Cryptocurrency exchanges have been expanding beyond just trading, adding staking, lending, games, social features, payments, remittances, and more. And it’s not just a fading fad but the need of the hour. Every crypto exchange software that has only been functioning solely as a trading engine today faces the same growth trap.

- High Acquisition Costs

- Declining Retention

- Flat Revenue Per User

Even exchanges processing billions of trading volumes are struck by economic constraints that don’t scale. Every new feature makes a new funnel and introduces a separate KYC process and data silos. This highlights the need for an interoperable decentralized identity (DID) that works across all ecosystems and unlocks access to swaps, staking, mini-games, Instagram-like feeds, mortgage or P2P lending, remittances, etc.

Why Unified Identity Matters For Super Cryptocurrency Exchange Development?

Traditional KYC processes were for the single-product exchanges, the kind that offered one service and one revenue stream. But if you’re planning your cryptocurrency exchange development for 2026 and beyond, the game is shifting towards super exchanges or exchangeverse models.

Users don’t want to bounce between wallets, staking protocols, exchanges, mini games, or community forums. They expect a unified crypto superapp experience that lets them trade, stake, play, socialize, and earn in a single login.

Future-proof crypto exchange platform development projects are already consolidating the value scattered across varied ecosystems by building multi-functional venues. These super exchanges or exchangeverse models not only unify the user experience but also generate multiple revenue streams for businesses.

Enter unified decentralized identity, an addition to this super crypto exchange development that holds every module together. It eliminates fragmentation and brings tangible results.

- Higher conversion rates as onboarding friction drops.

- Improved user experience and retention since users sign in once and then access everything, no verifications needed.

- Greater lifetime value(LTV), with users looping across multiple activities through a single login.

- New revenue lanes with staking, gaming, NFTs, payments, and more, without re-onboarding users.

How Decentralized Identity 10Xs Growth For Super Crypto Exchange Software?

Exchanges can unlock 10X revenue per user and drastically cut customer acquisition costs with a single, verifiable digital and decentralized identity that works across the entire ecosystem.

1. Cross-Selling Without Much Cost

When trading, earning, gaming, lending, and more are all on a single platform with no broken KYCs, it is easier to target users.

- A trader easily becomes a staker.

- A staker turns into a mini-game player who can also buy limited edition NFTs to level up.

- The trader also does everyday payments with the same trading application.

- Traders can also access DeFi mortgage loans on the same platform with the same interoperable decentralized identity.

With the right gamification tactics and reward systems, crypto exchange software platforms can cross-sell with minimal effort. This way, each interaction compounds and every activity feeds the same reward pool and fee engine. This also turns single-touch users into multi-product customers.

2. Retention That Multiplies LTV

Users’ churn is expensive. Crypto exchanges spend heavily to bring traders back. Super exchanges change this as users stay within the ecosystem for varied activities.

A unified rewards layer lets users carry the same profile, points, progress, and status across different mini-applications within the same ecosystem. Users are also rewarded for staying longer across multiple verticals. Crypto trading ecosystems with one identity layer can:

- Improve retention by 2.3X

- Increase average revenue per user (ARPU) by 3-5X

- Grow referral activity by 4X

- 40-60% lower acquisition costs

All of these automatically boost the bottom line.

3. API Economy and Partner Monetization

With one identity standard, external partners featuring games, wallets, NFTs, and other dApps can plug into the ecosystem. This creates revenue opportunities for the ecosystem that earn per user, per API call, or per transaction. With x402 integration in crypto exchange development, API monetization is quite effortless for super exchanges as well as external partners. This creates a new B2B income without touching any user-acquisition budgets.

Apart from this, cryptocurrency exchanges with decentralized identity integration become an operating system for digital participation. Each verified user ID becomes:

- A trusted access token for DeFi, NFT, or GameFi partners

- A revenue channel via pay-per-user, pay-per-transaction, or subscription API models

- A data stream for compliant analytics and co-branded reward programs

What are The Essential Components of DID-Integrated Crypto Exchange Software?

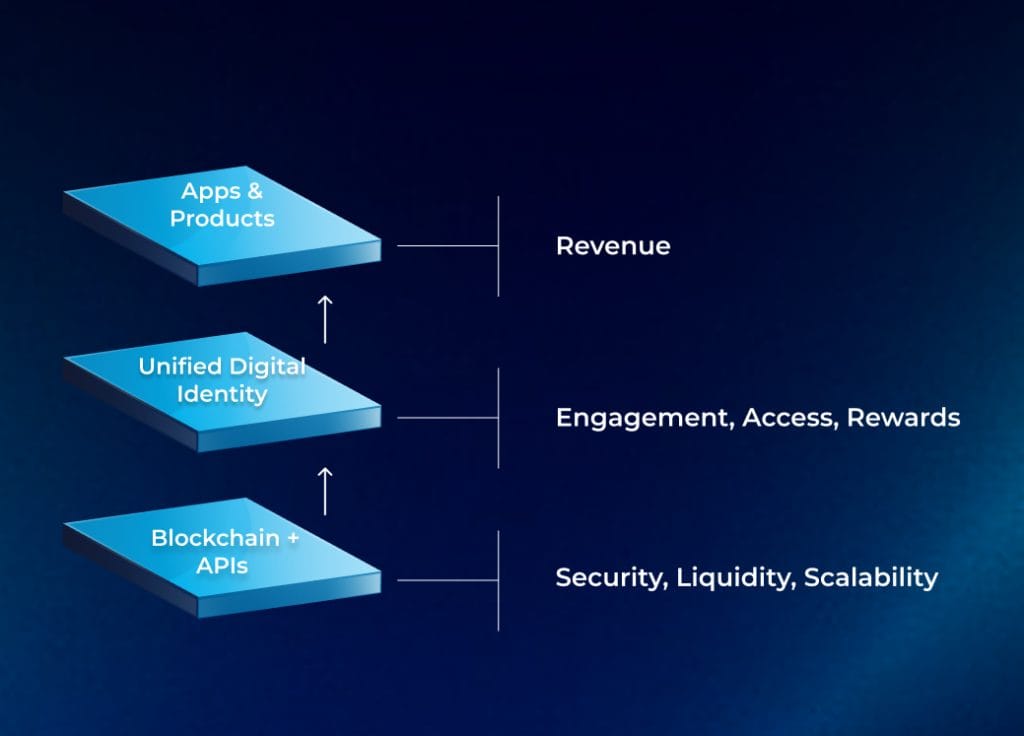

To understand how it works, you must understand the architecture that enables a single identity to operate across a super exchange ecosystem with multiple modules, such as perpetual trading, staking, games, etc.

- Decentralized Identity: Portable identity built on verifiable credentials.

- Smart Contract Vaults: Unified asset management and reward tracking.

- Session Key Model: Users stay connected without repetitive signing.

- Cross-Chain Adapters: Liquidity flows between L1s such as Ethereum, BSC, Polygon, and more, seamlessly.

- Compliance Hooks: Consent-based KYC and verifiable credential checks

Architecture Of DID-Integrated Crypto Exchange Software

What are the Business Benefits of DID-Powered Crypto Exchange Software Development?

For enterprises, it means:

- Launch faster: one identity, many product modules

- Lower compliance overhead via reusable KYC credentials

- Retain users across every vertical, not just trading

For investors, it means:

- Predictable, recurring revenue (multi-lane ARPU)

- Lower churn = stable cash flow

- Ecosystem defensibility = higher exit multiples

In short, this model transforms “exchange users” into ecosystem participants, and participation scales far more rapidly than volume.

Access Your DID-Powered Crypto Exchange Blueprint

How Much Does It Cost To Build A Crypto Exchange Software With DID Integration?

Building a super cryptocurrency exchange software with decentralized identity costs anywhere from $100k to $800k. But it is totally worth it. Here’s how:

| Metric | Traditional Exchange | Super Exchanges With DID |

|---|---|---|

| Avg. Revenue Per User | $8/month | $30–$60/month |

| Avg. Retention (6M) | 30-40% | 65-80% |

| Customer Acquisition Cost Payback | 8-10 months | 3-4 months |

| Product Lines | 1-2 | 5+ |

| Valuation Multiplier | 6-8× revenue | 12-18× revenue |

Final Word

The next wave of crypto exchange software won’t just add new features; it’ll strive to own the user relationship end to end. Integrated, auditable, on-chain identity module ties every interaction into a compounding ecosystem where trading, earning, and gaming fuel each other.

Antier, a leading cryptocurrency exchange development company, is engineering the future of crypto exchanges, turning them into comprehensive ecosystems that yield 10X more revenue without 10X the spend. Their expertise spans from the exchange core to the DID identity layer, tokenized reward systems, and more.

So, if you’re ready to build a robust trading engine with

Connect with our subject matter experts today.

Frequently Asked Questions

01. What are the main challenges faced by cryptocurrency exchanges today?

Cryptocurrency exchanges are facing high acquisition costs, declining retention rates, and flat revenue per user, which hinder their growth potential.

02. Why is a unified decentralized identity important for cryptocurrency exchanges?

A unified decentralized identity streamlines user experience by allowing access to multiple services with a single login, reducing onboarding friction and improving retention, ultimately leading to higher revenue.

03. How can super exchanges benefit from implementing decentralized identity?

Super exchanges can achieve 10X revenue per user and significantly lower customer acquisition costs by utilizing a single, verifiable decentralized identity, enabling users to engage in various activities without repeated verifications.