Real estate firms are beginning to realize that tokenizing a single property creates temporary efficiency; building a tokenization platform creates an ecosystem. A project ends when the asset is sold. A platform continues to onboard new issuers, investors, and secondary markets, compounding in value over time.

A well-designed tokenization infrastructure turns a traditional real estate company into a fintech powerhouse. You stop competing on location and start competing on liquidity, speed, and investor experience. They standardize issuance, automate compliance, and create liquidity rails for a multi-trillion-dollar market. This guide breaks down the complete technical architecture for providing the real estate tokenization platform development service and integration flow for developing such a platform.

Why Real Estate Enterprises Are Moving Towards Deploying Asset Tokenization Platforms

According to Boston Consulting Group, tokenized assets could represent $16 trillion by 2030, with real estate leading the charge. This enables the real estate firms to scale operations and serve multiple projects simultaneously. Here’s why:

- Control over infrastructure: Instead of relying on third-party issuers, building its own platform lets real estate or fintech firms own the issuance, marketplace, and compliance layers.

- Recurring revenue: Offer tokenization-as-a-service to other developers or real estate funds.

- Faster fundraising: Automate issuance, KYC/AML, and investor onboarding for property tokenization through digital channels.

- Liquidity access: Enable peer-to-peer or regulated marketplace trading for property-backed tokens.

- Global reach: Attract accredited investors across borders with built-in compliance filters.

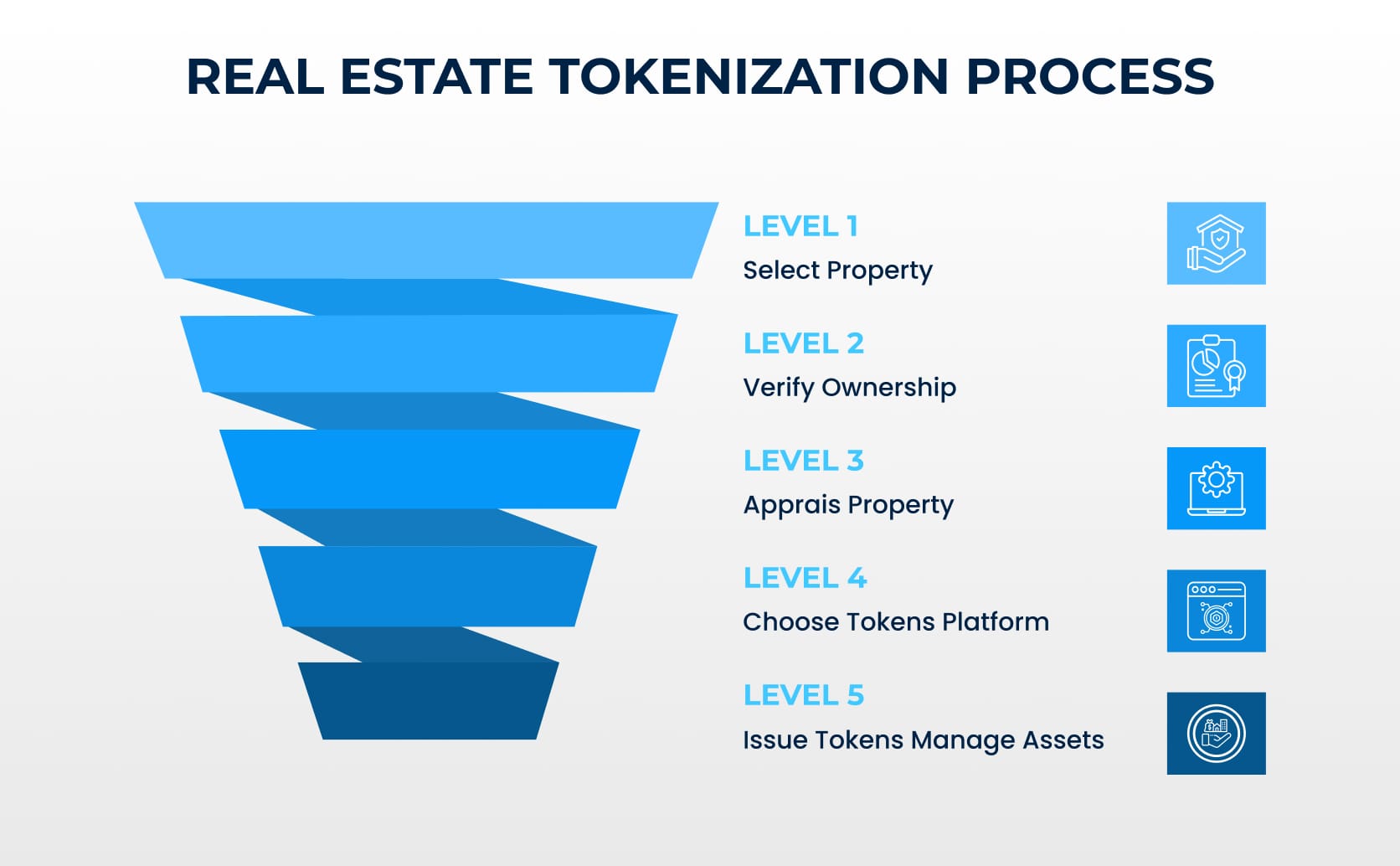

Core Architecture Behind the Development: Real Estate Tokenization Step-By-Step Guide

A well-architected platform typically consists of seven layers that connect the real world to the blockchain while maintaining legal enforceability and compliance.

Here’s an overview of how these layers interact:

- Asset Foundation Layer: This layer represents the legal structuring of the real estate assets, such as SPVs, title documentation, and ownership agreements. Every property must be wrapped legally before tokenization.

- Off-Chain Data Layer: Houses property-related data: valuations, income, occupancy, documents, insurance, and due diligence reports. This data feeds into the blockchain via oracles.

- Blockchain & Tokenization Layer: Where the property becomes a digital security. Smart contracts create, manage, and transfer tokens that represent fractional ownership.

- Oracle Integration Layer: Oracle’s bridge for real-world events and blockchain logic, including valuations, compliance updates, or rental income distribution.

- Compliance & Identity Layer: This layer manages KYC/AML verification, investor accreditation, and jurisdictional controls.

- Platform Backend & Frontend Layer: Backend powers dashboards, investor portals, analytics, and API integrations.

- Marketplace & Liquidity Layer: It facilitates peer-to-peer or exchange-based trading of tokens.

In this architecture of real estate tokenization systems, each layer is modular so that upgrades and compliance adjustments can be made without disrupting the entire infrastructure.

Build Scalable Tokenization Platforms with on-chain Compliance and Live Asset Data

The Compliance-First Mindset: Why Architecture Must Be Regulation-Aware

No amount of code or automation can save a tokenization platform that ignores compliance. Every component, from token standards to investor onboarding, must respect securities law, KYC/AML frameworks, and property ownership statutes in the relevant jurisdiction. Forward-thinking platforms are now adopting Compliance-by-Design architecture. Here’s how it works:

- Smart contracts are embedded with investor whitelists and jurisdictional controls.

- APIs connect to external KYC/AML providers for automated verification.

- Token transfer logic checks investor eligibility and asset restrictions before each transaction.

- Audit logs maintain immutable compliance history on-chain.

This approach ensures that every transaction is legally valid and regulator ready. It’s not just “good practice,” but a competitive moat. When regulators eventually tighten their stance on real estate tokens, compliance-ready platforms will already be miles ahead.

Oracles: The Silent Trust Layer of Real Estate Tokenization

While everyone talks about smart contracts, the real sophistication lies in oracle design. Oracles determine whether your token reflects the truth or an outdated spreadsheet.

In real estate, time lags between events and data updates can erode investor trust. A tenant defaulting on rent, a title dispute, or a major renovation can materially affect value. If your token’s NAV doesn’t update, investors are holding misinformation. That’s why oracles are the silent trust layer of any serious tokenization platform.

A modern oracle setup fetches data, verifies, aggregates, and attests to it cryptographically. It connects property management systems, valuation firms, IoT sensors, and regulatory feeds into a unified pipeline of authenticated data that smart contracts can consume.

Examples of oracle-driven automation:

- Rental payout: Property manager uploads rental income data → Oracle verifies → smart contract releases funds to token holders.

- Valuation update: Certified appraiser updates NAV → oracle transmits new value → investor dashboard reflects updated token worth.

- Sale event: Property sold → oracle validates sale → smart contract executes redemption, burns tokens, and disburses proceeds.

ROI Opportunities to Unlock with Real-Estate Tokenization Platform

When a real estate firm builds a tokenization platform, it transitions from property operator to infrastructure provider. Once operational, the platform can evolve into a white-label tokenization service for other developers or funds. Here’s how the real estate tokenization platform development service expands the business horizon:

- Primary issuance revenue: Charge issuers for token creation and SPV setup.

- Secondary market fees: Earn spreads or commissions on every trade.

- Compliance as a Service: Offer automated KYC/AML and reporting solutions.

- White-label licensing: License your platform to other developers or asset managers.

- Data monetization: Aggregate anonymized market data and sell analytics insights.

This diversification is why tokenization platforms attract investors faster than traditional real estate projects and convert a one-time tokenization project into a recurring income engine.

The Future of Tokenization Platforms: What Smart Builders Are Focusing on Now

Most tokenization projects today look impressive on the surface but are already aging underneath. The next-generation platform must be flexible, data-driven, and composable; capable of surviving multiple blockchain generations without rewrites. Here’s what separates tomorrow’s infrastructure from yesterday’s proof of concept:

1. Cross-Chain Token Standards and Interoperability

Single-chain ecosystems are giving way to cross-chain liquidity. Modern platforms are adopting interoperable token standards (like ERC-3643 or ERC-1400 with cross-chain bridges) that enable assets to move across networks without losing compliance data. This means a token issued on Ethereum could be traded or collateralized on Polygon, Avalanche, or a regulated sidechain — expanding reach and liquidity while preserving regulatory integrity.

2. Decentralized Identity (DID) Frameworks

KYC and accreditation are shifting from centralized databases to verifiable credentials stored in user-controlled wallets. Integrating DID standards (e.g., W3C-compliant identifiers) gives investors privacy, portability, and faster onboarding while ensuring regulators can still verify authenticity.

For enterprises, DID adoption reduces onboarding friction and recurring compliance costs- a practical step toward global investor participation.

3. AI-Powered Valuation and Smart Oracles

Static valuations are obsolete. The next generation of tokenization platforms will integrate AI-driven appraisal engines that analyze market data, rental yields, and macro trends to feed dynamic valuations into smart contracts via oracles. This enables real-time NAV updates, automated yield adjustments, and improved transparency for investors, bridging human appraisal judgment with machine precision.

4. DeFi Composability and On-Chain Liquidity

Tokenized properties are evolving into programmable financial assets. By integrating DeFi composability, property tokens can serve as collateral in lending protocols, be staked for yield, or traded in decentralized liquidity pools. This extends the platform’s utility beyond issuance and trading, turning real estate into a liquid component of the digital financial stack.

5. Token Metadata and Auditability Standards

Institutional investors demand verifiable transparency. Advanced platforms are now embedding metadata frameworks that track valuation history, ownership transfers, and legal documentation in standardized formats. This improves interoperability between exchanges, auditors, and regulators while reinforcing investor confidence through traceable, immutable data.

Build the Infrastructure That Powers Tokenized Real Estate

Takeaway

The convergence of blockchain, compliance automation, and real-world data is redefining the way real estate assets are issued, owned, and traded. Building a real estate tokenization platform demands technical depth, regulatory foresight, and architectural precision. It requires an understanding that tokenization is a transformation of asset liquidity, investor accessibility, and operational transparency.

A successful deployment brings together legal compliance, blockchain architecture, data oracles, and investor experience under one unified system. It empowers you to tokenize, manage, and trade assets seamlessly while maintaining trust and regulatory alignment.

Ready To Launch Your Real Estate Tokenization Platform?

At Antier, we design and deploy full-scale tokenization ecosystems, integrating legal structuring, smart contracts, oracle design, compliance automation, and secondary market architecture. Our Real Estate Tokenization Platform Development Service is built for institutional-grade trust, scalability, and interoperability for enterprises to transition from physical assets to programmable digital ownership.

Partner with our Real Estate Tokenization Platform Development company to build infrastructure that turns your real estate portfolios into liquid, tradeable digital assets.