Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tom Lee devoted a six-post thread on X yesterday to a single proposition: if corporations deal with Ethereum (ETH) the best way MicroStrategy treats bitcoin, the token worth want solely observe the arithmetic of balance-sheet absorption to achieve roughly $30,000. Lee’s argument rests on the mechanics he says actually powered MicroStrategy’s spectacular fairness rerating. From 11 August 2020 by means of at present the software program firm’s shares climbed from $13 to about $455, a 35-fold acquire. Solely eleven of these thirty-five turns got here from bitcoin’s personal rise—roughly $11,000 to $118,000 in the identical interval—whereas twenty-five turns have been created by “treasury technique,” Lee wrote, which means repeated financings that elevated BTC per share even quicker than the coin’s spot worth.

Ethereum To $30,000?

Lee lists three strikes that made the template work and, in his view, shall be much more potent for ETH: issuing new inventory above net-asset worth to accumulate extra tokens, exploiting token volatility to decrease borrowing prices, and counting on convertibles or most popular shares to cap dilution. As a result of ether’s realised volatility nonetheless exceeds bitcoin’s, Lee argues the price of debt-and-option buildings used to lever the treasury will be pushed decrease nonetheless, accelerating token accumulation.

Associated Studying

In the identical thread he reposted a chart displaying that his personal automobile, BitMine Immersion Technologies, bought 4 occasions extra notional worth in its first week of exercise ($1 billion in ETH) than MicroStrategy purchased in its first week of bitcoin purchases again in 2020.

BitMine’s numbers illustrate the size. A regulatory submitting and follow-up press launch on 17 July confirmed the corporate now holds 300,657 ETH—simply over $1 billion on the time of publication—after closing a $250 million personal placement on 8 July. Lee, who chairs BitMine’s board, mentioned the agency is “effectively on our option to buying and staking 5 per cent of the general ETH provide.”

The second-largest treasurer is SharpLink Gaming, chaired by Ethereum co-founder Joseph Lubin. On 17 July the corporate up to date its SEC prospectus to extend the inventory it may possibly promote from $1 billion to $6 billion, saying proceeds will fund extra ETH purchases. SharpLink had already raised $413 million between 7 and 11 July and disclosed 280,706 ETH on its books as of 13 July, all however a couple of hundred of that are staked for yield.

Associated Studying

Bit Digital rounds out the trio. After a $172 million underwritten share sale on 7 July and the liquidation of 280 bitcoin, the Nasdaq-listed miner reported a treasury of 100,603 ETH and declared its intention to grow to be “the pre-eminent ETH holding firm on the planet,” in accordance with chief government Sam Tabar.

Taken collectively, the three companies now management roughly 682,000 ETH, or about half a per cent of the circulating provide, and every has lively authorisations to concern extra fairness or debt expressly for ether accumulation. Lee insists the reflexive loop this creates—increased share costs offering ever-cheaper capital that buys nonetheless extra token per share—can compress the time it takes for worth to seize shortage.

Crypto analyst DCInvestor, responding to Lee’s thread, distilled the arithmetic into a variety: “Tom Lee mainly calling for like $30-80K ETH. And a few of you assume we’re gonna cease $1-2K after final cycle’s all-time excessive.”

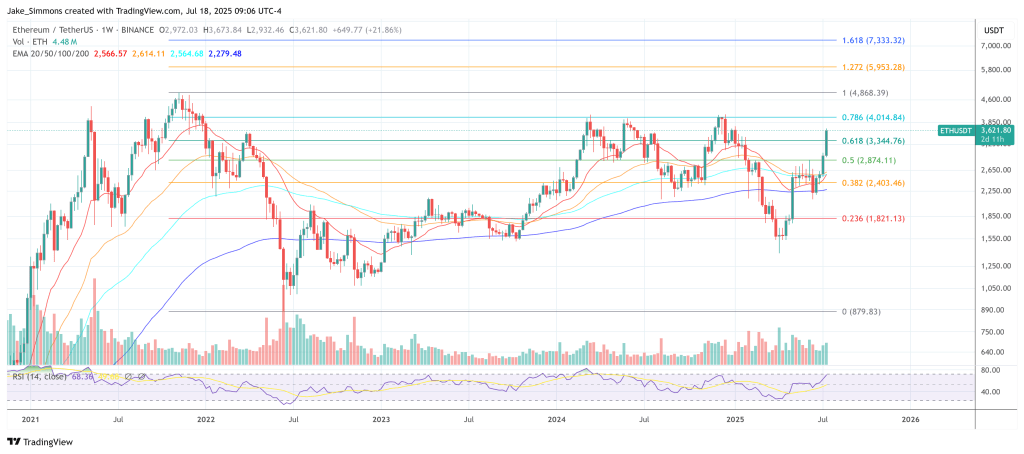

Ether adjustments fingers at present close to $3,600. An eight-fold transfer to $30,000 would merely replicate the a number of that bitcoin logged between MicroStrategy’s first treasury buy and its 2021 peak. The distinction, Lee argues, is that MicroStrategy spent 4 years proving the mannequin; Ethereum treasuries have taken lower than two months to lift their first few billion {dollars}.

Featured picture created with DALL.E, chart from TradingView.com