Bitcoin is slowly pushing increased, aiming to reclaim the 200-day transferring common, however the worth stays caught beneath it. Contemplating the futures market sentiment, the subsequent breakout or rejection may spark main volatility.

Technical Evaluation

The Every day Chart

Because the day by day chart suggests, BTC has managed to get better from the March sell-off and is now buying and selling just under the 200 DMA, situated across the $88K mark, which is performing as a powerful dynamic resistance. The current construction reveals short-term increased highs and lows, however the worth continues to be capped beneath the $88K stage.

The consumers want a clear day by day shut above this zone and the 200-day transferring common to open the door towards $92K and finally, the $100K stage. If the worth will get rejected once more, the $80K area shall be key for sustaining a restoration construction.

The 4-Hour Chart

On the 4-hour timeframe, Bitcoin has damaged above the long-term descending trendline and is consolidating just under the $86K–$88K provide zone. The construction reveals increased highs and better lows, indicating bullish momentum.

Nonetheless, the worth motion has been uneven not too long ago, with a number of rejections from the $86K space. The RSI can be progressively rising however hasn’t reached overbought but, that means bulls nonetheless have gasoline, however they should present conviction. A confirmed breakout above $88K may set off a quick rally within the coming weeks.

Sentiment Evaluation

Open Curiosity

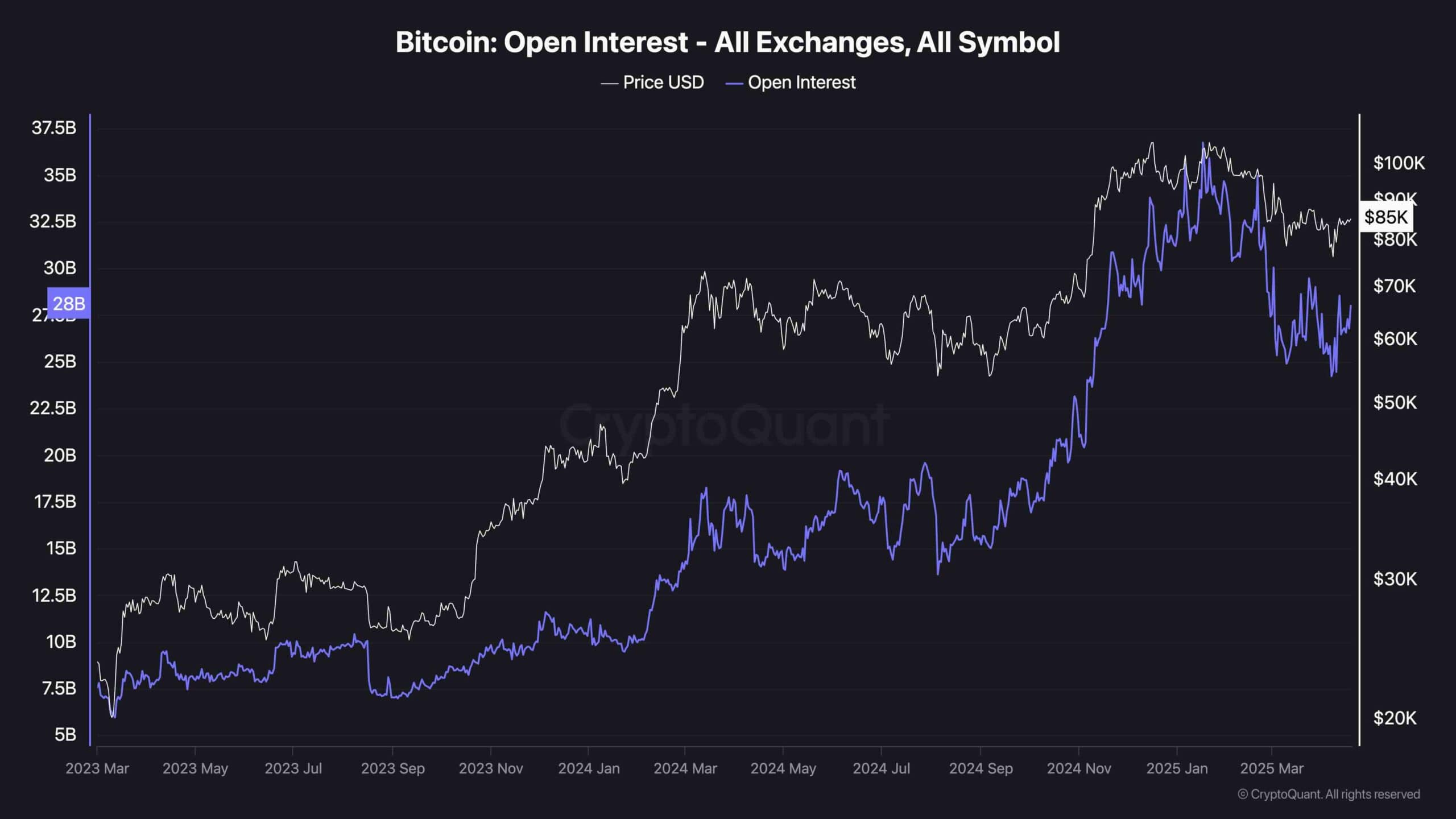

Trying on the futures market sentiment metrics, the open curiosity is climbing once more, now sitting round $28B as the worth hovers across the $85K mark. This rising OI development suggests rising speculative exercise within the derivatives market.

Traditionally, sharp will increase in OI throughout sideways or barely bullish worth motion typically precede main volatility. If the market breaks increased, the stacked lengthy positions may gasoline a squeeze to the upside. But when resistance holds and worth reverses, an extended liquidation cascade is probably going. Both manner, the subsequent main transfer will probably be amplified by this buildup in leverage.

The submit Bitcoin Price Analysis: How BTC Can Escape the Current Consolidation Range appeared first on CryptoPotato.