The False Gatekeepers

Cryptocurrency was designed to bypass middlemen. But in 2025, exchanges have change into the brand new gatekeepers — controlling which cash get liquidity, quantity, and visibility. Their bias is clear: they record closely pre-mined tasks, ICO tokens, and centralized Proof-of-Stake schemes as a result of these tasks pay itemizing charges, funnel insider provide, and reward the change with management.

In doing so, exchanges betray the unique ethos of Bitcoin — impartial, permissionless, commodity-like cash secured solely by work.

The Misplaced Commodity Benefit

The best authorized benefit in crypto in the present day is being a commodity-class asset. Bitcoin already holds that standing, and Litecoin ETFs validated the identical lineage. Dogecoin, too, rides this wave. These cash — truthful launched, mined, distributed with out insider allocation — are usually not securities. They’re digital commodities.

However exchanges have blurred this actuality. As a substitute of elevating pure Proof-of-Work cash, they flood the market with pre-mined, ICO-issued, foundation-controlled tokens — property that can by no means move regulatory muster as commodities. Of their chase for itemizing charges, they’ve poisoned the properly.

The 5 Forgotten Commodities

On this corruption, solely a handful of pure PoW property stay. They aren’t extensively promoted by exchanges, as a result of they don’t include insider treasuries or centralized entities to chop offers.

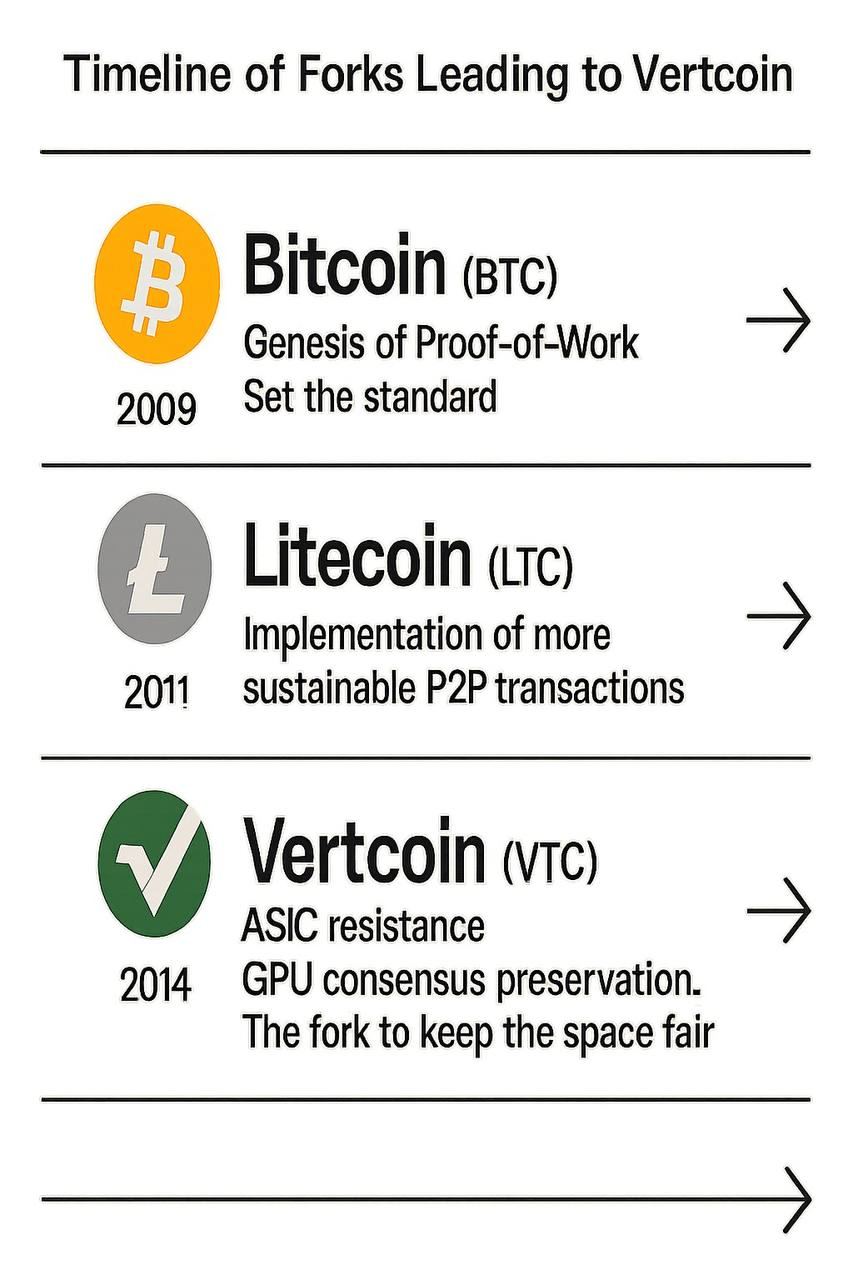

• Bitcoin (BTC) — Launched January 2009

• Litecoin (LTC) — Launched October 2011

• Dogecoin (DOGE) — Launched December 2013

• Vertcoin (VTC) — Launched January 2014

• Ravencoin (RVN) — Launched January 2018

These 5 are the true digital commodities. They launched pretty, with no ICO, no premine, no basis dictating governance. And but, exchanges constantly sideline them.

The Quiet Narrative

Exchanges need controllable tokens. Regulators need commodities. That contradiction is about to blow up.

And when it does, the cash that survived with out ICOs, pre-mines, or centralization would be the solely protected harbors.

The irony? Exchanges have ignored them for years. Vertcoin, Ravencoin, even Litecoin earlier than the ETFs — all sidelined as a result of they couldn’t be milked for insider provide.

When the commodity narrative dominates, exchanges will scramble to record the very property they as soon as ignored — as a result of they’ll haven’t any different possibility if they need compliant, enduring liquidity.

Why Vertcoin Stands Out

Vertcoin is exclusive. It was constructed to withstand ASIC management, making certain mining stays open to the folks. It had no ICO, no premine, no insiders. It sits instantly in Bitcoin’s commodity lineage. And it is among the solely remaining Proof-of-Work property not but embraced by the exchanges.

That silence is its benefit. Vertcoin isn’t diluted by basis wars, staking centralization, or insider video games. It’s a folks’s chain ready for the inevitable second when commodity purity turns into the one itemizing path left.

Powstrat.com

Vert.win

Vertcoin.org