Bitcoin has been fighting decrease lows in latest weeks, leaving many traders questioning whether or not the asset is on the point of a serious bear cycle. Nevertheless, a uncommon information level tied to the US Greenback Power Index (DXY) suggests {that a} vital shift in market dynamics could also be imminent. This bitcoin purchase sign, which has solely appeared 3 times in BTC’s historical past, may level to a bullish reversal regardless of the present bearish sentiment.

For a extra in-depth look into this matter, take a look at a latest YouTube video right here:

Bitcoin: This Had Only Ever Happened 3x Before

BTC vs DXY Inverse Relationship

Bitcoin’s value motion has lengthy been inversely correlated with the US Dollar Strength Index (DXY). Traditionally, when the DXY strengthens, BTC tends to wrestle, whereas a declining DXY typically creates favorable macroeconomic circumstances for Bitcoin value appreciation.

Regardless of this traditionally bullish affect, Bitcoin’s price has continued to retreat, just lately dropping from over $100,000 to beneath $80,000. Nevertheless, previous occurrences of this uncommon DXY retracement counsel {that a} delayed however significant BTC rebound may nonetheless be in play.

Bitcoin Purchase Sign Historic Occurrences

At present, the DXY has been in a pointy decline, a lower of over 3.4% inside a single week, a fee of change that has solely been noticed 3 times in Bitcoin’s whole buying and selling historical past.

To grasp the potential influence of this DXY sign, let’s look at the three prior cases when this sharp decline within the US greenback power index occurred:

- 2015 Publish-Bear Market Backside

The primary incidence was after BTC’s value had bottomed out in 2015. Following a interval of sideways consolidation, BTC’s value skilled a big upward surge, gaining over 200% inside months.

The second occasion occurred in early 2020, following the sharp market collapse triggered by the COVID-19 pandemic. Just like the 2015 case, BTC initially skilled uneven value motion earlier than a fast upward pattern emerged, culminating in a multi-month rally.

- 2022 Bear Market Restoration

The newest occasion occurred on the finish of the 2022 bear market. After an preliminary interval of value stabilization, BTC adopted with a sustained restoration, climbing to considerably increased costs and kicking off the present bull cycle over the next months.

In every case, the sharp decline within the DXY was adopted by a consolidation section earlier than BTC launched into a big bullish run. Overlaying the worth motion of those three cases onto our present value motion we get an thought of how issues may play out within the close to future.

Fairness Markets Correlation

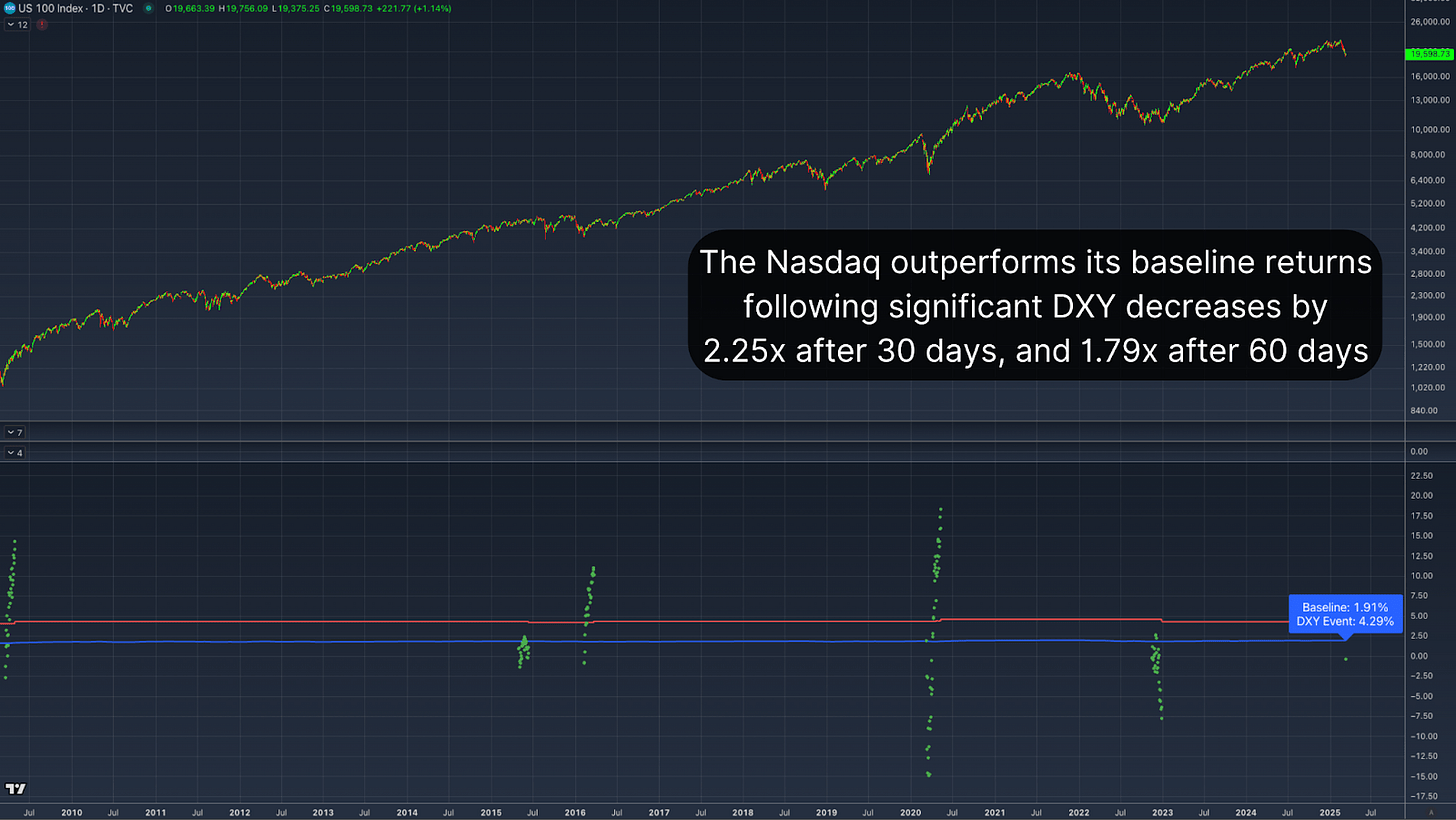

Apparently, this sample isn’t restricted to Bitcoin. The same relationship may be noticed in conventional markets, notably within the Nasdaq and the S&P 500. When the DXY retraces sharply, fairness markets have traditionally outperformed their baseline returns.

The all-time common 30-day return for the Nasdaq following an analogous DXY decline stands at 4.29%, properly above the usual 30-day return of 1.91%. Extending the window to 60 days, the Nasdaq’s common return will increase to almost 7%, practically doubling the standard efficiency of three.88%. This correlation means that Bitcoin’s efficiency following a pointy DXY retracement aligns with historic broader market tendencies, reinforcing the argument for a delayed however inevitable constructive response.

Conclusion

The present decline within the US Greenback Power Index represents a uncommon and traditionally bullish Bitcoin purchase sign. Though BTC’s fast value motion stays weak, historic precedents counsel {that a} interval of consolidation will seemingly be adopted by a big rally. Particularly when bolstered by observing the identical response in indexes such because the Nasdaq and S&P 500, the broader macroeconomic surroundings is organising favorably for BTC.

Discover dwell information, charts, indicators, and in-depth analysis to remain forward of Bitcoin’s value motion at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding choices.