Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

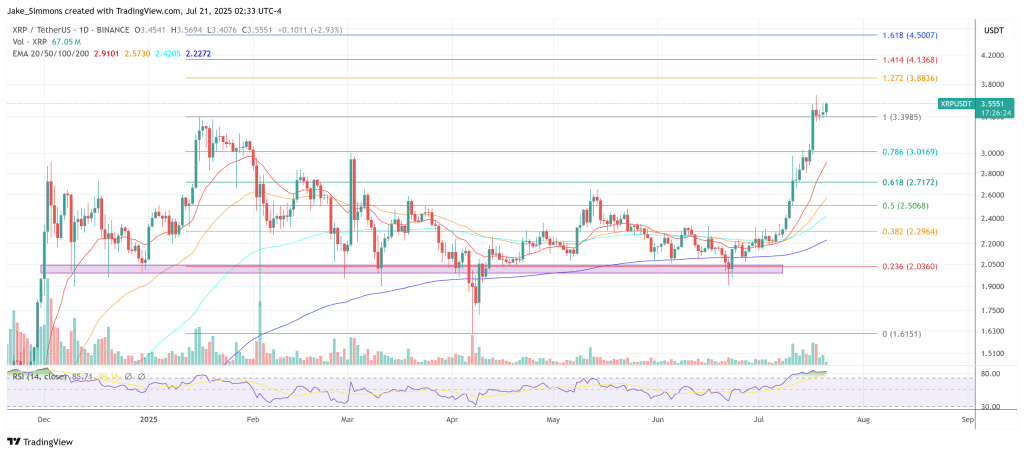

Pseudonymous market technician Dr Cat has laid out a tightly argued roadmap that will see XRP triple from its present vary to between six and ten {dollars} inside the subsequent two months—supplied Bitcoin’s ongoing advance carries the benchmark asset to $144,000.

XRP Poised For $10 If This Occurs

In a sequence of posts over the weekend, the analyst noted that XRP’s month-to-month chart in opposition to BTC is “coiling” simply beneath a vital Ichimoku Cloud threshold at 2,674 satoshis. “If this month closes above 2 674 I believe we must always go at the very least to 4 135 within the subsequent couple of months,” Dr Cat wrote, including that such a detailed would ship the primary bullish month-to-month kumo twist for the pair since 2018 and place XRP in a “help‑and‑regain” configuration not often seen in altcoins through the present cycle.

The 4,135–7,600 satoshi band marks what Dr Cat calls the “resistance / take‑revenue zone.” He argues that value seldom reloads instantly after such a multi‑yr breakout and {that a} wick to the higher finish of the zone is probably going as soon as momentum ignites.

Associated Studying

“All in all, if BTC goes to 144 Okay on this weekly transfer, this value vary for XRP in USD interprets to $6–$10,” the analyst informed followers, pencilling the transfer in for August or September if Bitcoin’s development steepens. Dr Cat conceded that the optimum danger‑reward evaporates above 7,600 sats—“Would you danger a ten× unrealised acquire for one more 0.7×?”—and stated he would rotate out of the place though longer‑time period targets above $30 stay “believable” into 2026.

On the XRP‑USD chart the image is equally constructive. Sunday’s weekly shut above $3.37 turned each the cloud and the Kijun‑sen increased and produced a textbook Chikou Span breakout in week 27 of the Ichimoku time cycle, the so‑known as Henka‑Bi candle.

Dr Cat’s value‑projection grid aligns conventional Fibonacci extensions with Ichimoku value‑measurement idea: the N‑wave goal sits at $4.53, the E‑wave at $6.31 and the 2E extension at $9.22. “With the situation of this weekly shut all of them are on the desk for the following one to 2 months and $4.5 ought to be absolutely the minimal,” he wrote, recalling that the identical $4.5 goal had been floated as “minimal” when XRP traded at $1.89 in early April.

Market context lends partial help to the thesis. Bitcoin is buying and selling simply above $118,500 after a subdued weekend session, consolidating a 20 p.c rally for the reason that begin of July, whereas ether holds close to $3,760 and dominance continues to erode in favour of enormous‑cap altcoins. XRP itself is hovering round $3.55 following a 50‑p.c weekly burst.

Associated Studying

Technically, the “month-to-month shut above 2,674 sats” stays the gating criterion. A failure to safe that stage would postpone the kumo twist and danger one other quarter of vary‑sure drift versus Bitcoin. Conversely, a decisive transfer into the 4,135–7,600 satoshi band would verify the primary bullish market‑structure shift on the lengthy‑time period ratio chart in seven years and nearly definitely drive speculative flows into the XRP‑USD pair.

Merchants watching for added affirmation might be monitoring whether or not the Chikou Span can clear value on the weekly timeframe “this or subsequent week”—a uncommon however highly effective sign that the analyst warns may invalidate the “wholesome cross” caveat and ship the market vertical even earlier than the textbook Tenkan‑Kijun crossover materialises.

For now, the trail to $6–$10 hinges on Bitcoin’s skill to increase its breakout towards the six‑determine mark. If the flagship asset stalls below $120,000 the proportional upside for XRP compresses; ought to the rally proceed, Dr Cat’s stacked Ichimoku‑Fibonacci targets argue that $4.5 comes first, $6 follows shortly and the fabled $10 print is lastly “on the desk” because the trifecta of cloud twist, time‑cycle symmetry and momentum converge.

At press time, XRP traded at $3.55.

Featured picture created with DALL.E, chart from TradingView.com