Bitcoin has lengthy adopted a predictable sample pushed by its halving occasions, which happen roughly each 4 years. These halving events, the place the block reward for miners is halved, have traditionally been adopted by vital Bitcoin price surges. Nevertheless, as we transfer towards the subsequent halving in 2028, many are questioning whether or not the previous 4-year cycle will proceed or if Bitcoin is on the cusp of a extra basic change. On this article, we delve into the present state of Bitcoin’s market dynamics, how the 4-year cycle has formed its historical past, and what the long run holds for this revolutionary asset.

The 4-12 months Cycle: The Historic Surge Sample Of The Bitcoin Worth

Halving occasions have been pivotal moments in its historical past, immediately impacting the bitcoin price. Every halving reduces the block reward for miners by 50%, resulting in a lower within the issuance fee of bitcoin. The result’s typically a major value improve because the decreased provide of recent cash drives up demand. Traditionally, Bitcoin has skilled substantial value surges within the yr following every halving occasion, albeit with some variation between cycles.

Within the first halving occasion in 2012, the reward dropped from 50 BTC to 25 BTC per block, resulting in a surge in bitcoin’s value that reached a peak in 2013. The second halving in 2016, which decreased the reward from 25 BTC to 12.5 BTC, was adopted by a major bull run, culminating in bitcoin’s meteoric rise to almost $20,000 in December 2017. The third halving in 2020, decreasing the reward to six.25 BTC, preceded a rally that noticed bitcoin’s value surpass $60,000 in 2021.

A 12 months After the 2024 Halving: A Softer Worth Motion Than Anticipated

Nevertheless, the most recent halving in April 2024 has seen a distinct type of value motion. Whereas there was some optimistic appreciation in bitcoin’s price, the huge exponential progress that many anticipated has been notably absent. As of the one-year mark after the halving, bitcoin’s value has risen by about 40%, which, whereas optimistic, is much under the explosive returns seen in previous cycles, such because the 2020-2021 rally.

Traditionally, Bitcoin’s value has skilled a interval of consolidation following every halving occasion, the place the market adjusts to the brand new inflation fee. After this adjustment section, a considerable rally normally ensues inside the subsequent 12 to 18 months. Provided that bitcoin has proven some optimistic motion, many nonetheless anticipate the value to rise considerably within the second half of 2025, following the standard post-halving cycle.

Bitcoin’s Hashrate and Miner Income: An Necessary Sign

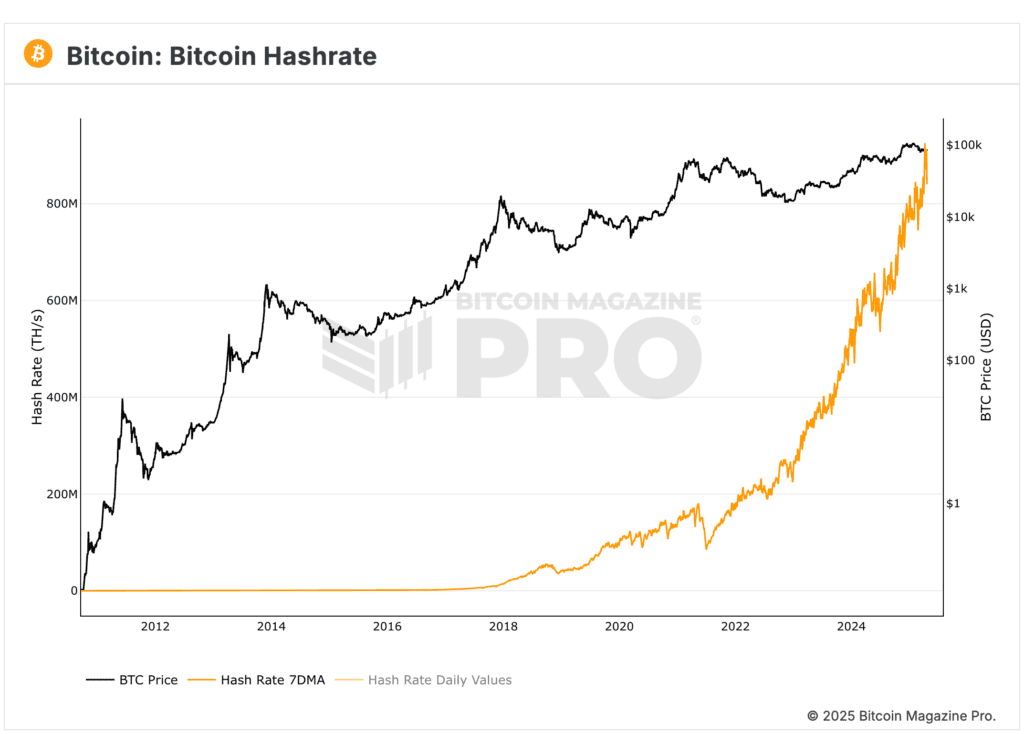

One of many extra essential indicators of Bitcoin’s well being post-halving is its hashrate, which refers back to the complete computational energy of the community. Because the halving occasion in 2024, Bitcoin’s hashrate has continued to climb. In actual fact, the hashrate has surged by virtually 50%, regardless of the discount in miner rewards. It is a testomony to the rising energy of Bitcoin’s community and the rising competitors amongst miners to safe the block rewards.

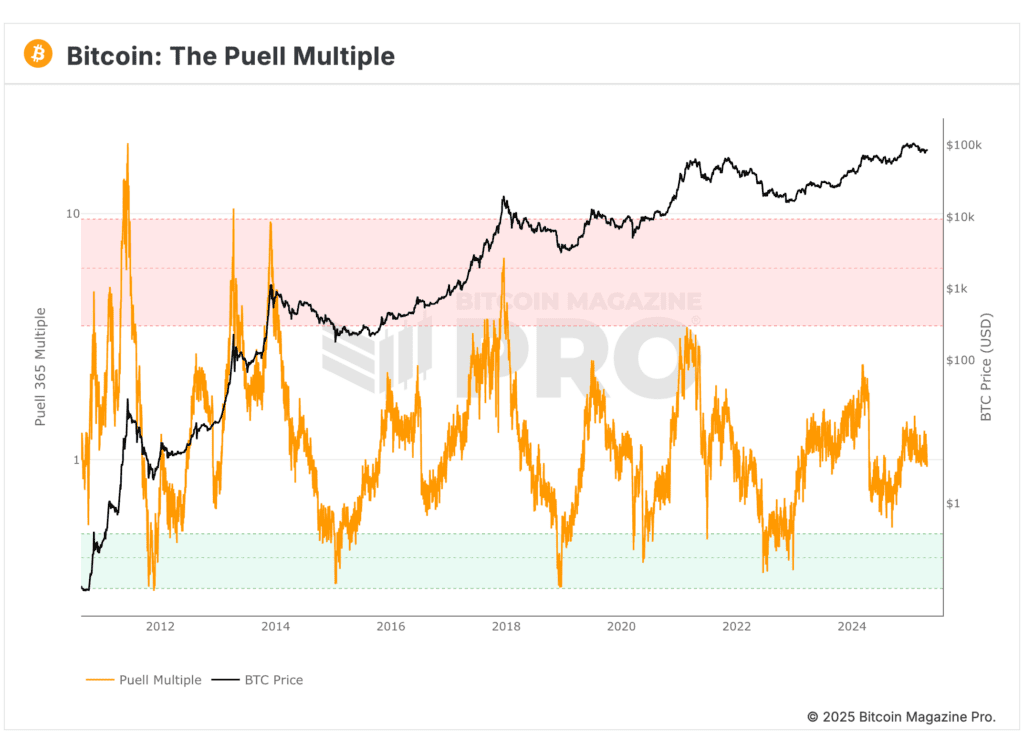

Moreover, Bitcoin’s Puell multiple, which measures miner income relative to the community’s value, additionally dropped considerably after the halving. Nevertheless, it has since rebounded, signaling that the market is stabilizing and getting ready for the subsequent section of the cycle. These indicators recommend that Bitcoin’s basic community energy is unbroken, even because the market adjusts to a decrease block reward.

The Finish of the 4-12 months Cycle: What’s Altering?

Regardless of the energy of Bitcoin’s community and the continued institutional curiosity, there are indicators that the normal 4-year halving cycle might not be as related sooner or later. As of now, 94.5% of Bitcoin’s complete provide has already been mined, and by the point of the subsequent halving in 2028, almost 97% of all Bitcoin will likely be in circulation.

The decreased move of recent BTC into the market signifies that the value might not be as influenced by the halving occasions. The quantity of recent BTC being mined day by day after the 2028 halving will likely be minimal—solely round 225 BTC per day, a quantity that may barely register on day by day inflows in comparison with present ranges of tens of hundreds of BTC.

Because the inflation fee of Bitcoin continues to lower, it’s possible that Bitcoin’s value motion will more and more be pushed by macroeconomic elements reasonably than the halving cycle. Institutional curiosity in Bitcoin has grown considerably in recent times, and it will possible proceed to affect the value. Moreover, Bitcoin’s correlation with conventional belongings just like the S&P 500 has strengthened, suggesting that Bitcoin’s value might start to comply with extra standard liquidity and enterprise cycles.

The Affect of Macroeconomics: Bitcoin’s Shift Towards Conventional Enterprise Cycles

Bitcoin’s relationship with conventional monetary markets, significantly the S&P 500, has grow to be considerably aligned in recent times. This correlation grew considerably after the 2020 COVID-induced market downturn, as large liquidity injections from central banks led to a pointy rise in asset costs, together with bitcoin.

Trying ahead, it’s possible that Bitcoin will grow to be extra aligned with international liquidity cycles and enterprise cycles. Somewhat than being solely pushed by the halving occasions, Bitcoin’s value might begin to mirror broader financial developments, significantly as institutional traders grow to be an much more dominant drive available in the market.

If Bitcoin follows these conventional enterprise cycles, the function of halvings in driving value motion might diminish. As an alternative, Bitcoin might expertise extra gradual value actions, influenced by elements such because the growth and contraction of worldwide liquidity, investor sentiment, and market cycles which can be acquainted to conventional belongings.

The 2028 Halving and Past: A New Period for Bitcoin

The upcoming 2028 halving occasion is anticipated to be an important turning level for Bitcoin. By this level, the community may have reached almost its most provide, and the block reward will likely be decreased to only 1.5625 BTC per block. This can mark a major shift in Bitcoin’s inflation fee, as the quantity of recent bitcoin getting into circulation will likely be minimal.

It’s possible that the 2028 halving would be the final to have a profound influence on Bitcoin’s value. After this, Bitcoin might not expertise the normal post-halving value surges which have characterised its historical past. As an alternative, Bitcoin’s value motion will possible be pushed by a mix of institutional curiosity, international liquidity cycles, and conventional market forces.

In Conclusion: A Altering Panorama for Bitcoin

Bitcoin’s conventional 4-year halving cycle has been a basic driver of its value historical past, however the market is evolving. Because the block reward decreases and Bitcoin’s circulating provide nears its most, the affect of halving’s on value motion will possible diminish. As an alternative, Bitcoin will most likely comply with extra standard enterprise and liquidity cycles, just like different main belongings. This shift will likely be pushed by the rising institutional curiosity in Bitcoin, its rising correlation with conventional markets, and the evolving function of Bitcoin within the broader financial panorama.

As we sit up for the 2028 halving and past, it’s clear that Bitcoin’s future ought to be formed by macroeconomic developments reasonably than the previous cycle-driven mannequin. Whereas this may increasingly change the best way we method Bitcoin funding and evaluation, it additionally opens up thrilling prospects for Bitcoin’s function within the international economic system.

To discover reside knowledge and keep knowledgeable on the most recent evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding choices.