Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In keeping with a current CryptoQuant Quicktake submit by contributor burakkemeci, Bitcoin (BTC) is starting to point out indicators of a development reversal after weeks of downward motion. Notably, BTC surged previous $100,000 yesterday for the primary time since February 3.

Bitcoin On The Verge Of Pattern Reversal?

On the time of writing, Bitcoin is buying and selling barely above $100,000, roughly 5.2% beneath its all-time excessive (ATH) of $108,786, set earlier this 12 months on January 20. The main cryptocurrency has staged a formidable rebound of over 20% from its current low of $74,508 recorded on April 6.

Associated Studying

Of their evaluation, crypto analyst burakkemeci referred to the CryptoQuant Bull-Bear Market Cycle indicator, saying that it’s flashing the early signs of a possible bullish development reversal. The analyst famous:

With Bitcoin surging again above $100K, the indicator has began flashing bullish alerts once more – for the primary time in weeks. Though the sign remains to be weak (coefficient: 0.029), the mere look of a constructive shift is encouraging.

To clarify, the CryptoQuant Bull-Bear Market Cycle indicator is an on-chain instrument that tracks long-term and short-term market sentiment by evaluating worth momentum and investor habits traits. It makes use of two key elements – the 30-day and 365-day shifting averages (MA) – to establish shifts between bull and bear cycles.

Importantly, the analyst identified that the Bull-Bear 30-day MA has began to show upward. If this metric crosses above the 365-day MA, historic traits counsel Bitcoin may enter a section of parabolic worth development.

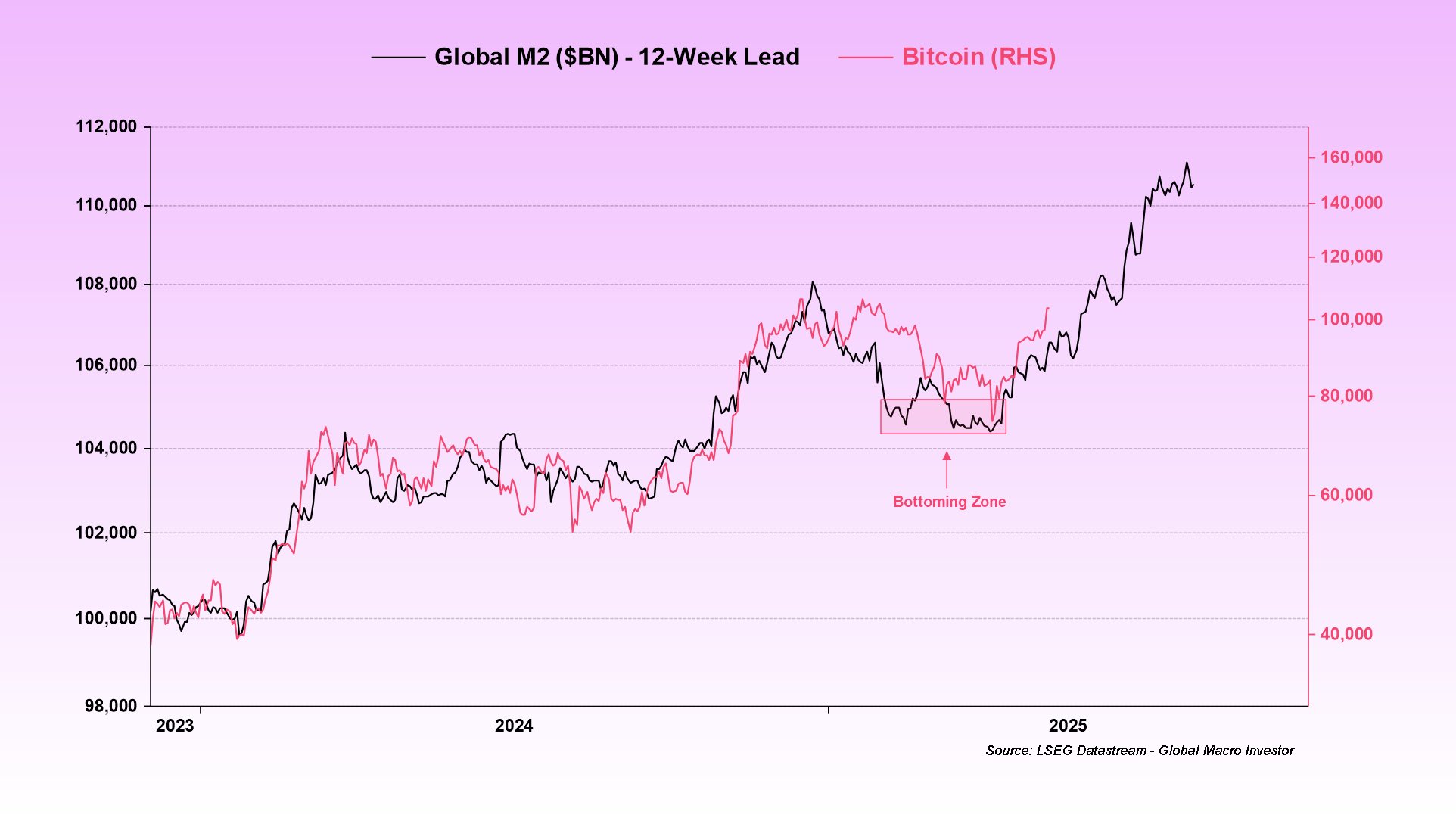

Current macroeconomic developments might additional assist the bullish narrative for Bitcoin. Julien Bittel, Head of Macro Analysis at World Macro Investor, lately highlighted the connection between the worldwide M2 cash provide and the worth of BTC.

Bittel shared a chart that overlays BTC’s worth with the M2 cash provide, adjusted with a 12-week lag. The info reveals a steep enhance in world liquidity since early 2025, implying that BTC may comply with this development and proceed rising within the months forward.

Warning Indicators Nonetheless Linger For BTC

Regardless of current power, not all alerts are bullish. Analysts warning that the present rally has been accompanied by aggressive profit-taking, rising the possibilities of a neighborhood high forming.

Associated Studying

Additional, current evaluation shows that BTC’s Demand Momentum is but to return out of damaging territory. The analyst famous that such market habits is generally prevalent throughout late-cycle distribution phases or macro-level consolidation durations.

That mentioned, Bitcoin’s Stochastic Relative Power Index (RSI) is starting to reflect renewed bullish momentum. At press time, BTC trades at $103,444, up 4% prior to now 24 hours.

Featured picture created with Unsplash, charts from CryptoQuant, X, and TradingView.com