Bitcoin USD holders have recorded their first 30-day stretch of realized losses since late 2023, according to on-chain data from CryptoQuant, shared this week. BTC USD

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

.cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) {

stroke: #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-trend.positive {

color: #008868 !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.positive {

border: 1px solid #008868;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.positive::before {

border-bottom: 4px solid #008868 !important;

}

.cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend {

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-graph-container.negative svg path:nth-of-type(2) {

stroke: #A90C0C !important;

}

.cwp-coin-widget-container .cwp-coin-popup-holder .cwp-coin-trend.negative {

border: 1px solid #A90C0C;

border-radius: 3px;

}

.cwp-coin-widget-container .cwp-coin-trend.negative {

color: #A90C0C !important;

background-color: transparent !important;

}

.cwp-coin-widget-container .cwp-coin-trend.negative::before {

border-top: 4px solid #A90C0C !important;

}

struggled to attract buyers as selling picked up, while spot Bitcoin ETFs saw nearly $395 million in outflows in a single day.

Zoom out, and the backdrop is clear: rising geopolitical tension is pushing money toward old-school safe havens like gold. This does not mean Bitcoin is broken. It does mean investor behavior has shifted, at least for now.

Bitcoin holders realizing losses, for a 30-day period since, late December for the first time since October 2023. pic.twitter.com/OGsPYm8714

— Julio Moreno (@jjcmoreno) January 20, 2026

Gold surged past $4,700 per ounce at the same time, a sign that fear is back in the market. When that happens, newer Bitcoin buyers usually feel it first.

Ongoing trade tensions between the US and Europe over Greenland are causing significant uncertainty in markets, and with a conflict a serious possibility, investors are taking the tried-and-tested approach of parking wealth in precious metals.

(SOURCE: TradingView)

What Does “Realized Losses” Actually Mean?

Realized losses track coins that get sold for less than their purchase price. Think of it like selling a stock for less than what you paid. On-chain data simply adds all those losses together.

According to Glassnode, a negative reading does not guarantee a price crash. It shows who is selling. Right now, sellers are mostly people who bought higher and lost patience, many of whom are cashing out at a loss.

That matters because long-term holders usually sit tight during these phases. Stress shows up first among newer investors, unable to ride the volatility on the charts.

In times like this, retail investors are capitulating for losses while institutions and treasury firms scoop up discounted tokens. This is evidenced by Michael Saylor’s Strategy today (January 20), which announced the acquisition of 22,305 BTC at a cost of $2.13Bn, bringing its total holdings to 709,715 BTC.

This is why newer investors should never put in more than they can afford to live without for a long time. The charts reward patience and those able to hold through volatile price swings, which is another reason to stick to spot and avoid leverage.

Strategy has acquired 22,305 BTC for ~$2.13 billion at ~$95,284 per bitcoin. As of 1/19/2026, we hodl 709,715 $BTC acquired for ~$53.92 billion at ~$75,979 per bitcoin. $MSTR $STRC https://t.co/pJM0Yuy32w

— Michael Saylor (@saylor) January 20, 2026

Why is Bitcoin Losing Attention While Gold Runs?

Money moves in cycles. When fear rises, investors reach for assets with a long history of surviving crises. Gold fits that role perfectly.

Bitcoin, by contrast, still trades like a risk asset in moments like this. Trade-war talk and tariff threats have pushed traders into “capital protection mode,” which helps explain why tariff threats impacting Bitcoin keep showing up alongside price dips.

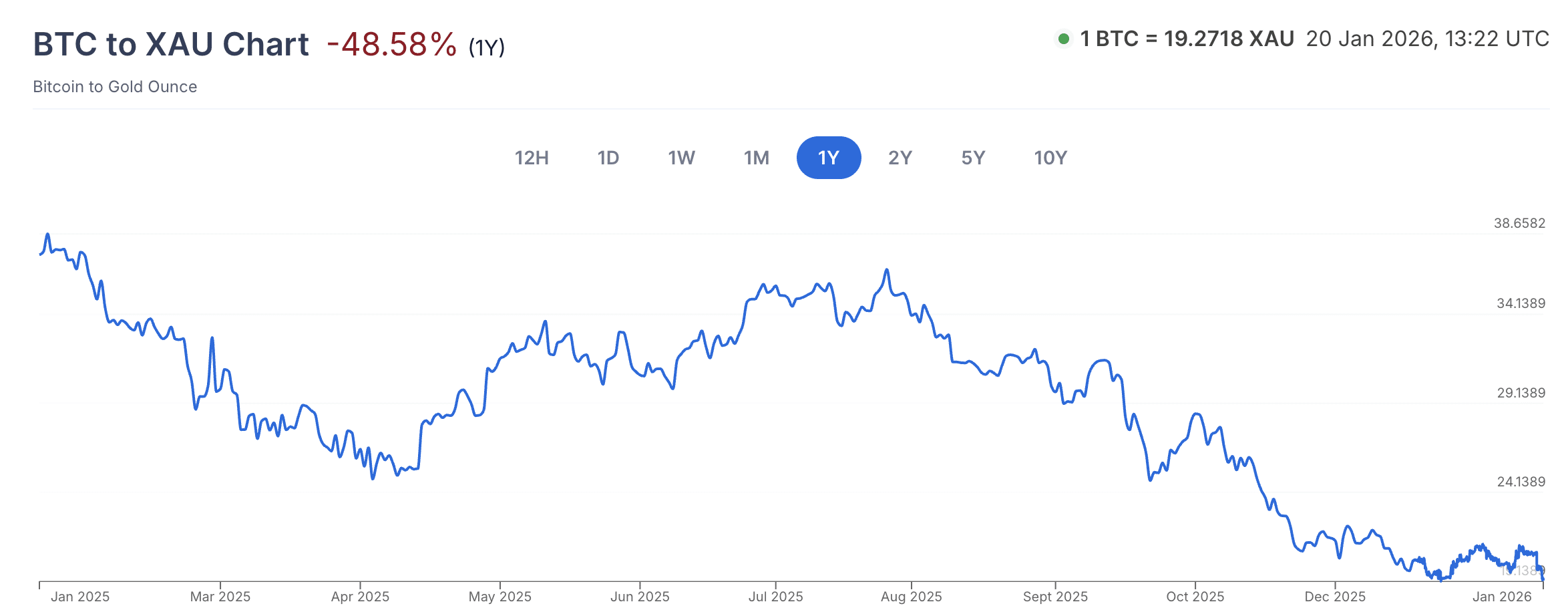

The Bitcoin-to-gold ratio has fallen nearly 50% from its peak, according to the BTC-to-Gold chart on xe.com. The last time that happened, Bitcoin later caught up as liquidity returned.

(SOURCE: xe.com)

EXPLORE: Best New Cryptocurrencies to Invest in 2026

What This Means for Everyday Bitcoin USD Investors

Large realized losses often look scary, but context matters. During recent corrections, over 90% of Bitcoin’s supply stayed in profit. That tells us losses are concentrated among late buyers, not long-term holders. This pattern showed up after FTX and during earlier shakeouts.

Glassnode also tracks seller exhaustion. When losses spike and then fade, it often signals that forced selling is running out of steam. If you already hold Bitcoin, this phase is about patience, not panic. Selling after losses locks them in.

$BTC has pulled back from recent highs of $98K, slipping back into the low-$90Ks. Momentum has cooled but remains above neutral, pointing to consolidation rather than trend deterioration.

Read more in this week’s Market Pulse

https://t.co/SqtQrQ3D8C pic.twitter.com/Z5ONm7bXM2

— glassnode (@glassnode) January 19, 2026

If you are new, this is where discipline matters. Bitcoin drops feel personal, but they are part of how this market resets. That said, this is still a volatile asset. Never invest money you need for rent or groceries.

Short-term price pain does not cancel the long-term story. It simply reminds us that Bitcoin moves in cycles, and fear-driven exits often mark the middle, not the end.

As long as macro pressure stays high, expect choppy moves. When fear cools, attention tends to swing back just as fast.

DISCOVER:

- 16+ New and Upcoming Binance Listings in 2026

- 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Bitcoin USD Logs First 30-Day Losses Since 2023 as Gold Steals the Spotlight appeared first on 99Bitcoins.