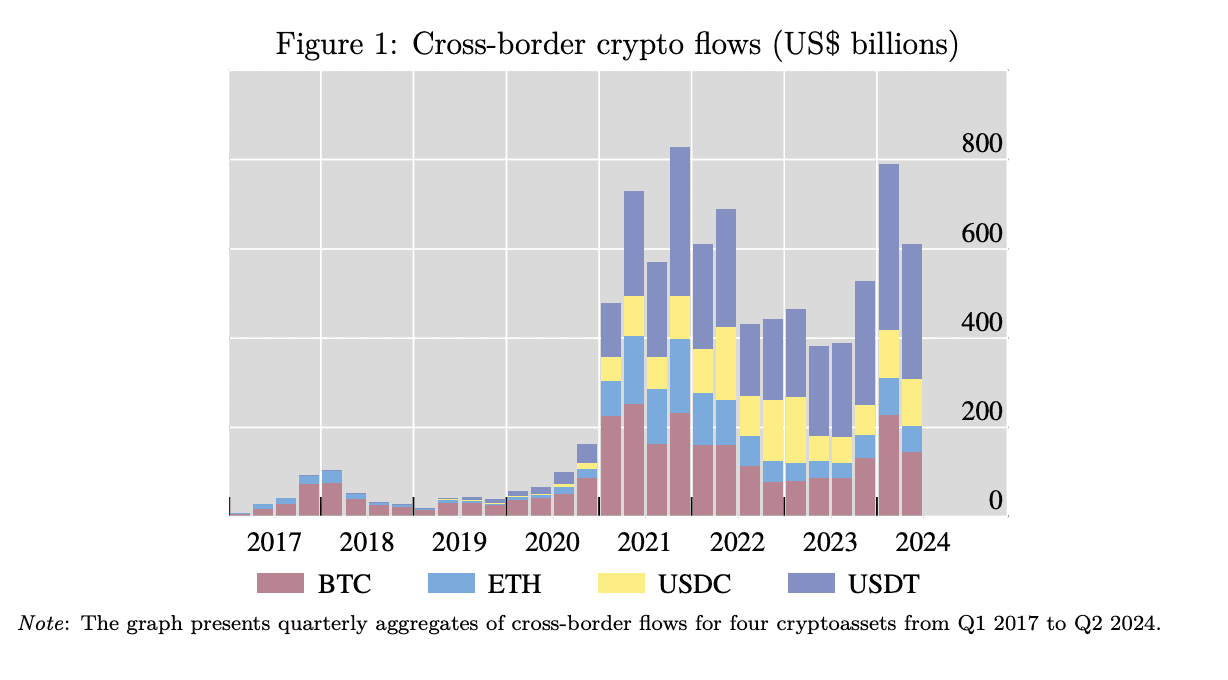

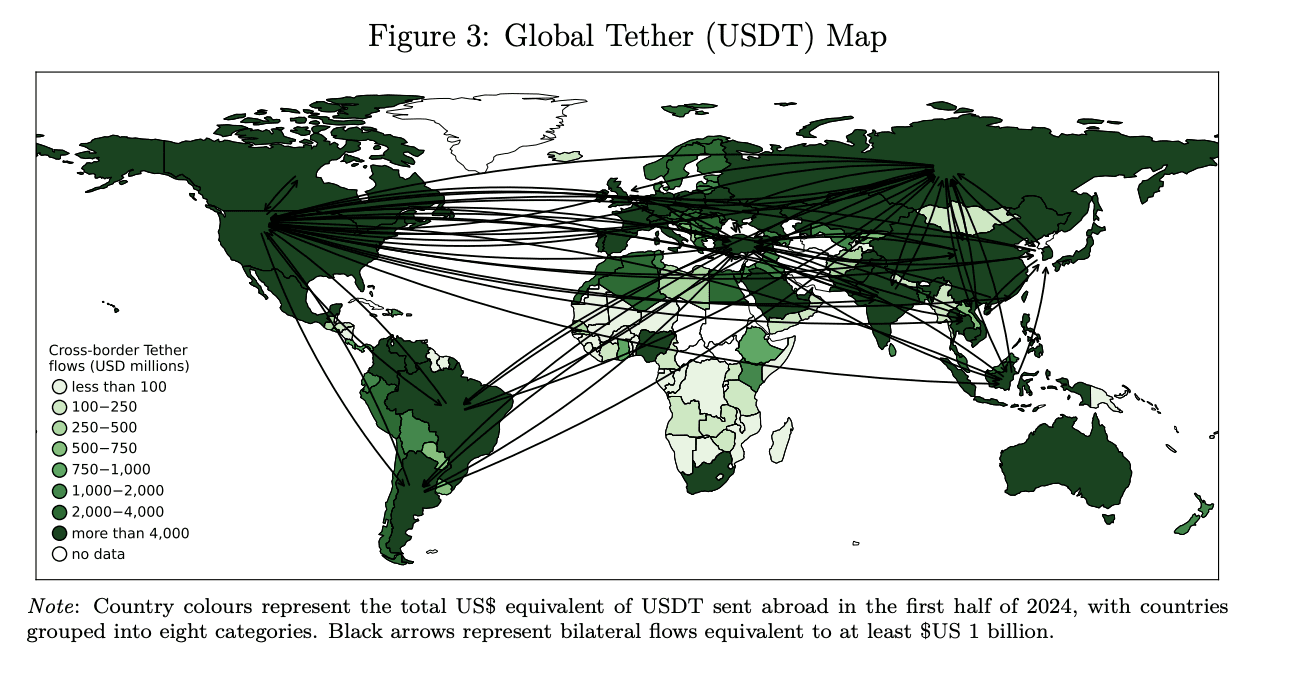

Utilizing information from crypto exchanges and app utilization patterns, the BIS mapped cross-border transactions of Bitcoin, Ethereum, USDT, and USDC from 2017 to mid-2024. Cross-border crypto flows skyrocketed from underneath $7 billion in Q1 2017 to over $800 billion in This fall 2021, earlier than falling to round $400 billion in 2022 throughout a crypto market droop. Nonetheless, they rebounded to roughly $600 billion by Q2 2024.

At first, Bitcoin made up about 80% of these funds. Now that quantity is under 25%, with extra individuals turning to stablecoins. This shift doesn’t imply Bitcoin is much less helpful—it simply reveals that individuals are selecting completely different instruments for various wants.

Crypto Use Is About Want, Not The place You Dwell

Not like common banks, Bitcoin use doesn’t rely a lot on the place you reside or what language you converse. The report says individuals use it when they should, not simply because it’s common. Additionally, when world monetary stress goes up—measured by issues just like the VIX (a market worry index)—Bitcoin use additionally goes up. This reveals that even buyers and companies use crypto extra throughout unsure occasions.