A growing coalition of decentralized finance advocates is pushing a new proposal they say could help ease the financial burdens faced by low-income households worldwide.

The initiative, backed by the DeFi Education Fund (DEF) and several influential crypto policy groups, argues that decentralized financial tools could save people up to $30 billion a year in fees, money that is currently lost to what researchers describe as the “poverty premium.”

How Much Longer Can the Poor Afford an Expensive Financial System?

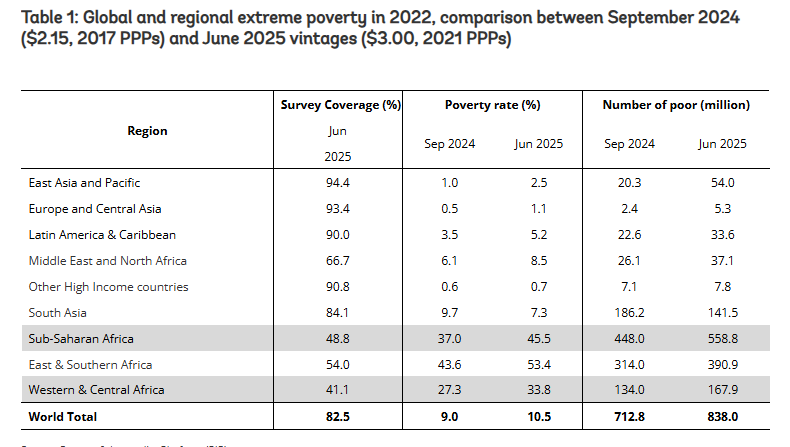

The renewed push comes as global poverty levels remain stubbornly high. In 2025, an estimated 808 million people are living in extreme poverty on less than $3 a day, according to updated global estimates.

Another 887 million are considered to be living in multidimensional poverty. Many of these households face overlapping pressures, including climate-related disasters, political instability, and rising economic fragility.

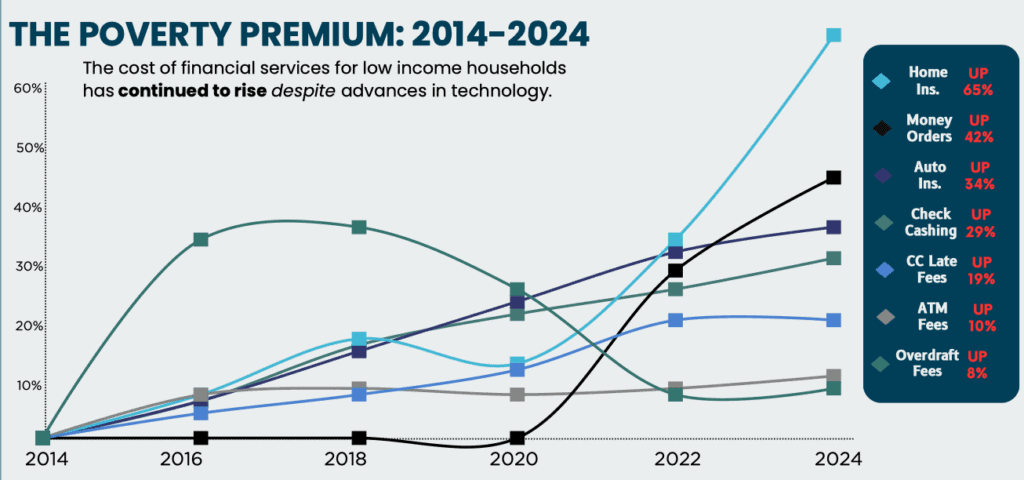

The DeFi Education Fund says the financial system itself is part of the problem. In new research released this year, the group highlighted the long-standing cost gap between rich and poor households in the United States.

Roughly 5.6 million U.S. households remain unbanked, and another 14.2% are underbanked, often forced to rely on costly financial alternatives.

Cashing a paycheck can cost up to 5% of its value, and fees eat up an average of 7.1% of annual income for low-income families, compared with just 0.2% for wealthier households.

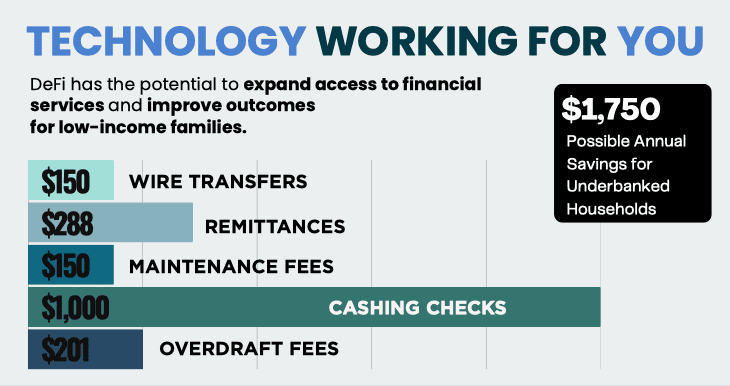

These costs add up. DEF argues that removing intermediaries through decentralized financial rails could dramatically reduce basic expenses like remittances, money transfers, and bill payments.

One estimate in the group’s proposal suggests DeFi infrastructure could cut global remittance costs by up to 80%, potentially saving the world’s unbanked populations $30 billion per year.

The initiative lands at a moment when Americans appear increasingly open to alternatives. A DEF survey conducted with Ipsos found that 42% of Americans would likely try DeFi services if new legislation clarifying crypto privacy protections is passed.

Many respondents expressed frustrations with banking delays, unexpected fees, and difficulty accessing their own funds. Across the sample, 56% of adults said they want full control of their money, and 54% said they want control over their financial data.

As DeFi’s Real-World Role Grows, DEF Accelerates Washington Advocacy

Alongside its economic arguments, the DeFi Education Fund (DEF) has expanded its policy efforts in Washington.

In August, the organization launched the DeFi Education Foundation, a nonprofit designed to broaden its advocacy and deepen engagement with lawmakers.

Around the same period, DEF and Andreessen Horowitz (a16z) urged the U.S. Securities and Exchange Commission to create a regulatory “safe harbor” for blockchain applications.

They argued that neutral software interfaces should not be classified as brokers, warning that current interpretations risk forcing developers into unintended regulatory roles and discouraging innovation.

DEF also submitted a formal response to the Senate Banking Committee’s draft Responsible Financial Innovation Act of 2025.

In that filing, DEF and several major crypto firms, including Paradigm, Jump Crypto, Multicoin Capital, the Solana Policy Institute, and the Uniswap Foundation, called for clear regulatory separation between software builders and financial intermediaries.

While debate over DeFi’s long-term value continues, advocates point to practical examples of how digital tools can expand access to financial services.

In Nigeria and parts of East Africa, crypto-based networks allow users to transact with or without smartphones.

In regions facing conflict or hyperinflation, including Venezuela, Zimbabwe, and Argentina, digital currencies have been used to move money and preserve savings.

Some humanitarian groups have adopted blockchain systems to distribute aid with greater transparency.

Still, researchers note that DeFi faces limits. Collateral-heavy lending models, volatile token markets, smart-contract vulnerabilities, and financial literacy barriers have slowed broader adoption.

Much of today’s activity remains concentrated in speculative trading rather than real-world economic use. Even in El Salvador, where Bitcoin became legal tender in 2021, daily usage has remained below expectations.

DEF maintains that policymakers should protect the aspects of DeFi that directly reduce costs for consumers.

The group argues that open access, low-cost settlement, and user control remain essential to reaching people living at the financial margins.

The post DeFi Advocates Propose $30B Plan to Fight Global Poverty — Here’s the plan appeared first on Cryptonews.