In The Satoshi Papers, we start a multifaceted exploration of how financial establishments particularly contribute to or militate in opposition to the flourishing of human societies. The essays on this quantity overview the character of cash, the historical past and capabilities of central banking, the connection between state financing and battle, and the introduction of Bitcoin as a brand new platform for transacting worth. The authors are in broad settlement that the appearance of a worldwide, politically impartial, nonstate, peer-to-peer sound cash just isn’t a prescription for the alternative of all different types of cash; fairly, it transforms a number of the background assumptions in regards to the relationship between states, societies, and people which have suffered from an authoritarian consensus in current many years. Fairly merely, there was a world earlier than Bitcoin, and there’s a world after it. If politics is the artwork of the attainable, as sure proponents of realpolitik have argued, then the area through which that artwork is practiced has now been re-formed.

The worldwide adoption of Bitcoin is going on in a world transitioning by means of the obsolescence of unipolar energy, which successfully organized a lot of the second half of the 20th century. The twenty-first century is giving rise to an more and more multipolar world through which sovereign actors vie to implement their very own political tasks propelled by a nexus of commodity wealth, industrial energy, and technological innovation. This doesn’t preclude the US from championing and exerting its energy as a jurisdictional base for industrial manufacturing and unfettered invention. Certainly, the US can be clever to embrace the chances afforded by sound cash—as a reserve asset, as a brand new foundation for personal capital accumulation and funding, and as a denominator of worth—and to resolve to steer the world in its adoption and institutionalization. That is the case made clearly by Avik Roy in his contribution to The Satoshi Papers, “Then They Struggle You.”

However embracing any type of sound cash has predictably led to fierce resistance from state actors who view it—accurately—as a possible constraint on state spending. As Josh Hendrickson demonstrates in his essay, “The Treasury Normal,” the adoption of the US greenback as the worldwide reserve forex and the US Treasury as the worldwide reserve asset was a part of an uncoordinated but decisive technique by generations of leaders throughout the US authorities to finance large-scale, open-ended army battle. This created a worldwide monetary system through which the sovereign debt of the US capabilities as the primary reserve asset for nations around the globe, successfully bankrolling limitless spending by the US authorities. Sarah Kreps argues in her essay, “Simple Cash, Simple Wars?,” that this has decoupled warmaking from taxation—and subsequently from the democratic course of. Thinker Immanuel Kant’s prediction that democracies can be much less prone to make battle than nations with authoritarian techniques of presidency has subsequently been disproven in a way that he and his eighteenth-century contemporaries—together with the founders of the US—couldn’t foresee. Kreps proposes that the US authorities transfer to a bitcoin commonplace partly to make battle costly once more and thereby to regulate the incentives that encourage states and the populations that fund them to make battle.

In his essay, “Bitcoin and Credit score,” Jack Watt makes an analogous case for the personal banking trade: He argues that the elimination of each sound cash and reserve necessities for lending establishments has resulted in an unsustainable explosion of illusory credit score that not solely drives inflation worldwide however is destined to break down as populations uncover that their alleged cash substitutes—bank-issued cash—will not be, actually, redeemable for base cash, or actual cash. He additional means that bitcoin’s capability to be self-custodied by its house owners will, over time, shrink the sum of money individuals deposit in banks, reducing banks’ capability to lend. Though this can lead to a contraction of the banking trade, it would additionally give rise to a proliferation of short-term credit score devices which are instantly redeemable for base cash. This much-needed correction—in some methods, a return to older types of banking—will make sure that credit score is deployed towards economically useful ends that lead to extra sustainable and disciplined progress general.

Some nations have already overtly welcomed the truth of bitcoin as a forex and fee system alongside conventional fiat currencies and legacy fee rails. One such nation, Argentina, lately elected a president, Javier Milei, who has given authorized safety to contracts denominated in any forex, together with bitcoin, and pledged to abolish the nation’s central financial institution. Leopoldo Bebchuk traces the historical past of Milei’s commitments by critically analyzing the combined legacy of the Central Financial institution of Argentina for the Argentinian individuals. Particularly, he demonstrates that the central financial institution has confirmed helpless to stop the numerous devaluation of Argentinian forex, 12 months after 12 months, decade after decade. Within the course of, generations of Argentinians have seen their wealth and financial savings destroyed, with the consequence that almost all Argentinians in a position to take action at the moment save in a overseas forex (the US greenback). Bebchuk examines the potential for bitcoin to function one other retailer of worth alongside the greenback and asks whether or not central banks can certainly fulfill the mandates of forex stability and sound credit score provision that drove their institution through the European Center Ages and early trendy interval.

Simply as bitcoin has automated the issuance and verifiable switch of cash with out involving central banks, so can it leverage its management of funds to implement authorized or normative social judgments with out involving a court docket system. Aaron Daniel exhibits how efforts to implement dispute decision with no state—like eBay’s Neighborhood Court docket in India, the Cell Jerga initiative in Afghanistan, the Benoam property injury claims decision system in Israel, or the Próspera Arbitration Heart in Honduras—have relied on centralized entities to handle and disburse the funds awarded in disputes, in the end relying on courts to coerce compliance with these award selections. Such centralized techniques can solely persist as long as the communities utilizing them maintain extraordinarily excessive belief within the integrity of the authorities overseeing the management and disbursal of funds. Bitcoin’s programmability, in contrast, permits its protocol to connect with resolutions produced by any off-chain on-line dispute decision (ODR) system, regardless of how massive or small, wherever on the planet. This allows bitcoin transactions to perform as noncustodial escrow, solely releasing funds upon the issuance of a call by a web-based dispute decision system. Utilizing Bitcoin for such a system might assist shut what some authorized students have referred to as “the justice hole” between those that can afford to legally defend themselves and people who can not, and between those that reside below a fairly well-functioning authorized system and people who face a deficit or absence of authorized safety.

The power of people to privately contract and economically transact with out the intervention of the state is a cornerstone of any free market system and free society. This precept served as a guiding mild for the cypherpunk motion, a bunch of technologists who foresaw through the Nineteen Eighties and Nineteen Nineties that the digitization of public and business providers through the web opened up vital new vectors of domination for each governments and companies. The cypherpunks acknowledged that if sturdy cryptography was not used to safe communications and financial transactions, individuals in all places can be simply surveilled and managed. Because of this, they devoted themselves to constructing sturdy encryption requirements and protocols for censorship-resistant, peer-to-peer digital money.

Satoshi Nakamoto, a pseudonymous developer, was the primary to synthesize many years of achievements in these areas to create a workable web cash within the type of Bitcoin. Andrew Bailey and Craig Warmke hint the historical past of Bitcoin’s adoption after its launch by Nakamoto. They present that he first seeded his invention with the teams most probably to make use of it for its peer-to-peer and censorship-resistant properties—the cypherpunks and the P2P Basis—whereas betting on the greed of speculators to scale its adoption to a a lot wider consumer base. Finally, nevertheless, it was Nakamoto’s stepping apart solely from the Bitcoin venture that enabled it to understand its promise as a decentralized digital financial system. Bailey and Warmke additionally look at the adoption of recent monies from a game-theoretic perspective, explaining how a forex doesn’t have to realize common acceptance so as to perform as a viable medium of trade. Within the course of, they recommend that various kinds of monies will be helpful for various functions, interesting to sure sorts of customers for particular use instances.

This leads us to an overarching query: What’s cash? Natalie Smolenski examines a number of main anthropological and financial theories of cash to suggest a definition that may function some extent of departure for each disciplines: Cash is the most cost-effective useful that reliably satisfies collectors in a given market. In different phrases, creditor satisfaction is the aim and performance of cash. Satisfaction is an ethical sentiment earlier than it’s a authorized or technological course of: It’s the creditor’s psychological acceptance that the debt they imagine is owed to them has been paid. Cash is just one approach of satisfying collectors, nevertheless; collectors might also demand or take satisfaction by means of social processes of apology and reparation, social ostracism, switch of nonmonetary belongings, and in the end violence, which incorporates establishments such because the blood feud, vendetta, revolution, and battle. By serving as a way for reliably satisfying collectors, cash subsequently considerably lowers the prices of transacting—not solely by fixing the issue of the double coincidence of desires, which economists have amply described, however by dramatically reducing the chance of violence in financial trade. Crucially, nevertheless, not each cash will fulfill collectors to the identical extent in each social setting and for each kind of transaction. Accordingly, completely different markets evolve various kinds of cash which are each useful sufficient to fulfill collectors and low cost sufficient to be produced and used repeatedly and at scale. This explains the chimerical nature of cash as an inexpensive, reproducible useful.

The essays in The Satoshi Papers are works of political concept, historical past, economics, anthropology, and philosophy. In instances of disaster and upheaval, when the ideas by means of which the world has been understood are actively shifting, our first crucial is to suppose. This quantity gathers collectively inquiries from throughout disciplines to make clear what’s at stake and what distinctions will allow us to skillfully navigate our period of profound transition. We hope these essays will function invites to suppose additional—to construct a group of excellent religion interlocutors collaborating within the shared venture of remodeling science into new custom, enabling a self-sovereign future for humanity at massive.

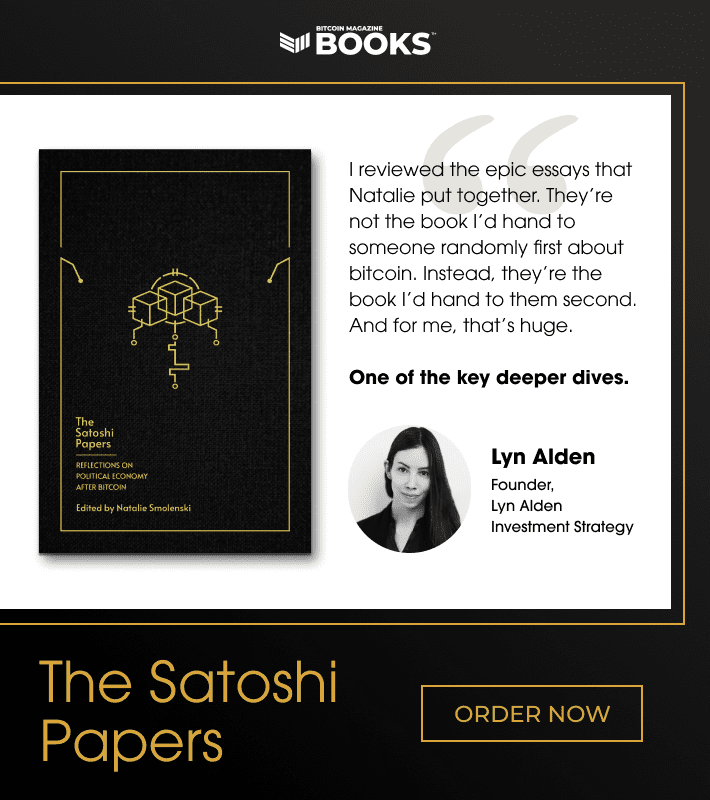

The Satoshi Papers is now out there within the Bitcoin Magazine Store – order the paperback right now or pre-order the restricted Library version, transport mid-June 2025.