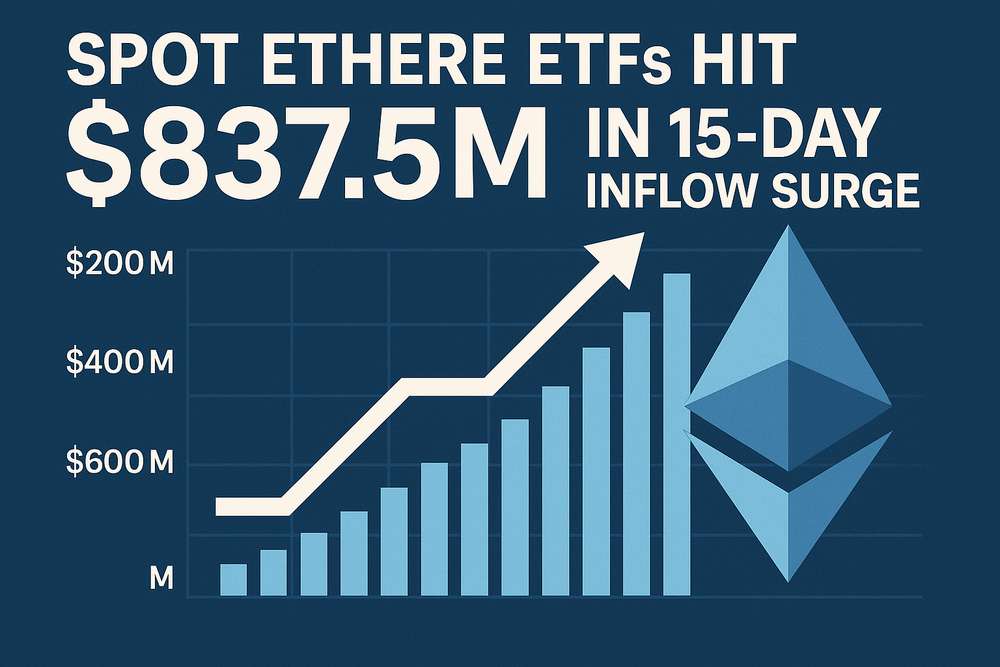

Spot Ethereum exchange-traded funds (ETFs) have recorded $837.5 million in internet inflows over a 15-day streak, marking some of the sustained durations of institutional demand for ETH-based merchandise since their launch. This surge brings whole year-to-date inflows for Ethereum ETFs above $3 billion, in accordance with information from Farside Buyers.

The influx streak started on Could 16 amid Ethereum’s value consolidation between $2,500 and $2,650. Funding advisors and hedge funds drove the momentum, with BlackRock’s iShares Ethereum Belief (ETHA) capturing 71% of the latest inflows. For real-time monitoring of institutional crypto actions, comply with Bloomberg’s ETF dashboard.

BlackRock Dominates Ethereum ETF Race

BlackRock’s ETHA has absorbed $576 million in the course of the 15-day interval, extending its cumulative internet flows to $4.8 billion. The fund now holds 298,000 ETH, representing practically 30% of all institutional Ethereum holdings by ETFs.

Constancy’s Regular Progress

Constancy’s Sensible Origin Ether Fund (FETH) secured second place with $123 million in inflows, although its $1.5 billion cumulative whole trails far behind BlackRock. The fund’s decrease payment construction (0.25%) in comparison with ETHA’s 0.30% has but to disrupt the market chief’s place.

Grayscale’s Paradoxical Efficiency

Whereas Grayscale’s Ethereum Belief (ETHE) suffered $4.3 billion in outflows year-to-date, its Ethereum Mini Belief attracted $688 million. This divergence highlights traders’ choice for cost-efficient merchandise, because the Mini Belief costs 0.25% versus ETHE’s 1.5% payment.

| ETF | 15-Day Inflows | Cumulative Flows |

|---|---|---|

| BlackRock ETHA | $576M | $4.8B |

| Constancy FETH | $123M | $1.5B |

| 21Shares CETH | $4.2M | $19.5M |

The Could 22 single-day influx file of $110.5 million underscores rising confidence in Ethereum’s regulatory positioning. Analysts attribute this to the SEC’s latest clarification on staking provisions in ETF constructions.

Market impression: Sustained ETF demand may alleviate promoting strain from Ethereum’s upcoming community upgrades. Nevertheless, merchants stay cautious as Bitcoin ETFs expertise simultaneous outflows tied to macroeconomic uncertainties.

Set up Coin Push cell app to get worthwhile crypto alerts. Coin Push sends well timed notifications – so that you don’t miss any main market actions.

- ETF

- Change-Traded Fund: A regulated funding car monitoring asset costs, traded on conventional inventory exchanges.

- Internet Inflows

- The web quantity of capital getting into a monetary product, calculated as whole deposits minus withdrawals.

- Spot Market

- A market for instant supply of belongings, versus futures contracts for later settlement.

This text is for informational functions solely and doesn’t represent monetary recommendation. Please conduct your personal analysis earlier than making any funding selections.

Be happy to “borrow” this text — simply don’t overlook to hyperlink again to the unique.