World liquidity has lengthy been one of many cornerstone indicators used to evaluate macroeconomic situations, and significantly when forecasting Bitcoin’s value trajectory. As liquidity will increase, so does the capital out there to stream into risk-on belongings, comparable to Bitcoin. Nevertheless, on this evolving market panorama, a extra responsive and even perhaps extra correct metric has emerged, one which not solely correlates extremely with BTC value motion however can be particular to the ecosystem.

World M2

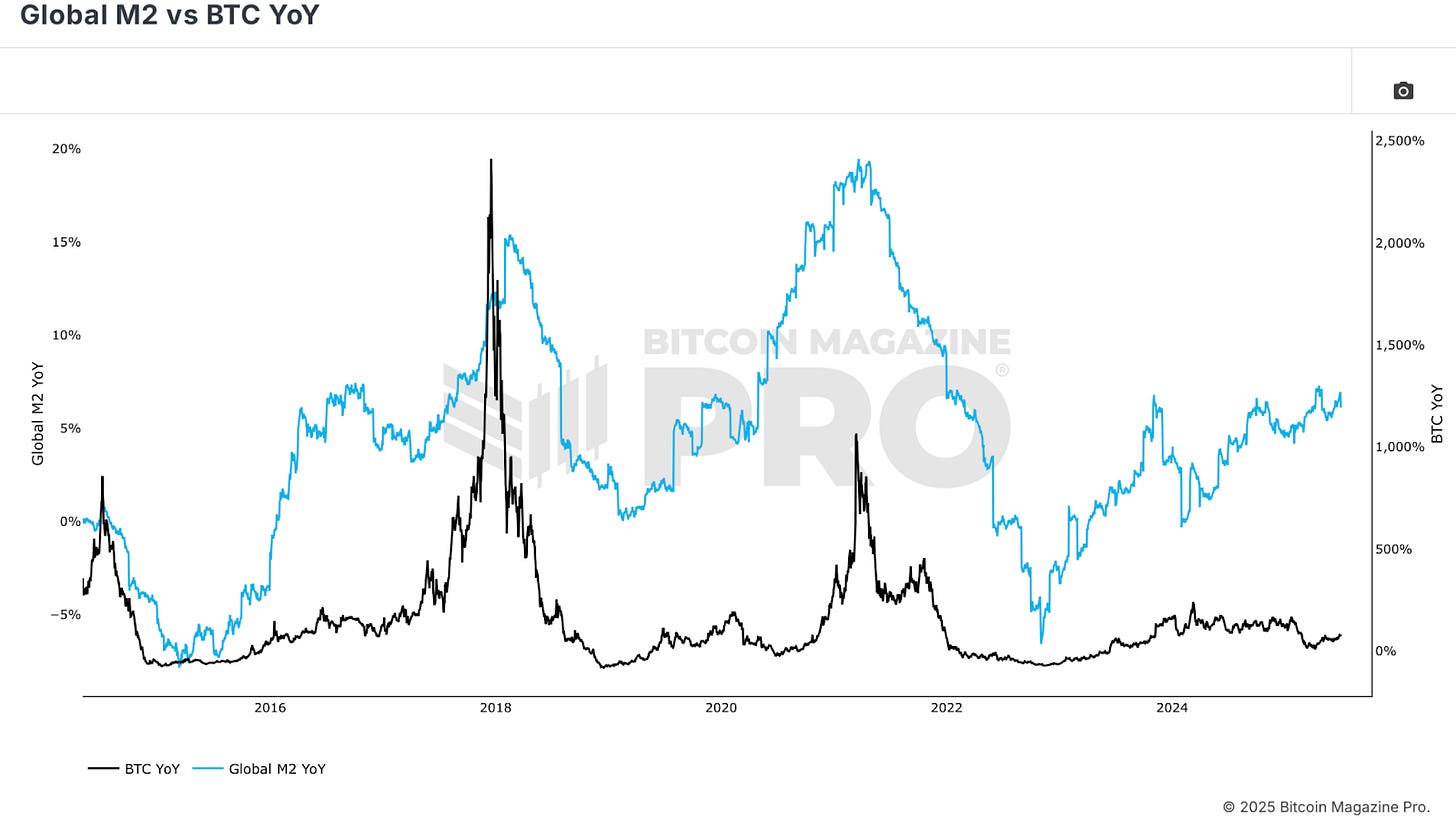

Let’s start with the Global M2 vs BTC chart. This has been one of the shared and analyzed charts on Bitcoin Journal Professional all through the present bull cycle, and for good motive. The M2 provide encompasses all bodily forex and near-money belongings in an financial system. When aggregated globally throughout main economies, it paints a transparent image of fiscal stimulus and central financial institution habits.

Traditionally, main expansions in M2, particularly these pushed by cash printing and monetary interventions, have coincided with explosive Bitcoin rallies. The 2020 bull run was a textbook instance. Trillions in stimulus flooded world economies, and Bitcoin surged from the low hundreds to over $60,000. The same sample occurred in 2016-2017, and conversely, intervals like 2018-2019 and 2022 noticed M2 contraction aligning with BTC bear markets.

A Stronger Correlation

Nevertheless, whereas the uncooked M2 chart is compelling, viewing Global M2 vs BTC Year-on-Year supplies a extra actionable view. Governments are likely to all the time print cash, so the bottom M2 provide practically all the time developments upward. However the price of acceleration or deceleration tells a unique story. When the year-over-year development price of M2 is rising, Bitcoin tends to rally. When it’s falling or adverse, Bitcoin usually struggles. This development, regardless of short-term noise, highlights the deep connection between fiat liquidity enlargement and Bitcoin’s bullishness.

However there’s a caveat: M2 knowledge is gradual. It takes time to gather, replace, and replicate throughout economies. And the influence of elevated liquidity doesn’t hit Bitcoin instantly. Initially, new liquidity flows into safer belongings like bonds and gold, then equities, and solely later into greater volatility, speculative belongings like BTC. This lag is essential for timing methods. We are able to add a delay onto this knowledge, however the level stays.

Stablecoins

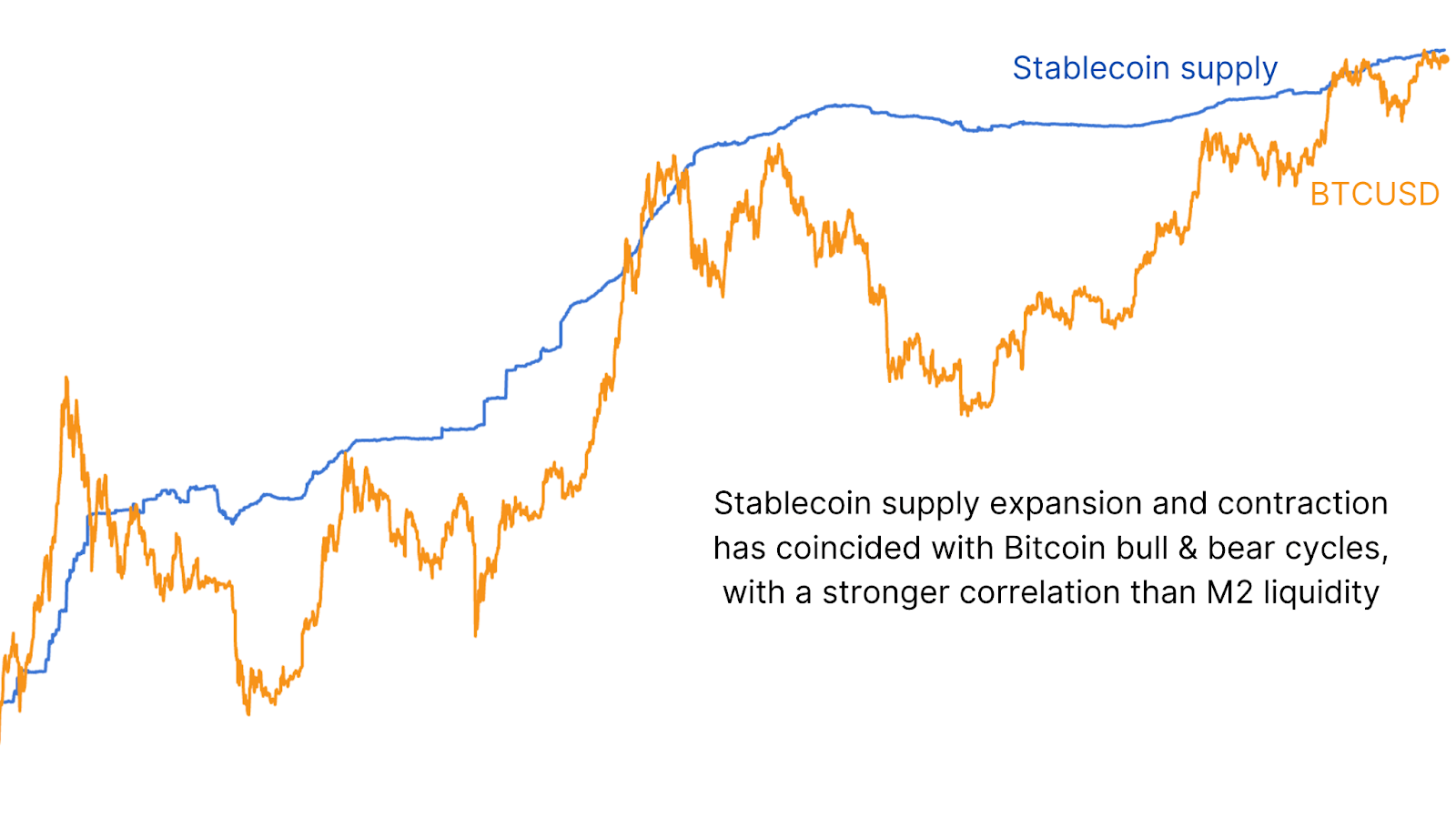

To handle this latency, we pivot to a extra well timed and crypto-native metric: stablecoin liquidity. Evaluating BTC to the availability of main stablecoins (USDT, USDC, DAI, and so on.) reveals a fair stronger correlation than with M2.

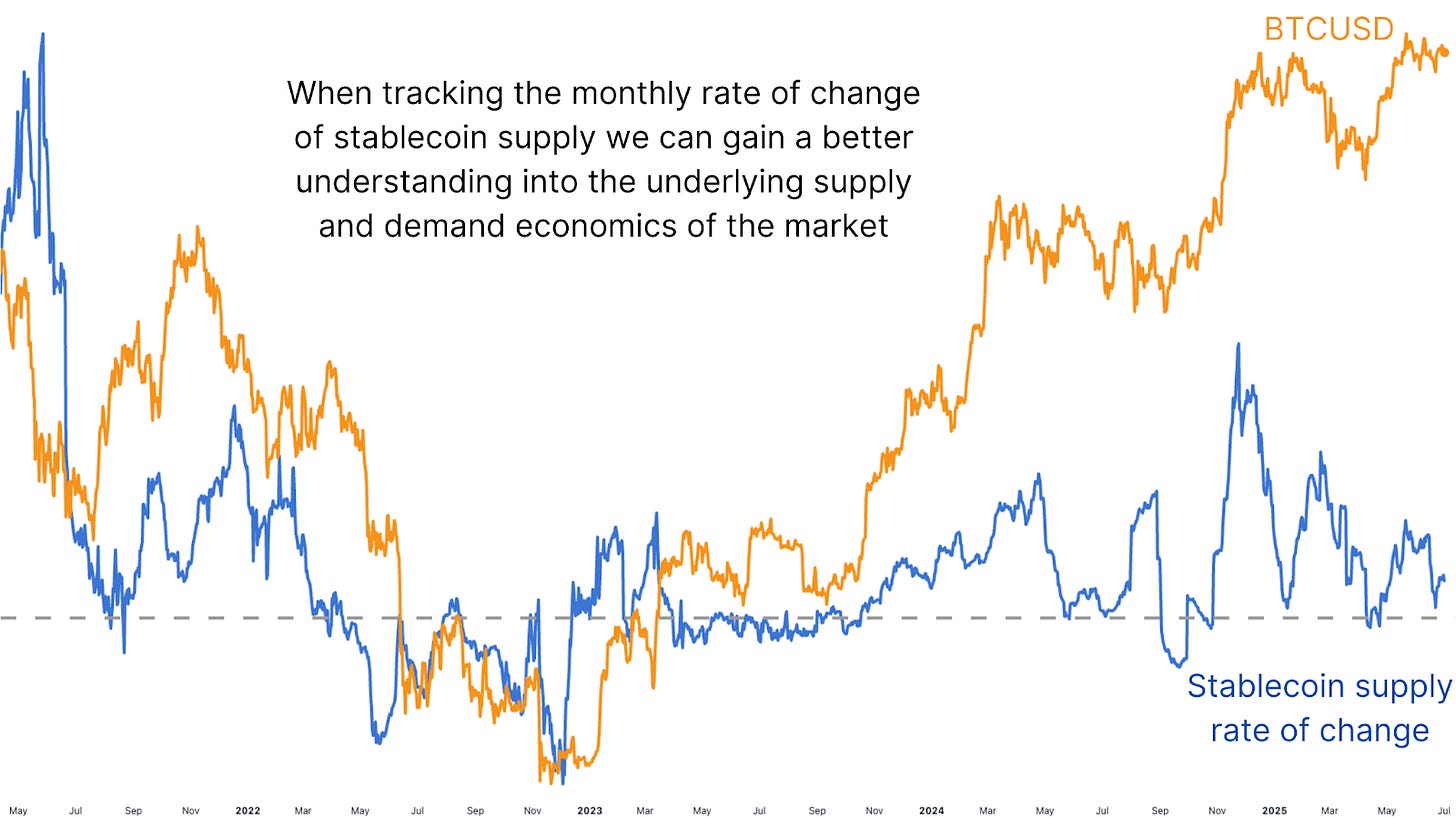

Now, simply monitoring the uncooked worth of stablecoin provide presents some worth, however to really acquire an edge, we study the speed of change, significantly over a 28-day (month-to-month) rolling foundation. This alteration in provide is extremely indicative of short-term liquidity developments. When the speed turns constructive, it typically marks the start of latest BTC accumulation phases. When it turns sharply adverse, it aligns with native tops and retracements.

Wanting again on the tail finish of 2024, as stablecoin development spiked, BTC surged from extended consolidation into new highs. Equally, the foremost 30% drawdown earlier this 12 months was preceded by a steep adverse flip in stablecoin provide development. These strikes have been tracked to the day by this metric. Much more current rebounds in stablecoin provide are beginning to present early indicators of a possible bounce in BTC price, suggesting renewed inflows into the crypto markets.

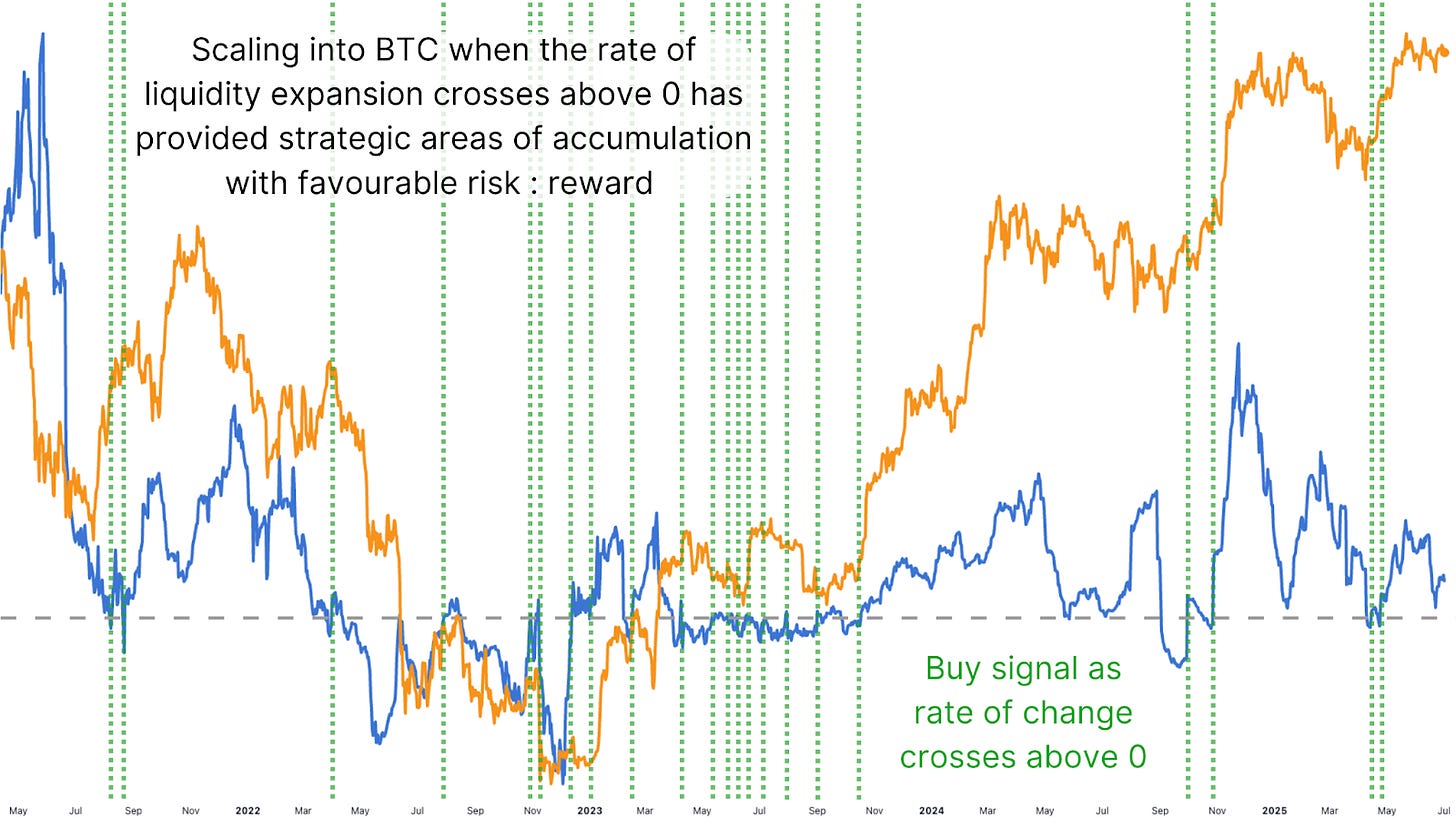

Determine 5: Up to now, the indicator triggered by the liquidity price crossing above zero has been a dependable purchase sign.

The worth of this knowledge isn’t new. Crypto veterans will keep in mind Tether Printer accounts on Twitter relationship again to 2017, watching each USDT mint as a sign for Bitcoin pumps. The distinction now could be we will measure this extra exactly, in real-time, and with the added nuance of rate-of-change evaluation. What makes this much more highly effective is the intracycle and even intraday monitoring capabilities. Not like the World M2 chart, which updates occasionally, stablecoin liquidity knowledge might be tracked stay and used on quick timeframes, and when monitoring for constructive shifts on this change, it will probably present nice accumulation alternatives.

Conclusion

Whereas World M2 development aligns with long-term Bitcoin developments, the stablecoin rate-of-change metric supplies readability for intra-cycle positioning. It deserves a spot in each analyst’s toolkit. Utilizing a easy technique, comparable to searching for crossovers above zero within the 28-day price of change for accumulation, and contemplating scaling out when excessive spikes happen, has labored remarkably nicely and can probably proceed to take action.

💡 Liked this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for extra knowledgeable market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to knowledgeable evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding selections.