Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

XRP’s worth has slipped by 4.7% up to now 24 hours, persevering with a pattern of high volatility that has outlined a lot of March. Amid this decline, nevertheless, some see opportunity, with one widespread analyst figuring out an attention-grabbing reversal sample that might flip the tide to bullish trajectory.

Associated Studying

Inverse Head And Shoulders Sample Seems On XRP Chart

XRP has extended its decline run from $2.47 into the previous 24 hours. Particulary, XRP is presently down by 13.8% up to now three days and now seems to be prefer it might simply break beneath $2.10.

Crypto analyst Egrag Crypto took to social media platform X to spotlight what he known as a “likely inverse head and shoulders” sample presently unfolding on XRP’s each day timeframe. The sample, which has been growing since early March, is now within the remaining levels of forming the second shoulder. As such, this section would possibly nonetheless see additional short-term draw back, as XRP doubtlessly dips once more to finish the construction of the second shoulder earlier than a breakout rally.

If confirmed, the inverse head and shoulders would result in a robust bullish reversal, which is going to be significant given XRP’s latest worth retracement. In keeping with Egrag Crypto, the measured transfer from the completion of this formation might ship the value to a worth vary between $3.7 and $3.9.

Analyst Says XRP Might Attain All-Time Excessive In 90 To 120 Days

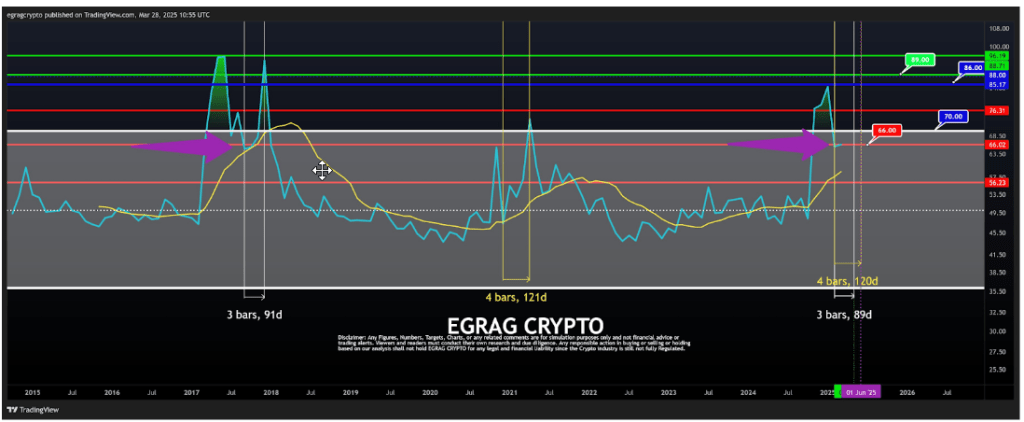

The inverse head and shoulder evaluation is a part of a bullish outlook that implies that the XRP worth can attain a brand new all-time excessive inside the subsequent 90 to 120 days. This prediction, also made by Egrag Crypto, is predicated on a recurring sample noticed in XRP’s Relative Energy Index (RSI) throughout previous bull markets.

He identified that throughout the 2017 and 2021 cycles, the RSI indicator on XRP exhibited two distinct peaks, with the second peak coming between 90 to 120 days after the primary peak. The second RSI peak in 2017 occurred about 120 days after the primary peak. An identical situation occurred in 2021, though the interval between the primary and second RSI highs was shorter at simply 90 days. This pattern units the stage for a historic surge that might align with the breakout from the present inverse head and shoulders setup.

Thus far on this cycle, XRP has already accomplished its first RSI peak, reaching as high as 85.17 towards the top of 2024. Following that, the RSI has been on a protracted cooldown section, dipping to a low of 65. On the time of writing, the RSI sits round 66, and a bounce is anticipated from right here, which is to peak someday round June.

Associated Studying

RSI usually rises with elevated market participation, capital influx, and bullish price movement. If the pattern performs out once more inside the subsequent 90 to 120 days, XRP’s RSI might peak once more round June. On the time of writing, XRP is buying and selling at $2.12, down by 4.7% up to now 24 hours.

Featured picture from Gemini Imagen, chart from TradingView