The US government dropped its insider trading case against former OpenSea NFT platform executive Nathaniel Chastain after an appeals court overturned his 2023 convictions for wire fraud and money laundering.

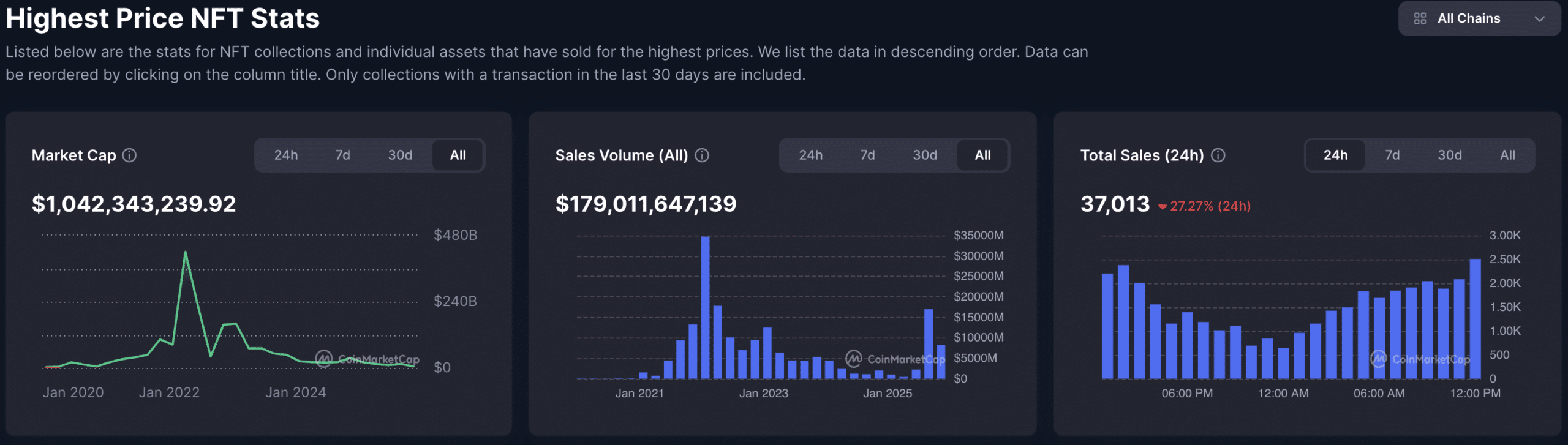

This case comes amid a multi-year bear cycle for NFTs, following their failure to sustain the hype of 2021-2022. The combined market cap for the NFT market sits just above $3Bn, down from over $420Bn in April 2022.

U.S. prosecutors have dropped all charges against former OpenSea product manager Nathaniel Chastain, bringing the first widely known “crypto insider trading” case to a close.

The decision follows a federal appeals court ruling that vacated his 2023 convictions for wire fraud… pic.twitter.com/69irBA77NY

— CryptoMoses (@realcryptomoses) January 23, 2026

To put it in further context, the most prominent NFT collection, ‘CryptoPunks’, has a current floor price of 27.25 ETH, down from 113.9 ETH, with regular trades in the multi-million-dollar range.

While this news is unlikely to spark a true NFT rally, it can only be viewed as a positive for the space, given the current poor price action; any crumb of good news surrounding OpenSea and the NFT space is welcome.

(SOURCE: NFTPriceFloor)

What Was the US Government’s Case Against the OpenSea NFT Platform About?

Nathaniel Chastain worked as a senior executive at OpenSea, the largest NFT marketplace at the time. Prosecutors said he secretly bought NFTs before OpenSea featured them on its homepage, then sold them after prices jumped.

These allegations were the crypto version of stock-market insider trading, in which someone with insider knowledge buys shares before a company rings the opening bell.

In 2022, the US charged him with wire fraud in what became the first NFT insider trading case. A jury convicted him. But in 2025, a federal appeals court reversed that conviction, ruling that the information he used did not constitute “property” under existing fraud laws.

With that ruling in place, prosecutors dropped the case entirely. There will be no retrial, no new charges, and Chastain, OpenSea, and the broader NFT space can move on from the ordeal.

JUST IN

US appeals court overturns fraud conviction of ex-OpenSea product manager Nathaniel Chastain in first-ever digital asset insider trading case.

— Moby Media (@mobymedia) July 31, 2025

Why is This Ruling Important for NFT Investors

This decision draws a bright line around what US prosecutors can and cannot call insider trading in crypto. In the stock market, using non-public information is clearly illegal. In NFTs, the court said the rules are not yet clear.

For regular buyers, this creates a strange mix of relief and risk. Relief, because it reduces the chance of aggressive prosecutions based on shaky legal definitions. Risk, because it also shows that marketplace insiders may not face the same rules as Wall Street traders.

OpenSea has already tightened its employee-trading rules following the scandal, and other platforms have followed suit. Those private rules now matter more than criminal law.

While the pool of NFT investors has diminished greatly over the past three years, for those who are still playing the market, this can only be viewed as a positive, though whether it translates into any upward ticks on the charts remains to be seen.

Crypto Regulation Hits a Legal Speed Bump

(SOURCE:CMC)

This case exposes a bigger issue in US crypto regulation. Many laws were written long before NFTs existed. Courts now decide how far those laws stretch.

That uncertainty affects builders and investors. Companies hesitate to list features. Users face uneven protections. Regulators lose leverage when courts reject creative legal theories.

The timing also matters. NFT trading volume collapsed from a daily high of $32Bn in early 2022 to just $620,000 as of today. Fewer trades mean fewer headline cases to test new rules.

This ruling does not make insider behavior okay. It only says current laws do not clearly cover it, but marketplaces can and will set their own rules, and will freeze accounts or ban users suspected of insider trading.

If you trade NFTs on OpenSea or any other platform, assume there are insiders. Avoid chasing sudden homepage hype. Set a budget. Never spend money you need for rent or groceries. NFTs remain extremely thinly traded and fast-moving.

For now, expect more courtroom fights before clear rules arrive for the NFT space. Until then, caution beats cleverness, although if you’re trading NFTs, cleverness may not be something you need to worry about.

DISCOVER:

- 16+ New and Upcoming Binance Listings in 2026

- 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post US Drops OpenSea Insider Trading Case: Could 2026 be the NFT Comeback year? appeared first on 99Bitcoins.