Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

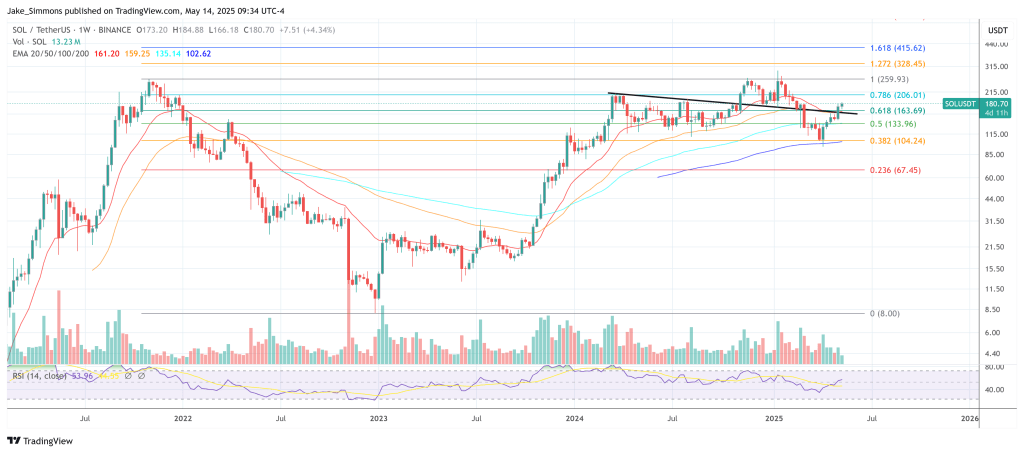

Solana’s native token is extending a formidable Could run that has already carried the market-cap chief amongst non-EVM smart-contract platforms from $146 on the finish of April to as excessive as $18” in Wednesday buying and selling, the very best day by day shut recorded since mid-February.

Towards that backdrop, unbiased analyst Extra Crypto On-line (MCO) launched a recent video update outlining why the transfer is technically “very full however not essentially overextended or overstretched.” Within the clip, MCO reiterates that the advance from the 30 April swing low traces out “a five-wave sample” and stresses that, as a result of “there was no confirmed prime, another excessive was nonetheless possible particularly so long as this micro-support space held.” The micro zone he referenced earlier within the week lay between $159.67 and $168.23, a spread Solana examined briefly earlier than powering greater.

Solana Might Surge To $360

Zooming in, the channel’s Elliott-wave depend now reveals 5 clear waves even on what MCO calls “the nano stage,” a configuration that, in classical wave principle, usually finishes both an impulsive first wave or the terminating leg of a diagonal.

“If it’s a five-wave transfer, it may be a so-called A-wave,” the analyst explains, which might “lead to a B-wave, ideally the next low, after which a C-wave up.” The choice—and MCO’s most popular state of affairs—treats the construction as wave 1 of a a lot bigger impulse that would in the end “simply get to $360 or greater.”

Associated Studying

For merchants making an attempt to calibrate danger within the close to time period, MCO isolates two numbers that matter most. On the upside he names $191.25 as “the subsequent upside stage to look at,” describing it because the 61.8 p.c extension of waves 1 and three—a textbook Fibonacci goal for a fifth wave.

On the downside he warns that “it takes a break under $172, which is the final swing low, to point {that a} worth prime has fashioned in wave 1.” In a follow-up submit on X he put it much more succinctly: “fifth wave to the upside is confirmed. $191.25 is the subsequent upside stage to look at … it takes a break under $172 … to point {that a} worth prime has fashioned.”

Associated Studying

A clear, high-volume break of $191.25 would affirm that the quick corrective danger has been deferred; a decisive day by day shut beneath $172 would as an alternative sign that the primary leg of the brand new advance has exhausted itself and {that a} retracement towards the upper-$160s and even the mid-$150s is underway.

As ever, merchants ought to do not forget that Elliott-wave projections are probabilistic somewhat than predictive. With volatility traditionally elevated in Solana, place sizing—alongside a transparent plan for the 2 technical ranges singled out in at this time’s evaluation—stays the primary line of defence.

At press time, SOL traded at $180.

Featured picture created with DALL.E, chart from TradingView.com