Binance Coin (BNB) is gaining contemporary curiosity as traders intently watch a possible breakout. The token is facing resistance round $593, with day by day commerce quantity at $1.24 billion. Its market cap is $83 billion. The present development is being attributed to sustained shopping for curiosity and steady technical cues.

Merchants Determine Triangle Sample On BNB Chart

Technical analysts are keenly watching a triangle price pattern forming on the chart of BNB in opposition to USDT’s 1-day chart. As analyst Andrew Griffiths explains, this formation is acknowledged for contracting worth motion, whereby the highs grow to be decrease and the lows grow to be larger. It usually signifies a major transfer within the close to future, both larger or decrease.

#BNB evaluation on the 1D chart vs USDT exhibits worth motion inside a triangle sample, indicating room for the present aspect development. Potential targets: T1 = $599, T2 = $617, T3 = $644. For threat administration, take into account Cease-Loss ranges: SL1 = $580, SL2 = $559, SL3 = $542, SL4 = $521.… pic.twitter.com/Qku1eChZ4R

— Andrew Griffiths (@AndrewGriUK) May 3, 2025

The graph signifies BNB trending in a narrower vary for the previous few periods. Such a setup usually signifies that there’s a breakout on the horizon. As BNB has been on an upward development previous to this sample forming, some assume it would maintain going up—if the help zones maintain. Nonetheless, a breach under these help ranges may reverse the development and push the value down.

Worth Targets Established At $599, $617, And $644

If BNB retains surging, analysts have cited three doable targets. The primary is $599, which is just under the psychological barrier of $600. The second is $617, a spot the place BNB fought to maneuver above again in March.

The third is $644, which is your entire vary of the triangle formation. These will probably be checkpoints if there may be momentum.

Though short-term bullish indications are there, the token has not but breached any of those ranges. For now, BNB is probing a major degree of help and resisting. The sort of worth motion is typical earlier than greater strikes in both course.

BNB: The 32% Prediction

Despite all of the short-term hype, a unique forecast exhibits BNB plummeting within the subsequent yr. Primarily based on a price forecast, the token may decline by 32% and hit $402 on June 4, 2025. That prediction doesn’t coincide with the present chart energy, creating an additional layer of uncertainty for long-term traders.

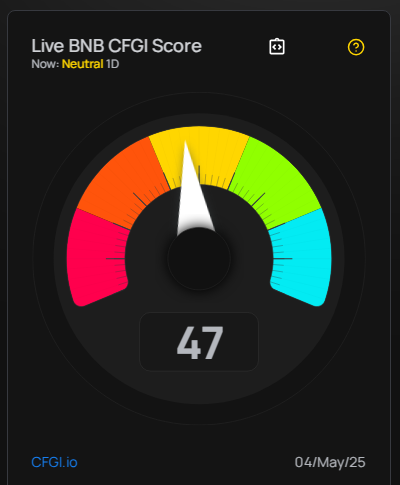

BNB has skilled 15 inexperienced days out of the previous 30, and its worth volatility has been solely 2.5%. The sentiment of the market appears to be neutral in the meanwhile, with the Concern & Greed Index standing at 52. Everybody continues to be targeted on the triangle formation and if BNB will extricate itself from it.

Featured picture from Gemini Imagen, chart from TradingView