Ethereum has soared to a multi-year excessive, touching the $4,330 stage — its highest value since November 2021. This milestone not solely reinforces ETH’s dominant place within the crypto market but in addition marks the return of co-founder Vitalik Buterin to billionaire standing, along with his publicly recognized wallets now valued above the billion-dollar mark.

Since April, Ethereum has delivered a staggering achieve of over 200%, outpacing most main cryptocurrencies and reigniting bullish sentiment throughout the market. Analysts attribute the rally to robust fundamentals, together with growing adoption in decentralized finance (DeFi), the speedy progress of layer-2 scaling options, and rising institutional curiosity.

The rally comes amid tightening provide dynamics, with change balances dropping to multi-year lows, suggesting that long-term holders and institutional gamers are accumulating aggressively. On-chain information factors to sustained community exercise and increasing use instances, including gas to the bullish outlook.

Buterin’s Holdings Cross $1B As Ethereum Rally Beneficial properties Momentum

Based on blockchain analytics platform Arkham Intelligence, Buterin holds roughly 240,000 ETH, alongside different digital property reminiscent of MOODENG and DINU. At present market costs, his ETH holdings alone are value round $1 billion, cementing his standing as one of many wealthiest figures in crypto — not less than on-chain.

The surge in ETH’s value comes after a sequence of risky strikes earlier this 12 months that left some questioning the sustainability of the rally. Nonetheless, the newest breakout above $4,300 suggests robust underlying momentum. Institutional adoption is taking part in a vital position, with public corporations like Sharplink Gaming including Ethereum to their steadiness sheets as a part of their treasury technique. This marks a notable shift in company crypto allocation traits, the place ETH is more and more seen not simply as a speculative asset however as a core long-term holding.

With on-chain information pointing to sturdy community exercise, the supply-demand dynamics seem favorable for continued beneficial properties. As establishments, public corporations, and long-term holders proceed to build up, Ethereum’s bullish narrative stays intact — and Buterin’s billion-dollar stake is now using the wave.

Ethereum Worth Evaluation: Breakout To Multi-12 months Highs

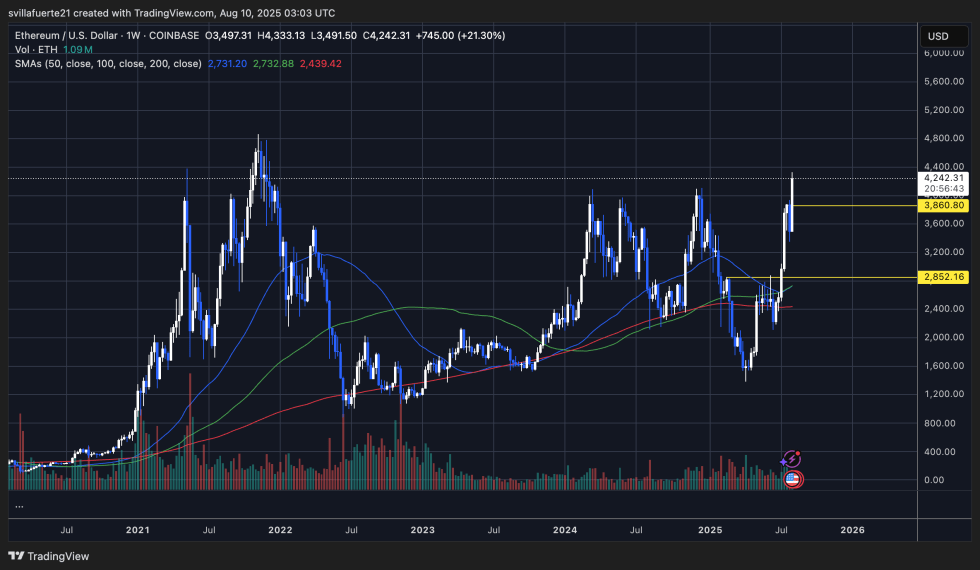

Ethereum (ETH) has surged to $4,242, marking its highest stage since November 2021 and confirming a serious breakout on the weekly chart. The rally, pushed by robust bullish momentum, noticed ETH climb over 21% previously week, decisively breaking by way of the $3,860 resistance stage that had capped value advances earlier within the 12 months.

The breakout is supported by rising quantity, signaling sturdy shopping for curiosity. ETH is now buying and selling effectively above its 50-, 100-, and 200-week transferring averages, that are all sloping upward — a basic signal of a powerful uptrend. This alignment means that the medium- to long-term pattern stays firmly bullish.

If momentum continues, the subsequent vital goal lies close to the $4,800–$4,900 vary, aligning with the earlier all-time highs. Nonetheless, after such a steep transfer, short-term consolidation is feasible, with $3,860 now performing as a key assist stage. A deeper pullback may retest $2,852, however this situation would possible require a broader market correction.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.