Over the following few weeks, I’m going to make a sequence of posts that’s going to be a big overview of the chances for scalability of Ethereum, desiring to create a exact understanding of the issues at bay in implementing a scalable cryptocurrency infrastructure, and the place the least-bad tradeoffs and sacrifices required to unravel these issues would possibly lie. As a basic define of the shape that this sequence goes to take, I intend to first talk about the elemental drawback with Ethereum 1.0 because it stands, in addition to each different cryptocurrency platform in existence, and introduce restricted options to particular issues that enable for far more effectivity – in some instances growing effectivity by a relentless issue, and in different instances making a extra basic complexity-theoretic enchancment – however solely in very particular use instances. In later posts, I’ll talk about additional and additional generalizations of such mechanisms, and at last culminating within the final generalization: making use of the ways that I describe to make sure packages run higher inside Ethereum to Ethereum itself – offering at the very least one path to Ethereum 2.0.

Essentially, the issue of scaling up one thing like Bitcoin and Ethereum is a particularly laborious one; the consensus architectures strongly depend on each node processing each transaction, they usually accomplish that in a really deep means. There do exist protocols for “gentle purchasers” to work with Ethereum, storing solely a small a part of the blockchain and utilizing Merkle timber to securely entry the remainder, however even nonetheless the community depends on a comparatively giant variety of full nodes to realize excessive levels of safety. Scaling as much as Visa or SWIFT ranges of transaction quantity is feasible, however solely at the price of sacrificing decentralization as solely a really small variety of full nodes will survive. If we need to attain such ranges, and go even increased with micropayments, we have to develop a consensus structure which achieves a basic enchancment over “each node processing each transaction”. Nonetheless, because it seems, there’s a lot that we are able to do with out going that far.

Protocol enhancements

Picture from https://bitcoin.org/en/developer-guide

Step one in growing area effectivity is a few structural alterations to the protocol – alterations which have already been a part of Ethereum since day one. The primary is a shift from UTXO-based structure to account-based structure. The Bitcoin blockchain depends on an idea of “unspent transaction outputs” – each transaction comprises a number of inputs and a number of outputs, with the situation that every enter should reference a legitimate and unspent earlier output and the full sum of the outputs should be no larger than the full sum of the inputs. This requires transactions to be giant, typically containing a number of signatures from the identical consumer, and requires about 50 bytes to be saved within the database for each transaction {that a} node receives. It’s significantly inconvenient when you may have an account that very many individuals are sending small funds to; within the case of ethereum.org, it would take us lots of of transactions to clear our exodus address.

Ripple and Ethereum as a substitute use a extra standard system of transactions depositing to and withdrawing from accounts, guaranteeing that every account takes up solely about 100 bytes on the blockchain no matter its stage of utilization. A second protocol adjustment, utilized by each Ripple and Ethereum, is that of storing the total blockchain state in a Patricia tree in each block. The Patricia tree construction is designed to incorporate maximal deduplication, so in case you are storing many nearly-identical Patricia timber for consecutive blocks you solely must retailer a lot of the knowledge as soon as. This enables nodes to extra simply “begin from the center” and securely obtain the present state with out having to course of your complete historical past.

These schemes are, in fact, counterbalanced by the truth that Ethereum opens itself as much as a wider array of purposes and thus a way more lively array of utilization, and on the finish of the day such optimizations can solely go thus far. Thus, to go additional, we have to transcend tweaks to the protocol itself, and construct on prime.

Batching

In Bitcoin, one transaction that spends ten beforehand unspent outputs requires ten signatures. In Ethereum, one transaction all the time requires one signature (though within the case of constructions like multisig accounts a number of transactions could also be wanted to course of a withdrawal). Nonetheless, one can go even additional, and create a system the place ten withdrawals solely require one transaction and one signature. That is one other constant-factor enchancment, however a doubtlessly slightly highly effective one: batching.

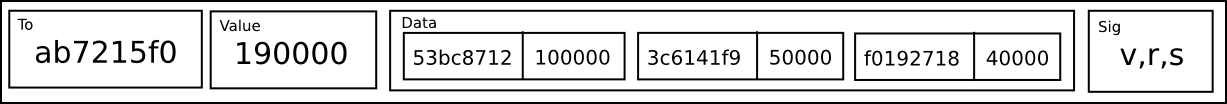

The thought behind batching is easy: put a number of sends right into a single transaction within the knowledge fields, after which have a forwarding contract cut up up the cost. Right here is the easy implementation of such a contract:

i = 0 whereas i < msg.datasize: ship(msg.knowledge[i], msg.knowledge[i+1]) i += 2

We will additionally lengthen it to assist forwarding messages, utilizing some low-level EVM instructions in serpent to do some byte-by-byte packing:

init: contract.storage[0] = msg.sender code: if msg.sender != contract.storage[0]: cease i = 0 whereas i < ~calldatasize(): to = ~calldataload(i) worth = ~calldataload(i+20) / 256^12 datasize = ~calldataload(i+32) / 256^30 knowledge = alloc(datasize) ~calldatacopy(knowledge, i+34, datasize) ~name(tx.gasoline - 25, to, worth, knowledge, datasize, 0, 0) i += 34 + datasize

As a substitute of utilizing your regular account to work together with contracts, the thought is that you’d retailer your funds and keep your relationships with contracts utilizing this account, after which it is possible for you to to make as many operations as you want unexpectedly with a single transaction.

Word that this scheme does have its limits. Though it could possibly arbitrarily amplify the quantity of labor that may be carried out with one signature, the quantity of information that should be spent registering the recipient, worth and message knowledge, and the quantity of computational sources that should be spent processing the transactions, nonetheless stays the identical. The significance of signatures is to not be underestimated; signature verification is probably going the costliest a part of blockchain validation, however the effectivity acquire from utilizing this sort of mechanism remains to be restricted to maybe one thing like an element of 4 for plain outdated sends, and even much less for transactions that contain numerous computation.

Micropayment Channels

A typical dream utility of cryptocurrency is the thought of micropayments – having markets on very tiny chunks of computational or bodily sources, paying for electrical energy, web bandwidth, file storage, street utilization or another micro-meterable good one cent at a time. Present cryptocurrencies are definitely helpful for a lot smaller funds than have been doable earlier than; Paypal fees a set charge of $0.30 per transaction, and Bitcoin presently fees ~$0.05, making it logical to ship funds as little as 50 cents in measurement. Nonetheless, if we need to pay $0.01 at a time, then we want a a lot better scheme. There isn’t a simple common scheme to implement; if there was, that might be Ethereum 2.0. Slightly, there’s a mixture of various approaches, the place every strategy is suited to a selected use case. One frequent use case is micropayment channels: conditions the place one celebration is paying the opposite over time for a metered service (eg. a file obtain), and the transaction solely must be processed on the finish. Bitcoin helps micropayment channels; Ethererum does as properly, and arguably considerably extra elegantly.

The channel works roughly as follows: the sender sends a transaction to initialize a channel, specifying a recipient, and the contract initializes a channel with worth zero and provides an ID for the channel. To extend the cost on the channel, the sender indicators a knowledge packet of the shape [id, value], with worth being the brand new worth to transmit. When the channel course of is finished, and the recipient desires to money out, he should merely take the signed [id, value, v, r, s] packet (the v,r,s triple being an elliptic curve signature) and push it to the blockchain as transaction knowledge, and the contract verifies the signature. If the signature is legitimate, the contract waits 1000 blocks for a higher-valued packet for the transaction ID to be despatched, and may then be pinged once more to ship the funds. Word that if the sender tries to cheat by submitting an earlier packet with a low worth, the receiver has the 1000 block interval to submit the higher-valued packet. The code for the validator is as follows:

# Create channel: [0, to] if msg.knowledge[0] == 0: new_id = contract.storage[-1] # retailer [from, to, value, maxvalue, timeout] in contract storage contract.storage[new_id] = msg.sender contract.storage[new_id + 1] = msg.knowledge[1] contract.storage[new_id + 2] = 0 contract.storage[new_id + 3] = msg.worth contract.storage[new_id + 4] = 2^254 # increment subsequent id contract.storage[-1] = new_id + 10 # return id of this channel return(new_id)elif msg.knowledge[0] == 2:

id = msg.knowledge[1] % 2^160 # Test if timeout has run out

if block.quantity >= contract.storage[id + 3]: # Ship funds

ship(contract.storage[id + 1], contract.storage[id + 2]) # Ship refund

ship(contract.storage[id], contract.storage[id + 3] - contract.storage[id + 2]) # Clear storage

contract.storage[id] = 0

contract.storage[id + 1] = 0

contract.storage[id + 2] = 0

contract.storage[id + 3] = 0

contract.storage[id + 4] = 0

And there we go. All that’s wanted now’s a good off-chain consumer interface for processing the consumer-merchant aspect of the transaction.

Probabilistic Micropayments

However even nonetheless, micropayment channels should not a panacea. What if you happen to solely must pay $0.007 to obtain a 32 MB file from somebody, so even your complete transaction will not be definitely worth the single ultimate transaction charge? For this, we do one thing barely extra intelligent: probabilistic micropayments. Basically, a probabilistic micropayment happens when a sender performs an motion which provably has a specified chance of permitting a sure cost to occur sooner or later; right here, we’d do a 0.7% probability of paying $1. In the long run, each bills and receipts might be roughly the identical as within the non-probabilistic mannequin, however with the advantage of saving 99% on transaction charges.

So, how will we do probabilistic micropayments? The final strategy is to have the cost be a signed knowledge packet of the shape [nonce, timeout, to, value, prob], the place nonce is a random quantity, timeout is a near-future block quantity, to is the recipient, worth is the quantity of ether to ship and prob is the chance of sending multiplied by 232, after which when the block quantity surpasses timeout enable the info packet to be provided to the blockchain and cashed out provided that a random quantity generator, seeded with the nonce, provides a worth which mod 232 is lower than prob.

Assuming a random quantity generator, the code snippet for the essential receiving perform is:

# Money out: [0, nonce, timeout, to, value, prob, v, r, s] if msg.knowledge[0] == 0: # Helper contracts (addresses clearly will not work on testnet or livenet) ecrecover = 0x46a8d0b21b1336d83b06829f568d7450df36883f random = 0xb7d0a063fafca596de6af7b5062926c0f793c7db # Variables timeout = msg.knowledge[2] to = msg.knowledge[3] worth = msg.knowledge[4] prob = msg.knowledge[5] # Is it time to money out? if block.quantity >= timeout: # Randomness if name(random, [0, nonce, timeout], 3) % 2^32 < msg.knowledge[5]: # Decide sender h = sha3(slice(msg.knowledge, 1), 5) sender = name(ecrecover, [h, msg.data[6], msg.knowledge[7], msg.knowledge[8]], 4) # Withdraw if contract.storage[sender] >= worth: contract.storage[sender] -= worth ship(to, worth)

There are two “laborious elements” within the implementation of this strategy. One is double-spending assaults, and the opposite is easy methods to construct the random quantity generator. To defeat double-spending assaults, the technique is easy: require a really excessive safety deposit within the contract alongside the account’s ether steadiness obtainable for sending. If the sendable steadiness drops under zero, destroy your complete deposit.

The second half is, in fact, easy methods to construct a random quantity generator within the first place. Usually, the principle supply of randomness utilized in Ethereum is block hashes; as a result of micropayments are low-value purposes, and since the completely different nonce on every transaction ensures {that a} block hash is extraordinarily unlikely to favor any specific consumer in any specific means, block hashes will seemingly be adequate for this function – nonetheless, we want to ensure we seize a particular block hash slightly than merely the block hash when a request is shipped (utilizing the block hash when a request is shipped additionally works, however much less properly, because the sender and receiver have an incentive to attempt to disrupt one another’s makes an attempt to ship declare transactions throughout blocks which can be unfavorable to them). One possibility is to have a centralized contract keep an inventory of the block hash for each block, incentivizing miners to ping it each block; the contract can cost a micropayment for its API in an effort to pay for the service. For effectivity, one can restrict the contract to offering a reward as soon as each ten blocks. Within the occasion that the contract skips over a block, the following block hash is used.

The code for the one-every-ten-blocks model is:

# If we get pinged for the primary time in a brand new epoch, set the prevhash if !contract.storage[block.number / 10]: ship(msg.sender, 10^17) contract.storage[block.number / 10] = block.prevhash # In any other case, present the block hash: [0, block number] if msg.knowledge == 0 and msg.worth > 10^16: return(contract.storage[msg.data[1] / 10])

With a view to convert this into an appropriate implementation of the random contract, we simply do:

# If we get pinged for the primary time in a brand new epoch, set the prevhash if !contract.storage[block.number / 10]: ship(msg.sender, 10^17) contract.storage[block.number / 10] = block.prevhash # In any other case, present the hash of the block hash plus a nonce: [0, block number, nonce] if msg.knowledge == 0 and msg.worth > 10^16: return(sha3([contract.storage[msg.data[1] / 10], msg.knowledge[2]], 2))

Word that for one thing like this to work effectively, one “higher-level” piece of infrastructure that should exist is a few sort of incentivized pinging. This job may be carried out cooperatively with a pub/sub contract: a contract may be made which different contracts subscribe to, paying a really small charge, and when the contract will get pinged for the primary time in N blocks it supplies a single reward and instantly pings all the contracts that subscribed to it. This technique remains to be weak to some abuse by miners, however the low-value nature of micropayments and the independence of every cost ought to restrict the issue drastically.

Off-chain oracles

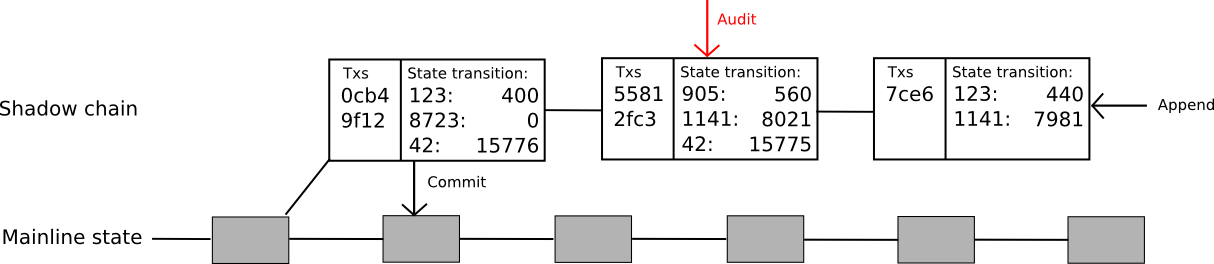

Following the spirit of signature batching, an strategy that goes even additional is to take your complete computation off the blockchain. So as to take action securely, we use a intelligent financial hack: the code nonetheless goes on the blockchain, and will get recorded there, however by default the computation is determined by oracles which run the code off-chain in a non-public EVM and provide the reply, additionally offering a safety deposit. When the reply is provided, it takes 100 blocks till the reply is dedicated; if every part goes properly, the reply may be dedicated to the blockchain after 100 blocks, and the oracle recovers its deposit and a small bonus. Nonetheless, inside that 100-block interval, any node can test the computation themselves, and in the event that they see that the oracle is mistaken they’ll pay for an auditing transaction – primarily, really run the code on the blockchain, and see if the outcome seems to be the identical. If it doesn’t, then the auditor will get 90% of the block reward and the opposite 10% is destroyed.

Basically, this supplies near-equivalent assurances to each node operating the code, besides that in observe just a few nodes do. Notably, if there’s a monetary contract, the events to the monetary contract have a powerful incentive to hold out the audit, as a result of they’re those who could be screwed over by an invalid block. This scheme is elegant, however considerably inconvenient; it requires customers to attend 100 blocks earlier than the outcomes of their code can be utilized.

To resolve that drawback, the protocol may be prolonged even additional. Now, the thought is to create a complete “shadow chain”, with computations occurring off-chain however state transitions being dedicated again to the principle chain after 100 blocks. Oracles can add new blocks to the “tail” of the chain, the place a block consists of an inventory of transactions and a [[k1, v1], [k2, v2] … ] checklist of state transitions attributable to these transactions. If a block is unchallenged for 100 blocks, the state transitions are utilized mechanically to the principle chain. If the block is efficiently challenged earlier than it’s dedicated then that block and all kids are reverted, and the block and all kids lose their deposits with half going to the auditor and half to the void (be aware that this creates further incentive to audit, since now the creator of the kid of a shadow block would favor to audit that shadow block lest they be caught up within the creator’s potential malfeasance). The code for that is far more sophisticated than the opposite examples; a whole however untested model may be discovered here.

Word that this protocol remains to be a restricted one: it solves the signature verification drawback, and it solves the state transition computation drawback, but it surely nonetheless doesn’t resolve the info drawback. Each transaction on this mannequin should nonetheless be downloaded by each node. How will we do even higher? Because it seems, we in all probability can; nonetheless, to go additional than this we’ve to unravel a a lot bigger drawback: the issue of information.