Have you ever ever traded crypto on a decentralized change and questioned the place the tokens come from? Effectively, the reply lies in liquidity swimming pools. However what are liquidity swimming pools, precisely?

They’re the engine behind most DeFi protocols, quietly enabling thousands and thousands of token swaps day by day. By locking digital belongings into sensible contracts, liquidity swimming pools take away the necessity for conventional order books and middlemen. They let anybody, anyplace, commerce immediately—and provides some customers the prospect to earn passive earnings by offering the liquidity others depend on. This information will stroll you thru how liquidity swimming pools work, why they matter, and how one can begin utilizing them.

What Is a Liquidity Pool?

A liquidity pool is a digital assortment of cryptocurrency locked in a smart contract. It’s used to allow buying and selling on decentralized exchanges (DEXs) like Uniswap or Curve, the place there’s no intermediary to match patrons and sellers.

Consider a liquidity pool like a merchandising machine. You inventory it with snacks (cryptocurrencies) so individuals can come by and make trades. The extra snacks obtainable, the smoother the method. On this setup, liquidity suppliers are those who inventory the machine. They supply liquidity by depositing two sorts of tokens right into a pool—for instance, ETH and USDC.

When somebody makes a commerce utilizing the pool, they pay buying and selling charges. These charges go on to the liquidity suppliers as a reward. This method retains the pool stuffed and functioning.

Liquidity swimming pools are important in decentralized finance (DeFi). Since there’s no centralized order e book or market maker, the pool itself permits customers to swap tokens immediately. That’s what makes decentralized exchanges work with no need a conventional dealer.

Learn extra: Decentralized vs. centralized exchanges.

What Is The Objective of a Liquidity Pool?

A liquidity pool ensures you could commerce crypto anytime with no need a purchaser or vendor on the opposite facet. It retains markets liquid, even when exercise is low, and prevents worth slippage throughout trades. In return for offering liquidity, customers earn rewards like buying and selling charges and incentives. This creates a self-sustaining system that fuels almost each a part of the DeFi ecosystem.

These swimming pools additionally allow automated pricing via algorithms, changing human market makers. This enables decentralized exchanges to operate with out centralized management.

Past buying and selling, liquidity swimming pools energy key DeFi companies like lending, yield farming, artificial belongings, and cross-chain bridges. They maintain and distribute worth routinely primarily based on sensible contracts.

How Liquidity Swimming pools Work

Liquidity swimming pools energy decentralized buying and selling by eradicating the necessity for conventional patrons and sellers. As an alternative of ready for somebody to match your order, you commerce immediately towards a pool of tokens locked in a sensible contract. Let’s check out how crypto liquidity swimming pools work.

Token Pairs & Pool Creation

Each liquidity pool begins with a buying and selling pair. It is a mixture of two tokens that customers can swap between—for instance, ETH and USDC. You, as a liquidity supplier, deposit equal values of each tokens into the pool. This course of is named liquidity provision.

As soon as the pool is created, customers can begin swapping one token for one more. The pool holds the reserves and executes trades routinely utilizing sensible contracts. No centralized entity or order e book is concerned.

Liquidity Suppliers (LPs)

Liquidity suppliers (LPs) are customers who fund these swimming pools with their tokens. Once you present liquidity, you obtain LP tokens in return. These signify your share within the pool and provide the proper to say a portion of the buying and selling charges.

As trades occur, the pool costs a small payment—usually round 0.3%. This payment is distributed amongst LPs in proportion to their contribution. This is among the main methods to earn passive earnings in decentralized finance.

Some platforms additionally supply additional incentives via liquidity mining. This implies you earn further tokens—usually the platform’s native cryptocurrency—on high of buying and selling charges.

Automated Market Makers (AMMs)

On the core of each liquidity pool is an Automated Market Maker (AMM). That is the algorithm that units token costs contained in the pool. It replaces the necessity for human market makers.

The most typical AMM mannequin is the fixed product components:

x * y = okay, the place x and y are token reserves and okay is fixed. This ensures that the product of the token balances stays the identical after each commerce.

Once you commerce within the pool, the AMM adjusts costs routinely. The extra you attempt to purchase, the upper the worth goes—this mechanism is what allows real-time worth discovery.

Incomes from Charges & Incentives

Each time somebody makes use of the pool, they pay a buying and selling payment. These charges go on to LPs. The extra buying and selling quantity, the extra earnings you earn. On standard platforms like Uniswap, these charges can accumulate shortly.

Along with charges, many DeFi platforms supply liquidity mining packages. These are incentives paid in additional tokens to draw extra liquidity. You possibly can stake your LP tokens to earn rewards, boosting your complete returns.

By combining buying and selling charges and incentive rewards, liquidity swimming pools turn out to be a strong software for producing passive earnings in DeFi. However you will need to additionally contemplate dangers like impermanent loss, that are lined later within the article.

Sorts of Liquidity Swimming pools

Not all liquidity swimming pools serve the identical objective—listed below are the primary sorts.

Product Swimming pools

Product swimming pools are the most typical kind. They assist you to swap one token for one more primarily based on market demand. These swimming pools often comply with the normal automated market maker (AMM) mannequin, such because the fixed product components utilized by Uniswap. You’ll usually discover buying and selling pairs like ETH/USDC, WBTC/DAI, or different token combos. These swimming pools exist primarily to help token buying and selling with out centralized intermediaries. They’re the spine of decentralized exchanges.

As a result of these swimming pools help a variety of tokens, they will expertise greater worth volatility, particularly in illiquid markets. You earn charges from each commerce, however you’re additionally uncovered to impermanent loss if costs shift considerably.

Stablecoin Swimming pools

Stablecoin swimming pools include tokens which might be designed to keep up a set worth, often pegged to fiat currencies just like the US greenback. Examples embody USDC, DAI, and USDT. These swimming pools use optimized AMMs like Curve’s StableSwap algorithm, which permits low-slippage trades. The diminished volatility makes stablecoin swimming pools splendid for minimizing impermanent loss.

This sort of pool can be important in cross-platform lending protocols, collateral swaps, and yield farming methods. As costs don’t fluctuate a lot, they’re usually thought of safer entry factors for brand spanking new liquidity suppliers.

Sensible Swimming pools

Sensible swimming pools are programmable liquidity swimming pools ruled by sensible contracts. Not like common swimming pools, sensible swimming pools enable customized parameters—corresponding to dynamic weights, automated rebalancing, or time-based rewards. Platforms like Balancer help sensible swimming pools, the place you possibly can outline how a lot of every token to carry or how the pool ought to react to market adjustments. This flexibility attracts superior customers and algorithmic merchants.

Sensible swimming pools are splendid if you want exact management over how decentralized liquidity is managed. Nonetheless, they require a strong understanding of sensible contract logic to keep away from surprising outcomes.

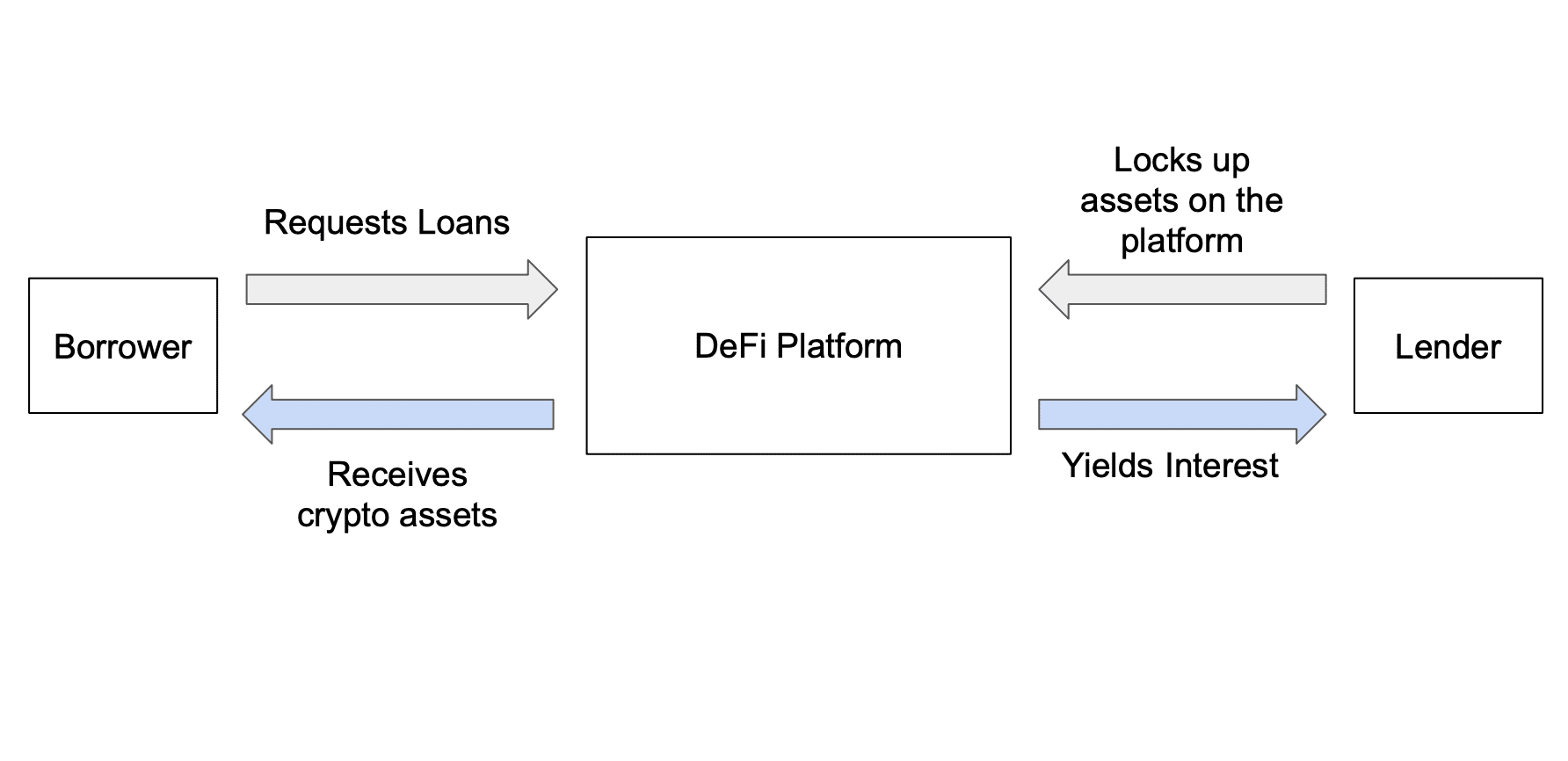

Lending Swimming pools

Lending swimming pools are utilized in decentralized lending protocols like Aave or Compound. These swimming pools don’t help direct token swaps. As an alternative, customers deposit belongings so others can borrow them, often overcollateralized.

You earn passive earnings from curiosity paid by debtors. The pool routinely adjusts rates of interest primarily based on provide and demand. If there’s excessive demand to borrow an asset, rates of interest enhance, encouraging extra deposits. These swimming pools are important in DeFi’s credit score layer. They provide a decentralized different to conventional banking, with out intermediaries. However additionally they carry dangers if collateral values drop too quick throughout market volatility.

Algorithmic Swimming pools

Algorithmic swimming pools use dynamic fashions to handle liquidity and pricing. Not like fixed-formula AMMs, these swimming pools adapt in actual time to market situations.

Bancor’s v3 protocol and Curve’s metapools are examples. They’ll reweigh belongings, rebalance portfolios, or alter payment buildings primarily based on utilization information.

Algorithmic swimming pools are perfect for managing illiquid markets, the place token costs can swing dramatically. These swimming pools assist cut back slippage and enhance effectivity. Nonetheless, the complexity of the algorithms means extra technical threat, particularly if the code comprises bugs or exploits.

Key Advantages of Liquidity Swimming pools

- Decentralized buying and selling entry. You possibly can swap tokens with out counting on centralized exchanges or third events.

- 24/7 market liquidity. Liquidity swimming pools assist you to commerce anytime, even throughout low market exercise.

- Passive earnings technology. As a liquidity supplier, you earn from buying and selling charges and incentives from each transaction within the pool.

- Permissionless participation. Anybody can create or be a part of a liquidity pool with out going via an approval course of.

- Lowered reliance on order books. Automated market makers (AMMs) deal with pricing and buying and selling, eradicating the necessity for matching patrons and sellers.

- Helps DeFi infrastructure. Swimming pools are important for decentralized lending, borrowing, artificial belongings, and cross-chain swaps.

- Incentivizes ecosystem progress. Liquidity mining and token rewards appeal to customers and assist new protocols develop quicker.

- Environment friendly worth discovery. AMM algorithms reply immediately to market demand, maintaining costs up-to-date.

Develop into the neatest crypto fanatic within the room

Get the highest 50 crypto definitions it’s worthwhile to know within the trade without spending a dime

Dangers and Challenges

Liquidity swimming pools carry sure dangers that might affect your returns. The most typical is impermanent loss, which occurs when token costs shift, decreasing the worth of your deposit in comparison with merely holding the belongings. Sensible contract bugs are one other hazard. If the pool’s code is flawed or exploited, your funds might be misplaced completely. Smaller swimming pools additionally face low liquidity, making trades inefficient and rising slippage.

Rug pulls are an actual menace in unaudited tasks, the place builders can withdraw funds and disappear. Regulatory uncertainty provides extra threat, as altering legal guidelines could have an effect on how and the place you need to use DeFi platforms.

You may also face worth manipulation in low-volume swimming pools, particularly via flash loans. On high of that, fuel charges might be excessive throughout busy community durations, making participation expensive. For brand new customers, the complexity of those programs can result in expensive errors.

Widespread DeFi Platforms That Use Liquidity Swimming pools

- Uniswap. A number one decentralized change utilizing automated market makers for token swaps.

- Curve Finance. Optimized for stablecoin buying and selling with minimal slippage.

- Balancer. Permits customizable sensible swimming pools with versatile token ratios.

- SushiSwap. Neighborhood-driven DEX providing yield farming and liquidity incentives.

- Bancor. Options single-sided staking and built-in impermanent loss safety.

Yield Farming and Liquidity Swimming pools

Yield farming is a method to earn additional rewards on high of the charges you already earn from offering liquidity. Once you deposit tokens right into a liquidity pool, you obtain LP (liquidity supplier) tokens. Some platforms allow you to stake these LP tokens in a yield farm to earn bonus tokens—usually the platform’s native asset.

This method encourages extra customers so as to add liquidity, which retains swimming pools deep and buying and selling easy. In return, protocols reward you for serving to the ecosystem operate.

Yield farming is immediately tied to liquidity swimming pools—it’s merely the subsequent step after turning into a liquidity supplier. However with greater rewards come greater dangers, together with impermanent loss and sensible contract bugs. All the time analysis earlier than taking part.

How To Take part in Liquidity Swimming pools

Getting began with liquidity swimming pools is straightforward. Comply with these steps to affix and begin incomes rewards:

1. Select a DeFi platform

Decide a dependable platform like Uniswap, Curve, or Balancer. Search for tasks with good liquidity, energetic customers, and clear documentation.

2. Join your pockets

Use a crypto pockets like MetaMask or Belief Pockets. Ensure that it helps the blockchain the place the pool is hosted (e.g., Ethereum, Arbitrum, or BNB Chain).

3. Choose a buying and selling pair

Discover a pool you wish to be a part of. Most swimming pools require you to deposit two tokens in equal worth—like ETH and USDC.

4. Add your tokens

Deposit each tokens into the pool. The platform will calculate the precise quantities you want. After depositing, you’ll obtain LP tokens that signify your share within the pool.

5. Stake your LP tokens (non-compulsory)

Some platforms allow you to stake your LP tokens in a yield farm to earn additional rewards. This step is non-compulsory however can enhance your returns.

6. Earn charges and rewards

As trades occur within the pool, you earn a share of the buying and selling charges. When you’re staking LP tokens, you’ll additionally obtain farming incentives.

7. Withdraw anytime

You possibly can exit the pool everytime you need. Simply return your LP tokens to the platform, and also you’ll get again your share of the pool—plus any earnings.

Earlier than becoming a member of, all the time verify the dangers and perceive how the particular pool works. Select well-established platforms to keep away from scams or safety points.

Ultimate Ideas: Is Offering Liquidity Proper for You?

Liquidity swimming pools open the door to decentralized earnings, quicker trades, and a brand new sort of monetary freedom. They allow you to transfer past conventional markets and take part immediately in programs that facilitate transactions with out banks or brokers. However with better management comes better accountability—and threat.

When you’re snug with crypto, perceive the dangers, and wish to earn out of your digital belongings, offering liquidity could be best for you. Simply begin small, use trusted platforms, and all the time keep knowledgeable. In DeFi, information is as priceless as capital.

FAQ

How do you earn money from a liquidity pool?

You earn a share of the buying and selling charges each time customers facilitate trades utilizing the pool. Some platforms additionally reward you with governance tokens, rising your revenue via yield farming.

What is healthier, a staking or liquidity pool?

Liquidity swimming pools supply rewards from buying and selling charges and farming, whereas staking often pays mounted returns from locking tokens. When you’re trying to facilitate transactions and earn actively, swimming pools could supply greater returns—however with extra threat than staking.

Can you’re taking cash out of a liquidity pool?

Sure, you possibly can withdraw your share at any time by redeeming your LP tokens. The sensible contract returns each your belongings, plus any earned charges, minus any potential impermanent loss.

Are you able to lose crypto in a liquidity pool?

Sure, you possibly can lose worth as a result of impermanent loss, sensible contract bugs, or scams. Not like conventional markets, there’s usually no insurance coverage or restoration if one thing goes unsuitable.

What belongings are in a liquidity pool?

Most swimming pools maintain two digital belongings like ETH and USDC. Some superior swimming pools could embody a number of tokens and use algorithmic methods to steadiness and handle liquidity.

Disclaimer: Please notice that the contents of this text aren’t monetary or investing recommendation. The knowledge offered on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties in regards to the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native laws earlier than committing to an funding.