Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As gold continues to set new all-time highs (ATH) – trading at $3,333 per ounce on the time of writing – Bitcoin (BTC) has seen extra subdued value motion, consolidating within the mid-$80,000 vary. Nonetheless, analysts recommend that the highest digital asset could quickly mirror gold’s latest momentum.

Bitcoin Set To Observe Gold’s Momentum?

In a latest post on X, crypto buying and selling account Cryptollica hinted that BTC could also be poised to duplicate gold’s historic value motion seen over the previous few months. The account shared the next chart, highlighting the placing similarities between the value actions of gold and BTC.

The chart reveals each gold and BTC forming a macro-bottom round early 2023, adopted by a rejection on the vary high in early 2024. Gold ultimately broke out within the following months, whereas BTC lagged barely, breaking out round November 2024.

Associated Studying

In keeping with Cryptollica, BTC now seems to be breaking out of a consolidatory wedge sample, with a possible mid-term goal as excessive as $155,000. Presently, Bitcoin’s ATH stands at $108,786, recorded earlier this yr in January.

BTC can also be more likely to profit from a number of favorable macroeconomic developments. For instance, the worldwide M2 cash provide is anticipated to increase in 2025, a growth that usually helps risk-on property like Bitcoin.

BTC Maturing As A Protected Haven Asset

Past technical chart patterns, BTC has demonstrated outstanding resilience amid escalating international tariff-induced uncertainty. In keeping with the newest The Week On-Chain report, each gold and BTC have carried out nicely through the ongoing tariff conflict. The report notes:

Amidst this turmoil, the efficiency of arduous property stays remarkably spectacular. Gold continues to surge greater, having reached a brand new ATH of $3,300, as traders flee to the standard protected haven asset. Bitcoin offered off to $75k initially alongside danger property, however has since recovered the week’s positive factors, buying and selling again as much as $85k, now flat since this burst of volatility.

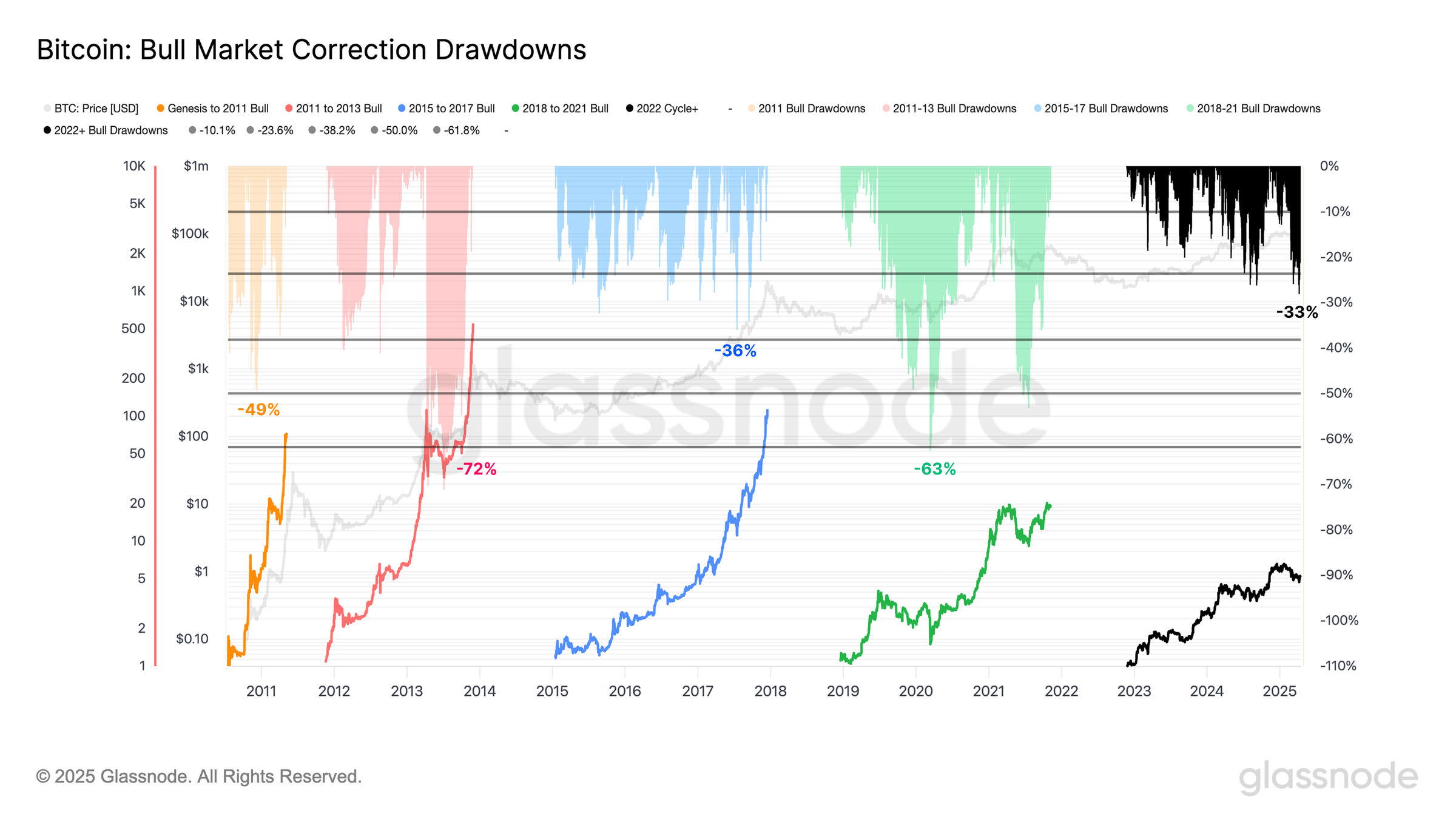

The report additionally mentions that BTC not too long ago skilled its largest value correction of the 2023–25 cycle, a -33% drawdown from its ATH earlier this yr. Nonetheless, this correction stays comparatively modest in comparison with these seen in earlier market cycles.

Associated Studying

The next chart illustrates BTC bull market correction drawdowns since 2011. As proven, the latest -33% correction is the shallowest amongst previous cycles, with the deepest being -72% through the 2012–14 bull market.

Whereas BTC continues to indicate indicators of maturing as a dependable asset throughout occasions of geopolitical uncertainty, institutional traders appear to be taking income. That is evidenced by latest outflows from Bitcoin exchange-traded funds (ETFs). At press time, BTC is buying and selling at $84,694, up 0.7% up to now 24 hours.

Featured picture from Unsplash, charts from X, Glassnode, and Tradingview.com