Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana has returned to the highlight as hypothesis round a possible Solana ETF approval good points momentum. Whereas nonetheless unconfirmed, rising indicators from market insiders counsel that regulatory inexperienced lights might not be far off. If accredited, a Solana ETF would mark a serious milestone for the ecosystem, opening the door to conventional capital flows and broader institutional publicity, much like what Bitcoin and Ethereum skilled following their very own ETF breakthroughs. For long-term buyers, this improvement may set the inspiration for a brand new part of sustainable development.

Associated Studying

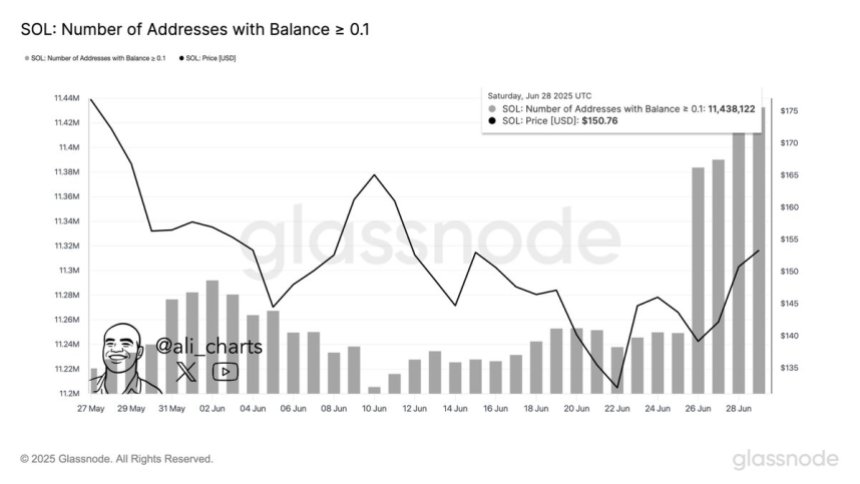

Supporting this bullish outlook is recent knowledge from Glassnode, which reveals that the variety of wallets holding over 0.1 SOL has reached a brand new all-time excessive. This milestone marks a rise in retail participation and rising confidence in Solana’s long-term potential. Because the community continues to mature, the rise in small holders additionally indicators increasing grassroots adoption—an encouraging signal throughout a interval of market uncertainty.

Whereas short-term price action should still be pushed by broader macro traits, sentiment round Solana is clearly enhancing. If ETF approval turns into a actuality, the mixture of elevated accessibility and rising on-chain adoption may considerably increase Solana’s market place within the coming months.

Solana Rising On-Chain Adoption

Solana is presently buying and selling beneath the $150 mark after experiencing a pointy retracement from its Could excessive. The asset has misplaced greater than 20% in worth since peaking earlier this cycle, pushed largely by broader market consolidation and declining danger urge for food throughout altcoins. Regardless of the latest pullback, SOL continues to carry a powerful assist zone close to the $135–$140 vary, which has confirmed resilient throughout earlier sell-offs.

Analysts stay cautiously optimistic, noting {that a} sustained push above key provide zones—notably the $155–$165 vary—may reignite bullish momentum. Nonetheless, the market stays in a part of indecision. Value motion throughout main property, together with Solana, displays uncertainty as merchants await a transparent breakout or breakdown to verify the subsequent transfer. With no sturdy catalyst, SOL could proceed to consolidate alongside the broader altcoin market.

Amid the sideways worth motion, one encouraging sign is the rising on-chain adoption. High analyst Ali Martinez shared data from Glassnode exhibiting that the variety of wallets holding over 0.1 SOL has reached a brand new all-time excessive, now exceeding 11.44 million. This regular rise in non-zero wallets factors to increasing retail participation and long-term holder confidence, at the same time as short-term volatility persists.

The divergence between worth motion and consumer adoption means that Solana’s elementary development stays intact. If momentum returns and macro situations enhance, Solana could also be well-positioned for a breakout, particularly with ETF rumors fueling speculative curiosity. For now, the $150 stage stays a psychological pivot because the market watches for indicators of route.

Associated Studying

SOL Value Motion Particulars: Key Ranges To Watch

Solana (SOL) is presently buying and selling at $149.30, slightly below the important thing resistance confluence of the 50-day, 100-day, and 200-day shifting averages, all clustered between $150 and $151. This space has acted as a powerful technical barrier, and SOL’s repeated failure to reclaim it displays the market’s hesitancy amid broader uncertainty. After rallying to $159.99 earlier within the session, bears stepped in and pushed the value again down, closing the candle with a bearish wick, signaling ongoing promoting stress.

The chart reveals a protracted consolidation sample that has developed for the reason that mid-Could rejection close to $180. Regardless of a number of bounce makes an attempt, SOL has not been capable of regain bullish momentum. The amount profile additionally suggests fading curiosity throughout upswings, a standard trait throughout accumulation or exhaustion phases. Notably, worth stays above the March low, preserving a key larger low construction, which is essential for the broader bullish outlook.

Associated Studying

If SOL breaks above the $151–$155 vary with sustained quantity, it may set off a transfer towards $180. Nonetheless, failure to clear this resistance would possibly result in one other take a look at of assist round $135. Merchants ought to look ahead to a decisive shut above the shifting common cluster to verify pattern continuation, particularly with ETF hypothesis fueling long-term optimism.

Featured picture from Dall-E, chart from TradingView