Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

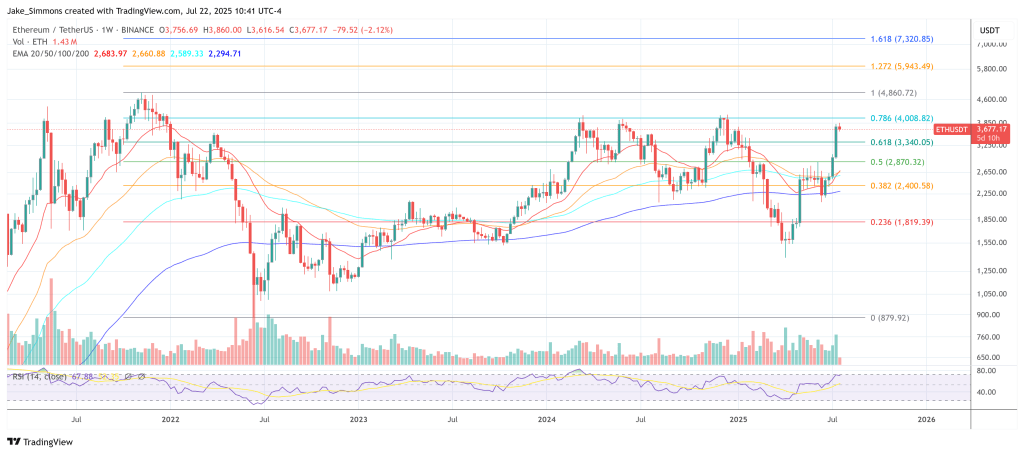

In a recent put up to X on 21 July, long-time cryptoc sceptic and gold advocate Peter Schiff urged holders of Ethereum (ETH) to exit whereas costs hover “close to the higher finish of its buying and selling vary.” “For those who personal any, it is a nice time to promote,” he wrote, including that—painful although it was for him to confess—flipping the proceeds into Bitcoin “is a greater commerce than holding Ether.”

Promote Ethereum, Purchase Bitcoin

Schiff doubled down when quizzed by followers. “It’s not [better] so far as I’m involved. I’m simply wanting on the charts,” he replied, arguing that Ethereum’s narrative faces “extra acknowledged competitors” than Bitcoin’s digital-gold storyline.

At pixel time Ether modifications arms at roughly $3,650 whereas Bitcoin trades simply above $118,000, placing the ETH/BTC ratio close to 0.031—towards the decrease half of its five-year vary.

Associated Studying

Schiff contends the ratio’s weak point displays a structural bear marketplace for Ether towards Bitcoin. “I believe Ether is in a bear market when it comes to Bitcoin, and I believe it simply had a bear-market rally,” he instructed one consumer who pressed him for fundamentals, concluding: “So if you wish to personal crypto, promoting Ether to purchase Bitcoin is sensible.”

Not everybody was persuaded. Veteran cycle watcher TechDev responded drily, “Thanks in your service sir,” reposting Schiff’s February “occasion is over” name that preceded Bitcoin’s spring rally.

A Acquainted Chorus—And A well-known Final result

Schiff’s newest chart-based admonition follows a string of bearish milestones which have mis-timed each main leg of Bitcoin’s secular advance. On 25 February he declared, “End up the lights, the #Bitcoin 100K occasion is over… the bear market is simply getting began.” Lower than 5 months later, Bitcoin nonetheless hovers comfortably above $118,000.

Associated Studying

Solely a month after that February warning he predicted a full-blown crash to $10,000 as soon as gold reaches $5,000, reasoning that Bitcoin would capitulate “95 % from its 2021 peak.” In late 2023 he ran a Twitter ballot and concluded—opposite to the vote—that Bitcoin would “crash earlier than the ETF launch.” Spot ETFs have been authorized in January 2024; Bitcoin by no means seemed again.

Again in November 2018, with Bitcoin buying and selling at $3,800, he insisted it might “simply drop one other 80 % from right here, and at $750 it will nonetheless be costly.” The remaining is historical past.

Now, Schiff argues that Ethereum’s smart-contract dominance is eroding as Layer-1 rivals acquire mind-share and as regulators inch towards approving different altcoin spot ETFs.

Whether or not the newest name joins the rising archive of ill-timed bearishness will activate the ETH/BTC cross. If altcoin rotation doesn’t proceed, Schiff might lastly chalk up a win; if the ratio rolls over, his chart-reading case for a relative commerce into Bitcoin shall be vindicated whilst his absolute bear thesis stays unproven. For now, the market is reserving judgment.

At press time, Ether traded at $3,677.

Featured picture created with DALL.E, chart from TradingView.com